Bitcoin is visibly struggling. The price of the leading crypto has dropped by about 26% from its all-time highs, wiping out $400 billion in market capitalization and destroying market sentiment.

Investors are now frightened by Donald Trump’s aggressive tariff policies that favor a rise in the US dollar index, while draining interest in speculative assets. The pump, previously triggered by the US presidential elections, has been completely nullified.

However, there is still a glimmer of hope for holders: historically, drawdowns like these precede a strong rebound, which could materialize in a new market rally. In the meantime, on-chain data and the behavior of whales offer us valuable clues about Bitcoin’s future price action.

Summary

Why is Bitcoin going down? A comprehensive overview

In a delicate moment like this, everyone is asking why Bitcoin is falling and what has triggered such a marked bear movement. The answers are likely to be found outside the cryptographic context, within the more complex macroeconomic sphere. In fact, alongside Bitcoin, the S&P500 is also giving unpleasant surprises, losing over 4% in the last 5 days.

Donald Trump represents one of the main actors in this financial markets dump, as his foreign policies do not seem to have been well received by investors. Recently, the new president of the United States announced that from March 4th, he will impose trade tariffs on Canada and Mexico, also doubling the universal 10% tariff applied to imports from China. The import taxes have also affected the European Union, which from April 2025 will face an increase on its USA exports.

All this negatively impacts the U.S. inflation, with an increase in price pressures that could make it more difficult for the Federal Reserve to adopt an expansive monetary policy. Consequently, there could be fewer interest rate cuts than those expected just a few months ago, influencing the trend of speculative markets like that of Bitcoin in a bear direction.

The only one who benefited from this scenario is the US dollar index (DXY), which on Thursday, February 27, rose by 0.77%. Usually, the trend of DXY is inversely proportional to the growth of Bitcoin and stocks. It is no coincidence that during the bear market of 2022, this index reached local highs at 114 points. Since the US dollar is the world reserve currency, its price changes can affect the purchasing power of individuals and institutions and influence the demand for riskier assets.

The worst trading week since June 2022 for BTC

With the latest price drop, Bitcoin recorded the worst weekly performance since June 2022, when its value plummeted by about a third. On that occasion, Coinbase was accused by the SEC of operating without a license and offering unregistered securities. This time, however, we have Bybit, the second exchange in the crypto market for spot volumes, which was hacked for $1.5 billion in $ETH by the North Koreans of the Lazarus group.

At the time of writing the article, Bitcoin marks a disastrous week of -18%, dangerously falling below the $80,000 support. With this sell-off, the coin has filled the CME gap that had formed in mid-November. Some analysts suggest that from here it could test lower price levels, while others believe that a bull impulse will start from here. Let’s remember that there is another small CME gap at $93,000 waiting to be filled.

According to on-chain data, in the last 3 days the realized losses by Bitcoin traders exceed the 3 billion dollars mark. This is one of the most bearish values since August 2024, when the carry trade in yen ended and the cryptocurrency reached $49,000.

Also consider that the last weekly candle of the BTC-USDT chart represents the worst ever in terms of price excursion, with an overall amplitude of almost $18,000.

In total, according to the data from TradingView, the cryptocurrency market capitalization has lost a whopping 1.1 trillion dollars, bringing the total to 2.59 trillion dollars. Much of this exodus is by retails who bought in the last month and panicked with the market crash. According to IntoTheBlock, currently there are still 6.34 million addresses “out of the money” on Bitcoin, which bought at a price between $86,000 and $106,000.

Bitfinex margin traders take advantage of discounts and go long on Bitcoin

While the price of Bitcoin faces a heavy retracement, some users are taking advantage to shop in the market and average their positions. In particular, traders on the exchange Bitfinex, known for its presence of whale investors, seem to be betting heavily on an imminent rebound of the cryptocurrency. The number of BTC purchased on Bitfinex with borrowed money has indeed risen to more than 60,000 BTC from 50,773 this month.

Usually, the investors on this platform tend to accurately predict the peaks and bottoms of the cryptocurrency market. These traders, holders of large amounts of bitcoin, accumulate during the downtrends or in rangebound phases, and sell during moments of heightened hype. This pattern was evident during the market highs of 2021 and 2024. For example, in the middle of last year, their participation was very active, given the great speculative opportunities that arose with the summer dip in prices.

In these days, a Bitfinex whale seems to have gone shopping by purchasing as much as 4,000 BTC, equivalent to 323 million dollars. The same user had accumulated 70,000 BTC between $40,000 and $16,000 during the Luna crash and FTX in 2022, only to sell them between $40,000 and $70,000 in 2024. His new remarkable purchase suggests that despite the bear outlook, Bitcoin could recover very well in the coming months.

The fear and greed index of Coinglass indicates a value of extreme fear, rarely observable in the market. In the last year, the market has seen only four days of extreme fear. Probably the Bitfinex trader had as a mentor the old baron Rothschild, who at the beginning of the 19th century recited the wise phrase “The time to buy is when blood is running in the streets.”

Are we in the middle of a gigantic dip or at the dawn of a new bear market?

At the moment, predicting the future trend of Bitcoin is particularly difficult, especially due to the numerous macroeconomic variables at play. According to various projections, the crypto asset still has room for one last bullish push, which could culminate in a new all-time high and mark the end of the bull run. However, technical analysis indicates increasing control by the bears, raising the risk of a depreciation phase. If this trend were to consolidate, it could trigger a prolonged bear market.

“`htmlBitcoin needs a catalyst that can justify a strong price rebound, restoring the typical balances of the bull market. One of these could be the inclusion of the currency as a reserve asset of the US Treasury, as promised multiple times by Donald Trump. Another factor that could bring liveliness back to the market is the end of the war between Russia and Ukraine, which would reduce geopolitical uncertainty and favor a more stable climate for investments.

“`The largest support for Bitcoin is in the $73,000 area: a break of this level, confirmed by a lower close with a weekly candle, would give further strength to the bears. A recovery of the resistance at $89,000 would instead create greater confidence in considering the current pattern as a large bottom construct. The cryptocurrency is displaying its most valuable characteristic, as well as the most cruel, namely unpredictability.

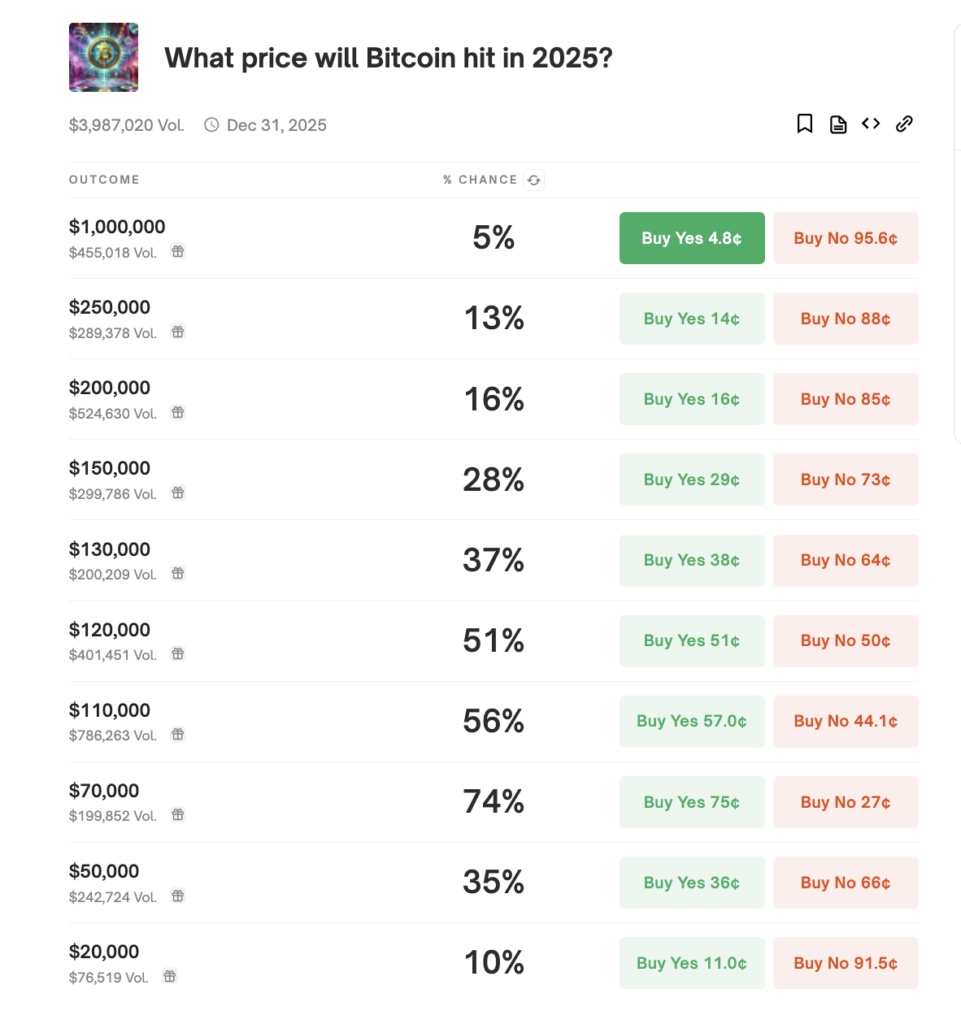

The forecasts of Polymarket suggest that anything can happen in 2025, with Bitcoin potentially reaching $200,000 or revisiting the top of the bull market of 2017 at $20,000. Everyone plays their own game.