The well-known Binance exchange, through its Binance Research department, has published a report on investors’ habits in the crypto asset market and on how these influence market trends.

One of the most established and well-known facts is the very high correlation between the trend of the bitcoin price and that of the so-called altcoins, which is also confirmed on a statistical level. In fact, the correlation rate between bitcoin and other crypto assets, according to the Binance Research report, is particularly high, with an average of 0.9.

Investors had already sensed for some time the very high link between the first virtual currency and the others, but this research puts it at a scientific level: there have been some weeks when the correlation value exceeded 0.94, indicating an almost perfect correlation between the trend of bitcoin and that of the other crypto assets.

However, according to the report, the value of the correlation has never been less than 0.8 so, in general, it is always possible to count on a uniform trend of the cryptocurrency sector.

As far as the presence of institutional investors is concerned, the research shows that last January there were as many as 700 funds specialised in crypto assets, for a total value of about 10 billion dollars.

This is an interesting but still limited capitalisation, considering that American institutional investors, for example, invest only 7% in virtual currencies in relation to what they decide to invest in the stock market.

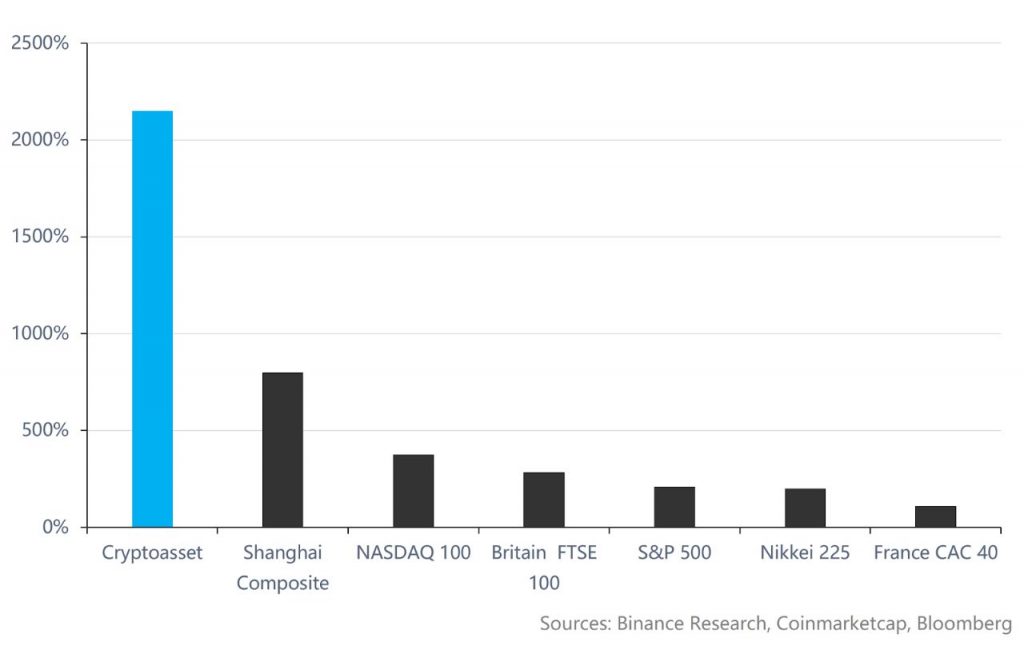

The lower number of operators on the market, however, does not mean less activity: in fact, the turnover of institutional operators in the virtual currency market amounted to 2150% during 2018, a figure that corresponds to 8 times the turnover of the US stock market or three times the turnover of the Chinese one. This means that investors in the crypto assets are much more active in buying and selling each time there are market movements or fresh news.

The study of the UTXO data shows a further evolution in the behaviour of crypto investors: in fact, during the bear market periods, there is a tendency not to give in and wait for a rise, behaving therefore as hodlers.

At the same time, the market does not yet appear mature enough to make a clear distinction between good and poor projects: in fact, when there are moments of euphoria, all the virtual assets grow regardless of the quality of the business idea behind it and, in the same way, in moments of great pessimism all the currencies collapse, even those which are interesting and successful. Unfortunately, this is a factor of immaturity that indicates that there is not yet a sufficiently in-depth study of cryptocurrency projects from a business point of view.