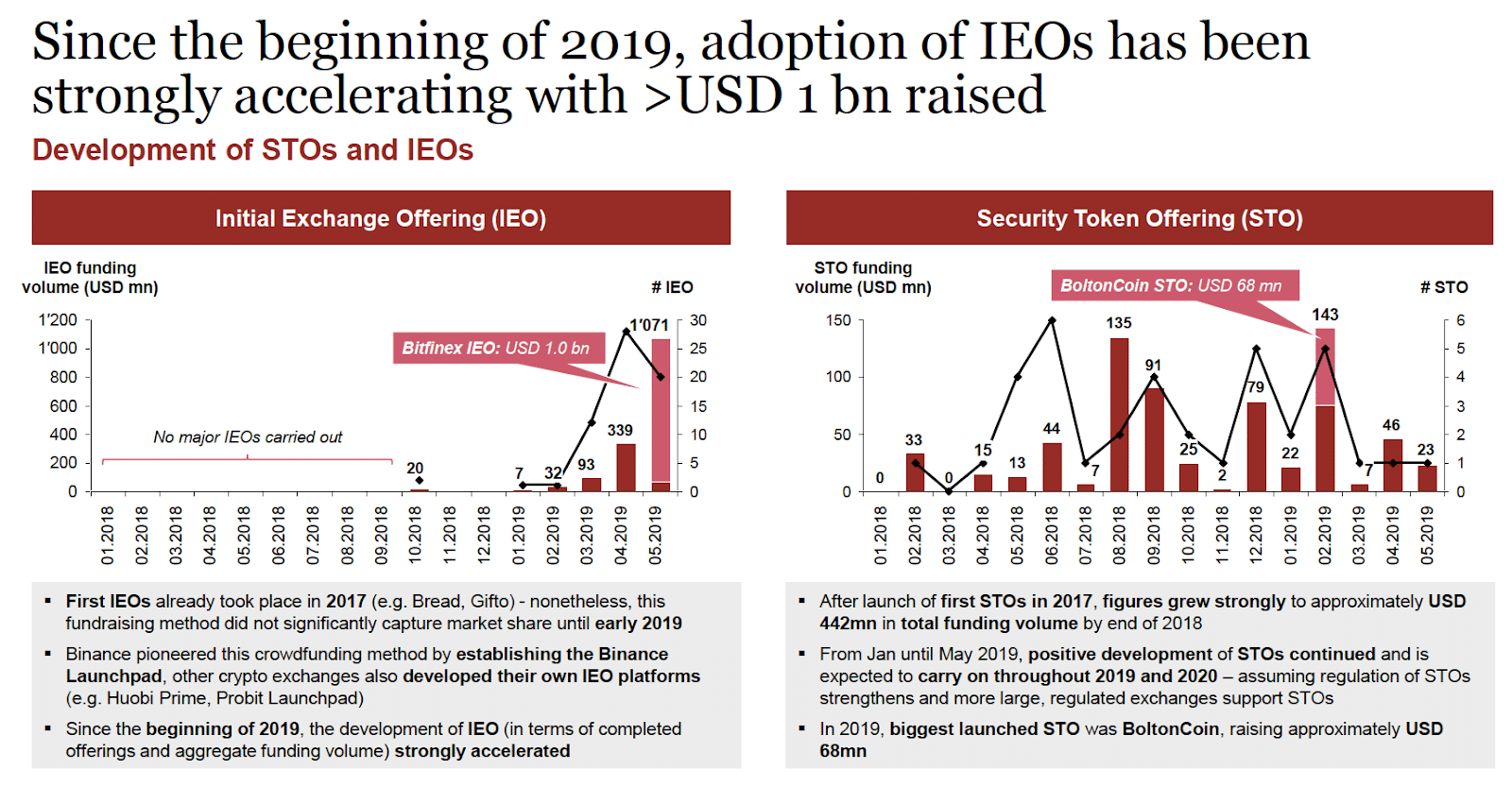

In the token sale sector, Security Token Offerings (STOs) cannot boast the same extraordinary results as Initial Exchange Offerings (IEOs), whose adoption has accelerated sharply with more than $1 billion collected before the end of the first half of 2019. Nonetheless, the former are in great demand, as demonstrated by the improvement in financing volumes.

After the launch of the first token sales on the market in 2017, numbers and volumes have risen sharply with the total amount of funding raised through STOs reaching $442 million at the end of 2018. This was reported by Blackchain during the first half of 2019.

In early 2019, more than 250 tokens were successfully launched through ICOs, IEOs and STOs. Digital asset placements enabled issuers to raise a total of 3.3 billion in new funding.

The two most successful operations were Bitfinex ($1 billion) and GCBIB ($143 million), which together accounted for 35% of the volumes in the first five months of the year.

The overwhelming arrival of IEOs

These are important numbers, inflated by the mighty arrival of IEOs. The new fundraising model in the crypto ecosystem – in which an STO or ICO is conducted exclusively on one or more exchange platforms in the sector – “is undergoing a significant acceleration in terms of successful offerings and volume of funding,” the study summarises.

For the first two years, there was little talk of this. The forerunner was Binance, with the introduction of Binance Launchpad, its personal IEO platform. Other financial companies then followed (see the cases of Huobi Prime and Probit Launchpad).

The concept of IEO, introduced only two years ago, had not been successful until this year. Now, however, it seems to have become a cheaper alternative than the others available when it comes to launching new coins or tokens. The figures in the report focused on the “strategic prospects” of the sector and STOs don’t seem to be any different.

“End of the crypto winter”

The growing success of token sales, which are nothing more than an alternative to the traditional financing of private equity and venture capital groups, is also favoured by a more serene crypto market in the first half of 2019 in the wake of a difficult 2018.

Since February, capitalisation has risen from its lows at $110 billion. Thanks to the gradual clarity of the regulatory framework and the renewed interest in the sector on the part of institutional investors and large companies, the crypto winter can be considered over.

Bitcoin recovered more than 120% of its value in the first five months of 2019 reaching $8,590 on May 31st. Meanwhile, the total capitalisation of digital currencies has risen to 270 billion.

From January to May 2019, the trend continued and analysts estimate that the trend will continue to be positive until 2020. Assuming the regulatory framework of STOs is strengthened and that larger and more regulated trading platforms support the issuance of tokenised financial assets on a blockchain.

BoltonCoin, the most successful STO

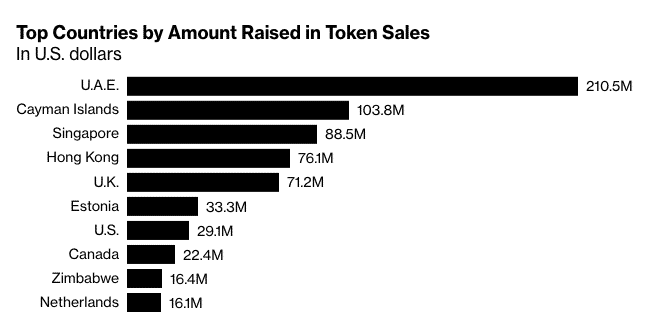

This year the most popular STO was that of BoltonCoin, which brought home a figure of around $68 million. The token in question, which runs on the Ethereum blockchain, is registered in the United Arab Emirates, which have become the world capital of digital token sales.

According to CoinSchedule’s data for the first four months of the year, the Emirates attracted about a quarter of all the money raised in these sales.

STO: there is a risk for scams

The arrival of Security Token Offerings on the market has aroused some fear among analysts and commentators in the sector, who suspect that the amateur ICO scams will be nothing compared to the more professional ones involving security tokens. A possible STO scam is able to affect an even larger number of people, either indirectly or directly.

The possibility that STOs may turn out to be scams or even worse, mega-scams exists, but as is the case with all speculative investing, it is precisely for this reason that credentials, white papers and reviews by industry analysts need to be thoroughly studied before participating in the Security Token Offerings.

In addition, Bitfinex, Binance and the other most popular exchanges are gearing up to protect customers from hacker attacks or scams. For example, Binance has set up a fund (Secure Asset Fund for Users, SAFU) whose $41 million (May 2019 data) is used to cover any unjustified losses incurred by customers.)

Similar to a share, the digital financial asset can be used to create securities and carry out transactions almost instantly. It also gives its owner certain rights, such as voting at meetings, paying a dividend or sharing profits.

A more robust infrastructure and regulatory framework

At the global level, political and market surveillance authorities are continuing to improve the regulatory framework of the crypto ecosystem. It is a favourable element for the token sales, within the context of the institutionalisation of crypto platforms.

“The innovation of IEO operations – reads the Blackchain report – emphasises the increasing institutionalisation of the most important crypto platforms in the world. They have become the cornerstone of the infrastructure of crypto finance”.

In June this year, the Financial Action Task Force (FATF) introduced a new set of standard measures for groups offering crypto services (including exchanges and wallet companies). And the G20 has already confirmed its adoption, demonstrating that a change is also taking place in the attitude of the establishment.