It was a very important week for bitcoin which, due to international tensions, attracted attention for having recovered again the 12000 dollars area, which was abandoned in the first ten days of July.

Bitcoin is generating more and more interest, as demonstrated by the dominance that is heading towards 70%, levels abandoned in March 2017. Despite today’s uncertain day, with the bitcoin value fluctuating around parity (now at -0.2%), BTC manages to maintain a market cap of 210 billion dollars. The total capitalisation of the sector remains above 305 billion dollars.

As for the other cryptocurrencies, 60% are now in red, but there is nothing worrying about it, as the biggest falls of the day are only three and just over 7%: these are Basic Attention Token (BAT), Metaverse (ETP) and Decred (DCR).

On the opposite side, the highest step of the podium is occupied by Bytecoin (BCN), which rises by more than 25%. At the moment it has 127 million dollars of capitalisation occupying the 49th position in the ranking.

The week sees the highest weekly trading since mid-July, mostly thanks to bitcoin. This is detrimental to all the other altcoins. The situation is very well portrayed by Ethereum’s performance in the last few hours.

Ethereum loses 4% on a daily basis, highlighting how these last days characterised by the lack of volumes (as opposed to what is happening with bitcoin), prices are dropping again. This also affects the dominance of Ethereum which falls below 7.5%, the lowest levels since March 2017.

The same is true for Ripple which, on a daily basis, contains the decline falling by about 2%, bringing its market share to the lowest levels of the week, close to 4.3%.

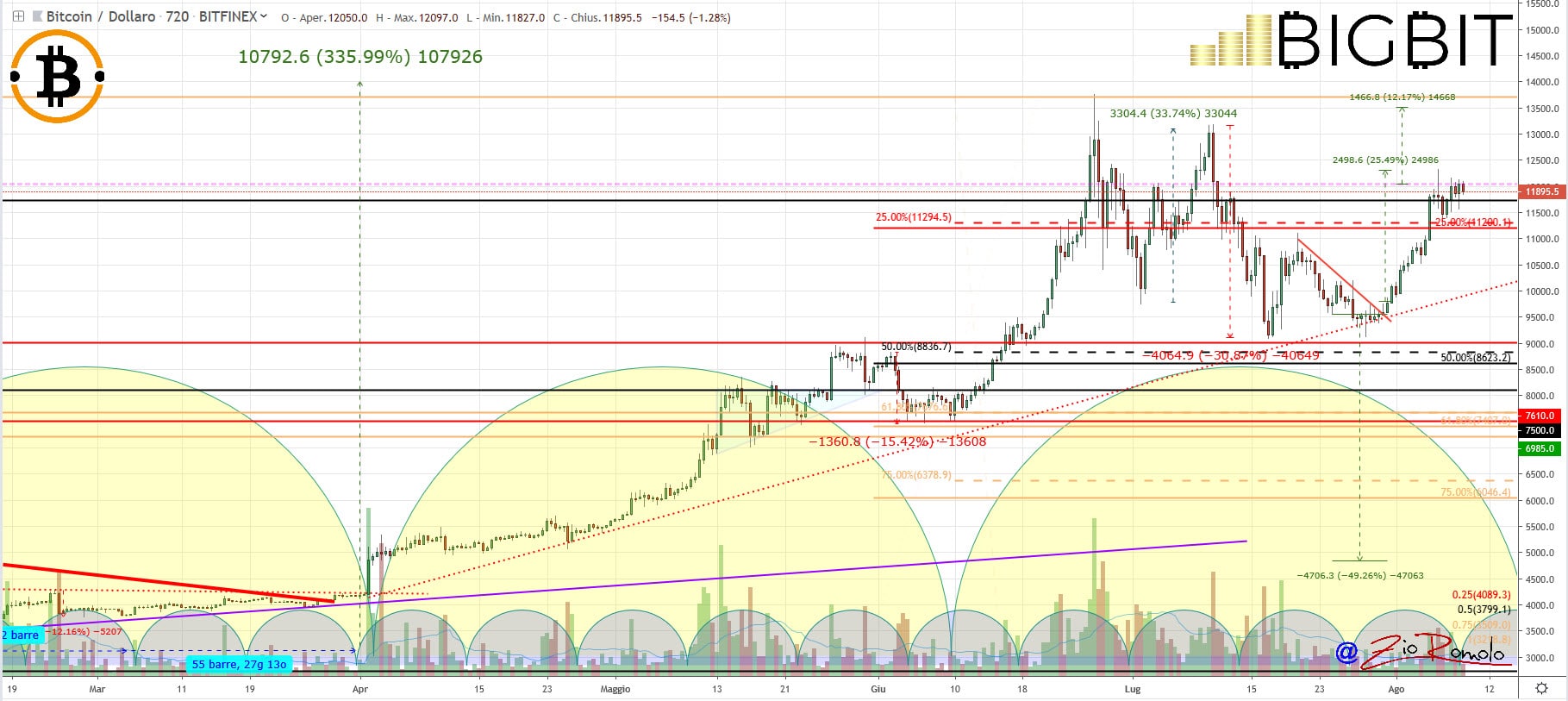

Bitcoin (BTC) price at 12000 dollars

Bitcoin, with the bullish movement of the last days, has recovered the 12,000 dollars, a level that attracts the micro oscillations of this period. Despite trying to stretch above this threshold, it has currently failed.

Consolidation above this level would project prices above the technical and psychological level of 13,000. On the contrary, if the 12,000 dollars should not be violated upwards over the weekend, it would increase the chances of a price retracement with a landing in the 10,800 dollars area in the coming days.

For bitcoin, the trend will remain bullish if prices do not go below $10,000.

Ethereum (ETH) price

The failure to break $235, a level tested at the beginning of the week, brings prices back down to the current daily levels of $215. For Ethereum, the trend remains bullish and would continue if prices remained above 210-215 dollars.

If this level is violated, downward speculation may return with a first target at $190, mid-July levels, the lowest low in the last three months. An upward return above $235 and consolidation above this level would project prices back into the $250-255 area, a short-term resistance level.

This week’s news: Monero (XMR)

Monero, during this week of significant tension, is the altcoin that manages to keep up bitcoin’s pace. The rise of this last week pushes prices just below the threshold of 100 dollars, levels abandoned on July 11th. Monero sees the focus return to itself, keeping the pace of bitcoin with an upward trend that from the lows of mid-July has seen prices recover over 35%.

For Monero, it will be important in the next few days to stay above 100 dollars, otherwise, a price retracement and a test of the previous relative highs of mid-July in the area of 85 dollars could prevail.