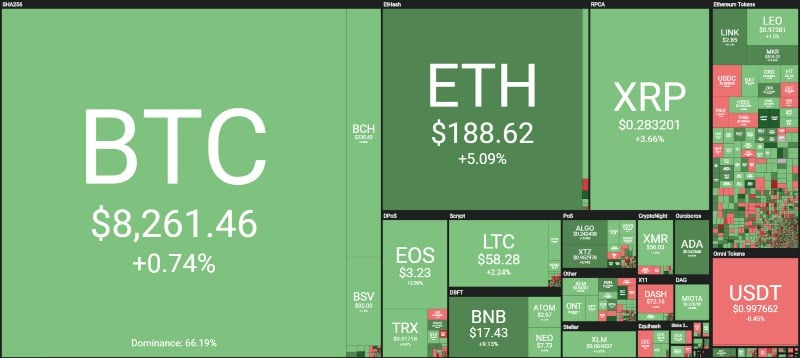

Analysing the first 20 cryptocurrencies per market cap, there are only three red signs and one is bitcoin, whose negative swings are not in line with the rest of the market. Bitcoin today loses 0.3%, the same downward intensity for Monero (XMR).

For the rest of the industry, today’s is the third consecutive day on the rise, an event that hasn’t happened since the first week of September when five consecutive positive days were recorded. The green sign clearly prevails, but not with the same intensity as in recent days, for 75% of the first 100 cryptocurrencies.

Dash shows a much more evident retreat, falling 2%, and is the worst of the day among the big ones, together with ZCash (ZEC), which loses 1.5%.

On the opposite side of the spectrum, there are strong upward rises. The first is that of Binance Coin, which rises 8%. Investors are positively affected by the latest developments of the exchange, which with the integration of WeChat and Alipay gives the opportunity to buy bitcoin and Ethereum in China.

With this news, Binance is making a good recovery. Added to the movement of the last 4 days, BNB rose by 20% compared to the lows reached in the last two weeks. Binance Coin, however, remains in a bearish channel.

With the price just over 17.40 dollars, it will be important for Binance to go over 20 dollars, to give a signal of a reversal in the medium to long term. The last bearish movement saw Binance fall back more than 60% from the top reached last June.

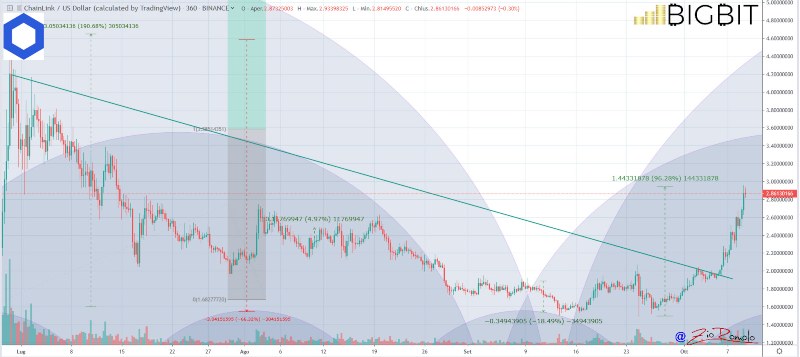

The best of the day in the top 40 is Chainlink, which rose 11% and continues to mark the rise of recent days, almost doubling its value from the lows of September. Chainlink is close to $3, a level abandoned since mid-June.

The gains of the altcoins push the capitalisation above 223 billion dollars, with trading volumes that register a slight retreat, marking just over 53 billion dollars in the last 24 hours. The swings of bitcoin cause further fractions of dominance to be lost, falling today to 66%, levels that had actually been recorded at the end of July.

The positive trend of both Ethereum and Ripple is good for their respective dominance: Ethereum rises to 8.9% of the market share, a level it has not seen since mid-July. Ripple is also on the rise, now gaining 2.5% on the price (it is the best of the top 5) and regains 5.4% of dominance, which XRP has not recorded since the beginning of July.

Bitcoin (BTC) swings

Bitcoin continues to hold $8,200 but in contrast to the rest of the industry. The day is as uncertain as yesterday, with fluctuations that have no direction and that do not clarify what investors expect from the queen of cryptocurrencies.

Prices continue to fluctuate between $7,800 and $8,400, levels to be monitored in the short term.

Ethereum (ETH)

Ethereum returns to attack the 185 dollars, but the volumes are not particularly convincing. This is an important condition: if the break was confirmed it would attract new purchases and a technical and psychological stimulus.

If the $200 threshold were exceeded, the trendline that forces Ethereum to adopt a bearish trend and that touches and joins the highest descendants of last June would be broken.

For Ethereum it will be important to climb above the threshold of 200 dollars, otherwise, it is necessary to monitor the quota of 165 dollars and then the minimum for the period at 155 dollars. A return of these levels would indicate the continuation of the bearish trend.