The day once again sees speculation surrounding Bitcoin Satoshi Vision (BSV), which has been on the rise for several months and has exceeded 30% on a daily basis in the last few hours.

The movement is most likely linked to the legal events of Craig Wright, which yesterday saw an evolution of the Tulip Trust Documents case that affects the founder of BSV. The BSV movement also benefits the other Bitcoin fork, Bitcoin Cash (BCH), which is up 10%.

Bitcoin (BTC) returns to test the downward dynamic in the $8,100 area in the last few hours, after having suffered a retracement that has characterized the last 48 hours with prices touching $7,600 during the night. This level confirms a support that must be maintained also in the next hours and days to confirm the rise that started from last December’s lows and that was sustained with the strong rise occurred on January 3rd with the beginning of geopolitical tensions between the US and Iran.

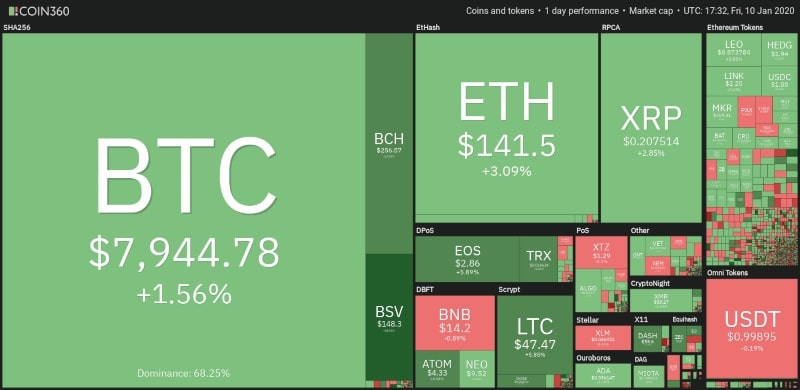

The day which is about to conclude the second week of the new year returns to give clear signs of an upturn with a clear prevalence of green signs, for over 70% of the cryptocurrencies. These movements are closing a week that sees a clear prevalence of green signs with volatility that returns to the markets following the months of December which was characterized by few fluctuations.

These movements bring the capitalization back above 210 billion dollars confirming the dominance of Bitcoin just under 69%. The market shares of Ethereum and Ripple also remain unchanged, at 7.3% and 4.2% respectively.

Bitcoin (BTC) on the rise

Bitcoin returns to test the $8,100, a level that will be important and decisive to keep the bullish trend.

For Bitcoin, it is important to overcome the weekend by confirming the $7,500-7,600. A push over $8,350 would be a strong bullish signal.

Ethereum (ETH) looks for confirmations

The first signs of a possible reversal are beginning to be seen for Ethereum. It is still too early to declare the end of the bearish trend that has been affecting Ethereum for six months. A second confirmation would be necessary, which would arrive with prices above 145-150 dollars in the coming days. Only the overcoming of this static resistance in the next days or weeks would give a second clear signal of medium to long term reversal.

On the contrary, a return below $130 would invalidate the current bullish structure that has formed since the lows of December 27th.