The day is characterised by the retracement movements of bitcoin and Ethereum, which first went beyond the weekly resistance and then fell back to the levels of two days ago.

This is a trend shared by the entire crypto sector. The day that opens its doors to the second weekend of October began with some turmoil. In the early hours of Friday in Europe (UTC+2), there was a strong movement, resulting in a sharp rise in prices. The following few minutes saw a determined retracement that brought the levels back to yesterday’s levels.

This is a nervousness that is not related to particular news, so it would seem an action related only to the technical side.

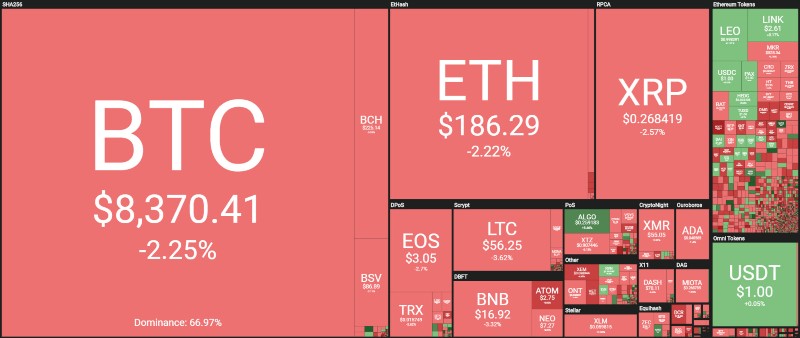

The day clearly marks a prevalence of red signs. Unlike the previous days, today the Bears take the stage, with more than 80% of the cryptocurrencies in negative territory.

Among the first 20, only a positive sign stands out: it is that of the LEO token which, with a jump of 3%, returns over 1 dollar, the level at which it was launched. Among the top 20, the worst are Binance Coin (BNB), Bitcoin Satoshi Vision (BSV), Ethereum Classic (ETC), Litecoin (LTC) and Bitcoin Cash (BCH), all with decreases that exceed 3%.

The worst of the day at the moment is Zilliqa (ZIL) in 82nd position which continues to show very strong volatility in this last period. Zilliqa today collapses by 17%, returning close to the 5 thousandths of a dollar (0.005 $).

In contrast, the best is Jewel (JWL), which flies and rises 80%, followed by Matic Network (MATIC), which rises 16%. Algorand (ALGO) is attempting to make up for lost ground and is now up 8%.

As far as market capitalisation is concerned, after having risen just over 230 billion dollars, with today’s falls it returns to 226 billion dollars. Bitcoin’s dominance remains unchanged at around 67%. Ethereum shows a slight retreat, with a few decimals below 9%, while Ripple tries to defend 5%.

Bitcoin (BTC) retracement

The rise of two days ago above $8,450, accompanied by volumes, had given hope of an exit from the laterality that had characterised the slow movements of the last week of September.

The push of a few hours ago to 8,800 dollars seems to have shaken the Bulls a little, but instead, it turned out to be a false technical movement, which is now pushing the prices of bitcoin into retracement, beneath the resistance of 8,450 dollars.

This is not a welcome technical signal, however, in order to better understand the situation, it will be necessary to wait for the rest of the day. The weekend becomes important and delicate and starts with the most feared uncertainty.

An eventual drop below 8,200 dollars would cause a false technical break that is usually not positive for the continuation of the movement. For this reason, it is necessary for the support of the 8,200 dollars to hold in the weekend. The upward resistance remains at 8,700-8,800 dollars, which has shown its strength and delicacy in these days.

Ethereum (ETH)

The breaking of the 195 dollars that occurred during these hours, pushed the prices to a step from 200 dollars, but instead of attracting new purchases that would have pushed and confirmed the upward trend, the downward defences are prevailing with a strong push that brings the prices of Ethereum to test the former resistance of 185 dollars.

It’s a similar context to that of bitcoin, which means that Ethereum will have to defend 185 dollars over the weekend. In case of a downward break with a prevalence of sales and the return of bearish pressure, the next support is quite far away in the $170 area.

For Ethereum it is mandatory to break the trendline that has been highlighting the bearish trend since the end of June.

Ripple (XRP)

The day’s retracement does not exclude Ripple, which drops 2%, although with a less evident intensity than BTC and ETH.

After failing to push beyond 30 cents in recent days, Ripple finds itself counteracting the former support of 25 cents. This will be the level that Ripple will have to defend over the weekend to lay the foundations to attack the 30 cents of the dollar.

This is the threshold where Ripple can return to build a solid upward trend in the medium term.