Craig Cohen, an analyst for JP Morgan Chase, has published a report on the bank’s future investments. According to Cohen, the US dollar may soon no longer be the most important currency in the world.

“We believe the dollar could lose its status as the world’s dominant currency (which could see it depreciate over the medium term) due to structural reasons as well as cyclical impediments. As such, diversifying dollar exposure by placing a higher weighting on other currencies in developed markets and in Asia, as well as precious metals makes sense today”.

The strength of Asia, gold and bitcoin

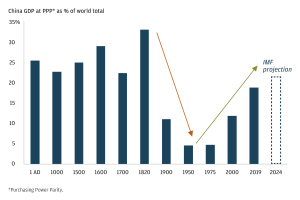

Cohen believes that the Asian markets are the future and the leading nation can only be China. Beijing is achieving amazing results and salaries are becoming more and more balanced.

JP Morgan believes that in the coming decades the world economy will no longer be dominated by the United States and that Asia will exercise ever greater power. Gold will also become more and more important.

“Alongside JP Morgan, central banks across the globe are also adding to gold reserves at their strongest pace on record. 2018 saw the strongest demand for gold from central banks since 1971 because gold is a stable source of value”.

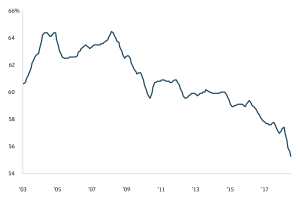

The report also points out that the dollar reserves of banks have fallen from 64% in 2008 to 55% today.

Trump’s trade war will further increase the stakes and the US economy has huge deficits that could lead to a loss of value. Investors, according to JP Morgan, should diversify their portfolio and focus less on US dollars.

Clearly, the President of the United States does not agree and in a recent tweet, he confirmed that the US dollar is stronger than ever and is by far the most dominant currency in the world and will always remain so.

In this situation, it is clear that bitcoin, increasingly seen as a store of value similar to gold rather than a means of payment, can play an important role. In fact, there are increasingly insistent rumours that central banks are investing heavily in BTC.

JP Morgan is a strong believer in cryptocurrencies and has invested in JPM Coin. JPM Coin is expected to be used for international payments, equity transactions and treasury services of JP Morgan itself. The first tests of this new currency will start soon.