Trading bitcoin (BTC) and crypto in general offers investors the opportunity to obtain substantial returns, but it also involves a very high risk.

Deciding on what to invest is always a personal choice and one should not be conditioned by people who have become rich with cryptocurrencies.

Although at first glance it may seem like a downhill road, full of easy gains, it is not so. Volatility strongly affects this market and the most common assets such as bitcoin (BTC), ethereum (ETH), XRP and many others are often complex from a bureaucratic and mandatory point of view.

However, a simple device connected to the Internet is enough to start trading with crypto. As far as traditional markets are concerned, there are bodies that protect investors but, with cryptocurrencies, there are no limitations.

So here are 5 things to avoid absolutely when starting to trade with cryptocurrencies.

1) There is no strategy to get rich quickly

Understandably, when a market has an increase of 10%, 20% and in many cases even figures that exceed 50%, there are many new investors who want to join. But crypto isn’t a get rich quick scheme. This is demonstrated by the fact that, just as they can register a double-digit increase, they can also fall very sharply.

Most cryptocurrencies have lost more than 90% from their all-time high (ATH). And this example shows very clearly how not everything that shines is gold. Since this is a highly speculative market there are certainly some people who have become very rich, while others have lost everything.

History teaches us that an asset cannot grow forever, sooner or later it will collapse. Trading with cryptocurrencies is risky. As for bitcoin (BTC) it has happened several times in history.

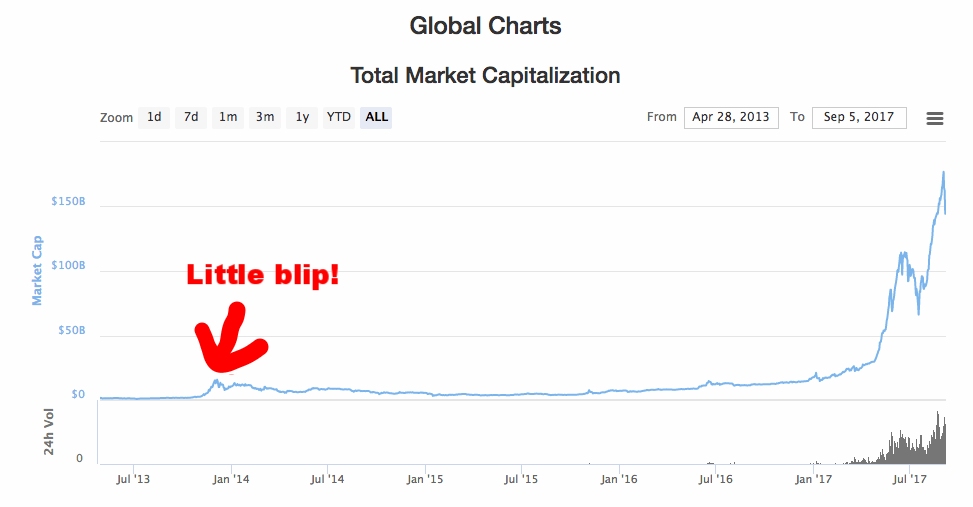

The graph below shows a slight collapse that affected Bitcoin (BTC) in 2013:

Except for the fact that it was not just a correction, but it was a real disaster. It sounds like something small compared to today’s market, but if the image is enlarged it is possible to notice several things.

The peak in 2013 was driven by speculation, people were putting money into bitcoin (BTC) because it was a new revolutionary currency and then the market literally crashed from a global high of $15.7 billion seen on December 5th, 2013, to a low of $3.3 billion on January 15th, 2014. A 79% drop. Many said it was the death of bitcoin (BTC) and crypto in general.

It took almost two years to recover the climb.

All of this can happen again and more than once. One should never invest more than is willing to lose. Those who invested in bitcoin (BTC) in December 2013 and did not panic during the collapse, had to wait until the beginning of 2017 to see a profit. More than three years.

2) Inexperienced people should engage in daily trading

Most crypto traders consider daily trading. Many people try it every day, some of them with success while others fail.

First of all, it is necessary to consider the lifestyle that is the result of daily cryptocurrency trading. Intra-day trading is a real job. It is not possible to do two full-time jobs efficiently. Leave everything to start trading cryptocurrencies without knowledge is very risky.

The cryptocurrency market operates 24 hours a day, 7 days a week, all year round. There is no weekend, Christmas or New Year’s Eve. It is a difficult, stressful and not always profitable job in which emotion plays a fundamental role.

The problem with day-trading is that the market can operate irrationally in the short-term, and one must always fight against emotions such as fear and greed, in order to be able to generate profits.

The chart below perfectly demonstrates the experience that day-trading traders need to have. No one knows what the market will do in the short term, so emotions will always lead to buying and selling at the wrong time.

Most investments in cryptocurrencies are pure speculation, but what is speculated about is that in the future digital currencies will become forms of payment, or store of value, and tokens will be supported by systems and technologies that will revolutionise markets and society. In this respect, daily trading is neither essential nor necessary.

3) The problem of Margin Trading with crypto

Margin trading involves borrowing money on the very same investment platform, and leveraging it. For example, if one wants to make a 10x leverage, for every dollar of price increase initially traded, one will get a cash return of 10 dollars. Similarly, for every dollar lost, compared to the price initially set, there will be a loss corresponding to 10 dollars.

Margin trading breaks the golden rule of not investing more than one can afford to lose.

From Investopedia:

“A margin call occurs when the value of an investor’s margin account (that is, one that contains securities bought with borrowed money) falls below the broker’s required amount. A margin call is the broker’s demand that an investor deposit additional money or securities so that the account is brought up to the minimum value, known as the maintenance margin”.

If the losses cannot be covered, the trade is closed and the initial investment is lost. It is already known that investing in cryptocurrencies is highly risky. Through margin trading it is much easier to lose everything, so using an instrument like leverage is recommended only for more experienced traders.

4) Avoid short trading operations with cryptocurrencies

The term shorting means betting on the loss of value of an asset, and it is a useful tool within the markets. The main problem is that we are operating in a once again a highly volatile market.

But not only that, another concern is that behaving in this way leads to being a day trader, as the price to keep an eye on should be in a short time frame.

Also from Investopedia:

“Short selling is an investment or trading strategy that speculates on the decline in a stock or other securities price. It is an advanced strategy that should only be undertaken by experienced traders and investors.Traders may use short selling as speculation, and investors or portfolio managers may use it as a hedge against the downside risk of a long position in the same security or a related one. Speculation carries the possibility of substantial risk and is an advanced trading method. Hedging is a more common transaction involving placing an offsetting position to reduce risk exposure”.

The most frightening thing is that there is theoretically no limit to the growth of the price of an asset. If you have an asset that is decreasing, the worst that can happen is a loss of 100%. An asset can double, triple, grow 10 times its initial value and, as it rises, one loses money.

Just imagine a short sale of Ethereum, with ETH registering a +400%. This is a possible scenario since such a situation has already taken place several times.

5) Security is the most important factor of all

Stock market investors do not have to worry about this, but it is one of the key points for anyone entering the cryptocurrency market. What makes it easy to trade in this market is, among other things, the possibility of finding security holes.

There are hackers all over the world trying to hack computers and exchanges to steal cryptocurrencies. It happens every day and cryptocurrency trading has opened up new horizons in terms of computer security.

The issue of security needs to be taken very seriously, a distraction can be fatal. A simple search on the web is enough to realise how many cases have occurred in these years, how many people have lost enormous capital and how much money hackers are able to steal.

It is vital to be careful and, if so, make sure to purchase a hardware wallet for maximum security.