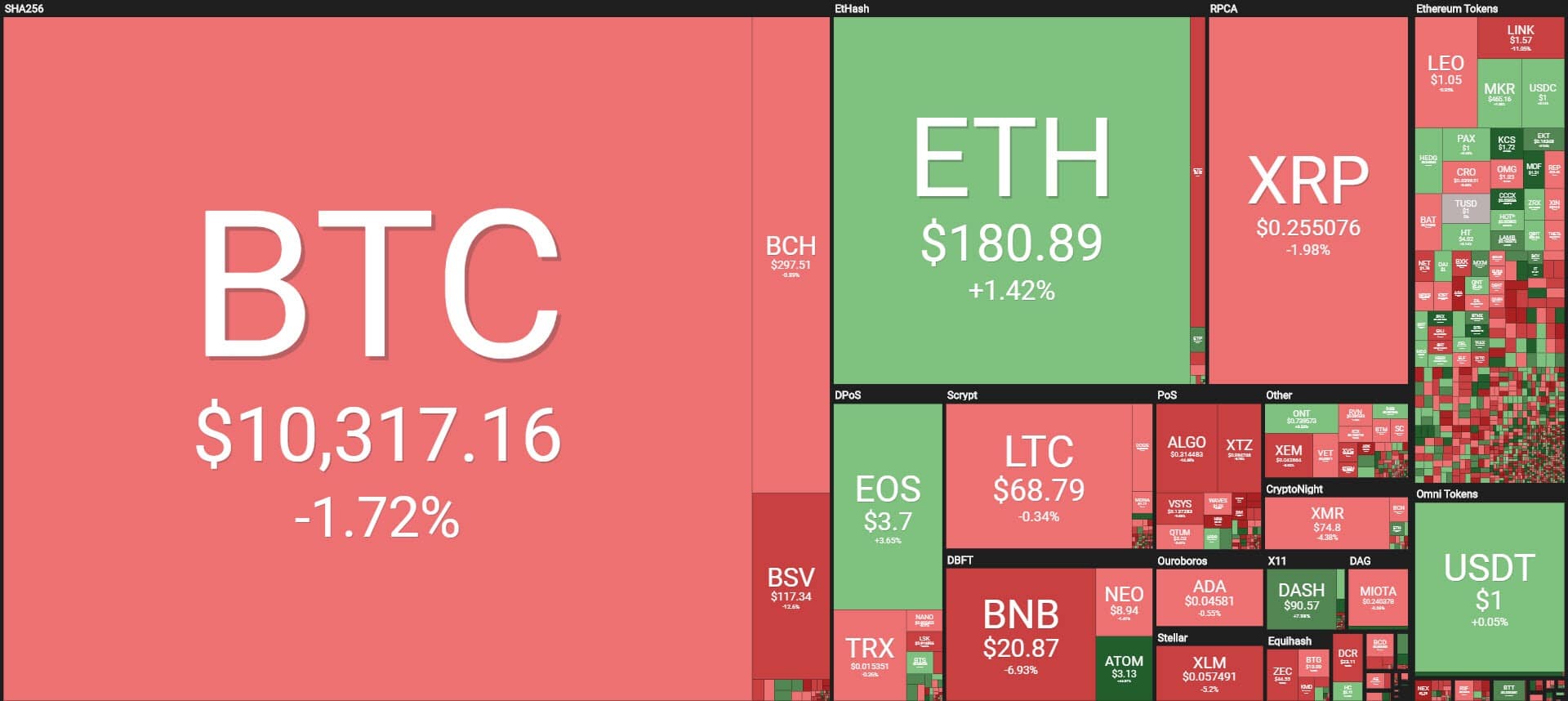

The second weekly in September for crypto market sees an alternation of red and green signs. After three consecutive weeks in red, and the subsequent break in the negative series last week, the current one ends in uncertainty.

If bitcoin closes the week at Friday afternoon levels between $10,300 and $10,400, it would give a signal of perfect balance on a weekly basis.

Among the top 20 cryptocurrencies, the most noticeable rise comes from Dash, who benefits from the inclusion in the basket of Coinbase Pro and this has led to a weekly rise of more than 10%.

But on the top step of the podium is Cosmos (ATOM) in 21st position, which instead rises by 51%. This leap allows Cosmos to revise the $3 level left exactly a month ago.

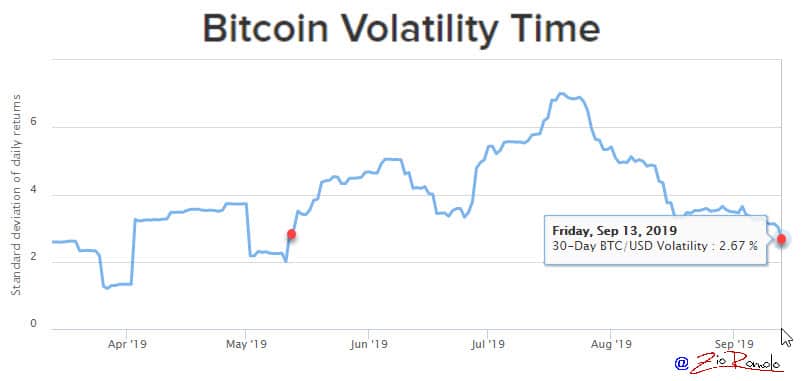

What stands out in this particular weekly closure for cryptocurrencies is the collapse of volatility that falls to 3%, levels that have not been recorded since the beginning of last May. This has brought the sector and in particular Bitcoin into a context of apparent calm. As the statistics and recent episodes show, this indication must raise the attention because periods of low volatility are broken by directional earthquakes that record a sudden explosion with upward or downward movements. If 2018 is remembered for explosions of volatility accompanied mainly by bearish phases, previously, as the statistics want, the volatility for Bitcoin and the cryptocurrency industry prefers upward movements, as opposed to stock markets, where volatility usually accompanies a downward movement.

This should lead to very careful observation from the next days of the new week of any breaks in levels of upward resistance or downward support.

There have been attempts during the week to reverse the trend, particularly for Cosmos which is now a step away from the 20th position where it would undermine NEO.

As happened in the first weeks of 2019, these increases could start to pull the sector, so they could be a positive wake-up call, but we will have to wait for further confirmation next week.

If this does not happen it is important to observe the panic that could arise from the breakdown of Bitcoin support placed in the area $9,500-$9,300 dollars.

Despite the slight recovery and narrowing of the spread between the capitalization of Bitcoin and the rest of the altcoins, most of the altcoins, including big ones and with rare exceptions such as Monero and EOS, continue to show clear signs of suffering, confirming the difficulty of keeping up the pace Bitcoin. Despite the fact that BTC has not experienced one of the best weeks of the summer period, it continues to give important signals, starting from the $10,000 point holding.

It is important to observe what will happen next week, where in all likelihood there will be valid indications, in a positive or negative sense, also for the second half of September, which is usually the month that heats the doors to open the rally at the end of the year.