Today there is a rather shaky situation for the price of bitcoin that is back struggling around the psychological threshold of 10,000 dollars, a level that has been recovered after a year from the second half of June.

Since June of this year, bitcoin prices have fluctuated from the bottom to the top about twenty times, with an intensity that has increased further over the last month. With the downturn suffered in mid-August, the price of bitcoin has repeatedly gone to test the psychological threshold of 10,000 dollars.

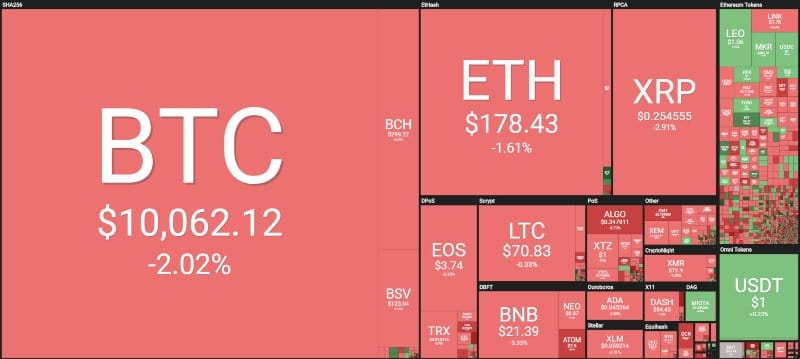

In general, the day sees a clear prevalence of red signs, about 80% of the first 100 cryptocurrencies are in negative territory. Among the first 20 cryptocurrencies for market cap, only Huobi Token (HT) is in positive territory with a rise of just over 5%. Thus, Huobi Token, with $1 billion of capitalisation, climbs to 14th position overtaking TRON (TRX), which is now down by more than 4%.

The best rise of the day, decidedly speculative, is that of Ocean Protocol (OCEAN), which with a 480% daily rise soars with prices over 15 cents of a dollar, gaining the 88th position. This is a rise to take with a grain of caution as the token has a low trading volume equal to $400,000 in the last 24 hours.

Among the best of the day, alongside Huobi Token, there is Bytecoin (BCN) in 59th position, with a +6%. The worst downturn of the day is that of Cosmos (ATOM) who, after the strong rises of the last few days, is experiencing a double-digit retracement (-10%).

Overall, it is necessary to update the number of new cryptocurrencies. Less than a week after reaching 2,600, today 2,700 are listed on CoinMarketCap. This confirms that September is a particularly profitable month for the launch of new projects despite the fact that August has marked a sharp contraction in investment and inflows of capital. August, in fact, had raised just under $100 million in revenue for new projects, a tenth less than August 2018 which was characterised by a bearish storm.

As a result, September remains an eventful month, which could open the doors to a new season for the altcoins, who are continuing to suffer at the moment. However, some of them are distinguishing themselves in these last days with countertrend dynamics.

The market cap feels the downturn of these hours and falls below 260 billion dollars, with contracting trading volumes, falling to 55 billion dollars.

The dominance of bitcoin continues to stay around 70% with Ethereum that, despite the difficulties in reacting over the last few days, still manages to recover 7.5% of dominance, levels abandoned at the beginning of September. Ripple is at an all-time low of the last two years, with 4.2% dominance.

The return of bitcoin (BTC) to 10,000 dollars

Bitcoin continues to fail to give clear positive reaction signals. The latest pullback, generated by last week’s rebound, saw prices rejected by the $11,000 threshold. It becomes increasingly important to hold the support of 9,500 dollars, which coincides with the threshold of the bearish triangle that as the days go by keeps lowering investor confidence. This technical figure would be invalidated only with a rise to 11,000-11500 dollars.

Otherwise, a break of the area 9.500-9.200 dollars could cause a sell-off triggered also by the coverings of traders who are following this technical structure from an intraday point of view.

A possible break would push the prices in the 8.800-8.500 dollars area. For this reason, bitcoin needs to recover $11,000-11,500 as soon as possible.

Price Ethereum (ETH)

The major altcoin continues to see prices fluctuate without a clear direction and a definite response of new purchases. Ethereum has now reached $180, a step away from the lows dangerously tested last weekend, at $165.

A break of the 165 dollars would almost certainly lead to the test of next medium-term support of 155 dollars, the last bulwark before undergoing a possible collapse that would become very worrying even in a long-term perspective.

For Ethereum, it is necessary to return to attract the attention of traders with new purchases and increases over 185 and 200 dollars. Without these two signals, the situation will continue to be very uncertain.