Today the price of Ethereum marks a decrease of 3.5%, with a break in the trendline of the long-term triangle that supported the rise in prices from the lows of mid-December of last year. The breaking of the 175 dollars brings the price of Ethereum to test the lows of the last 4 months at 165 dollars, which is certainly quite critical.

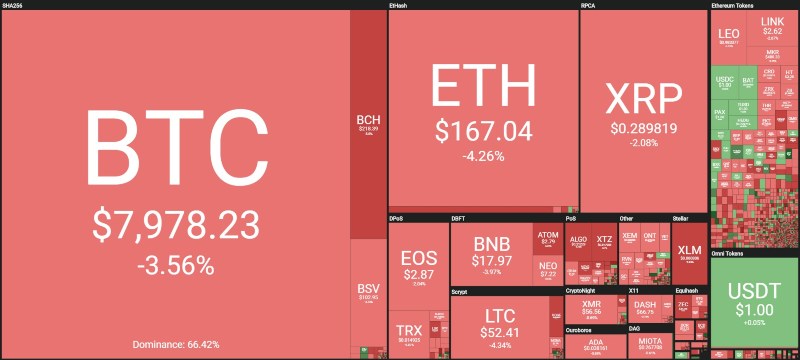

Aside from the price of Ethereum, over 80% of the first 100 cryptocurrencies today are below par. Among the big ones, it is necessary to go down to the 27th position occupied by Basic Attention Token (BAT) to find a green sign. BAT is the best of the day, rising 8% and returning to the 25 cents area.

Bitcoin is definitely in negative territory as well, retreating by less than 3% and testing again the psychological threshold of 8,000 dollars.

After having failed to reach more than 30 cents, Ripple continues the slow descent that today brings it to 28.6 cents of the dollar, a level that at the moment does not affect the short-term bullish trend of XRP, a small recovery that began from the lows of last September 24th.

The most significant downturn was that of Bytecoin (BCN), which lost 11%. Another negative double-digit performance was that of V Systems (VSYS), which lost more than 10%. These are the two worst performers of the day.

The worst of the big ones are Bitcoin Cash (BCH) and Bitcoin Satoshi Vision (BSV) which, after the increases of the last few days, show strong profit-taking.

The negativity brings the market cap down to $217 billion, levels lower than the last two weeks, which in recent days had been defended by the bulls, but this apathetic trend is not conducive to new increases.

The dominance of bitcoin remains tied to 66.5%, while that of Ethereum is suffering, returning below 8.4% of market share, levels of a month ago. Despite the difficulties, Ripple managed to hold on to its 5.7% market share.

Bitcoin (BTC) Price

Bitcoin returns to the psychological threshold of $8,000, which continues to shape the sentiment of operators. The volumes remain low, with trade below the average of the last few weeks, remaining above 15 billion dollars.

Bitcoin remains within the $1,000 range between $7,800 and $8,700. The technical structure does not change and does not provide useful operational indications.

Ethereum (ETH) price decrease

The breaking of the trendline which in the last two months saw 165 dollars as valid support defended by the bulls, in these hours brings prices to test this level that is crucial in the long run.

A decrease in the price of Ethereum below $155 could cause downward speculation with upcoming bearish targets that could push to $130-125.

Ether needs a bullish signal to recover the $180 area, which is neither far nor ambitious, and which could then give further contributions to start re-evaluating the $200 approach. Otherwise, it is necessary to observe with caution the 145-165 dollar area.