The developments of Bitcoin Cash will have a new funding plan: they will be supported with six months of forced fundraising. Supporters of this proposal will be committed to its completion.

This is unprecedented news: miners have published it and it is a revolutionary proposal in the world of SHA-256.

These figures are:

- Jiang Zhuoer – BTC.Top;

- Jihan Wu – Antpool, BTC.com;

- Haipo Yang – ViaBTC;

- Roger Ver – Bitcoin.com.

Referring to the great need to meet the costs of Bitcoin Cash code development, Jiang Zhuoer’s message is simple:

“The corporate donors have an undue influence on developers”.

For this reason, the plan is to build a system of proportional financing borne by the miners. This policy could also have costs for Bitcoin Cash users that, although minimal, could see the now very low transaction costs increase.

The vision is for the entire community to bear the costs necessary to make this blockchain grow in competitiveness.

A company based in Hong Kong will manage the proceeds of the collection. The withdrawal will be made through a 12.5% fee on the reward given to miners who add blocks to the BHC chain.

Referring to Chinese economic policies, the founder of BTC.Top believes that an immediate stance is essential. According to Jiang, the debate is a waste of time that the project cannot afford at this stage.

Those who do not comply will be “orphaned”, a neologism that indicates that they will be excluded from the Proof of Work lottery that distributes the reward for mining.

The power of these players is such as to impose itself on others, forcing the small miners connected to the pools to adapt.

Consistent with the culture mentioned by the author in the proposal, sometimes it is necessary to make difficult and unpopular choices for the common good. However, the choice of what represents the common good does not seem to be the same for everyone.

The first calculations have begun on the web and there are already those who are concerned about the effects that this dynamic will have on the sector. BitMEX researchers suggest launching the project after the halving, something that seems to have already been considered from the dates indicated.

It is probably a good idea, from a security perspective, that the plan by BCH miners to send 12.5% of the block reward to a developer fund, starts after the Bitcoin block reward is reduced. Although only by 3 days from the expected datehttps://t.co/T11g4RCBLT pic.twitter.com/Lsb1dkiIKA

— BitMEX Research (@BitMEXResearch) January 22, 2020

- Unlike Dash, which finances developments through transaction fees, there will not be a Masternode vote here. The initiative resembles more the Zcash model that has provided in the code a percentage of inflation dedicated to the foundation to support development costs.

- The initiative has a duration of 6 months (May 15th, 2020 – November 15th, 2020).

- The initiative is under the direction and control of the miners, who may at any time choose not to continue.

- This is not a modification of the protocol: it is a decision by the miners on how to spend their revenues.

- The activation of the protocol will take place in conjunction with the update of the protocol on May 15th. This will facilitate a consistent implementation among the participants in the ecosystem. The code will soon be ready for the first tests.

This part of the code, therefore, will be added in order to be applied to the participating nodes, those who connect to the pools of proposers will not be exempt from updating the code.

The Bitcoin ABC team and the led developer Amaury Sechet, the head of the most used BCH client, are happy and optimistic about the effects of the proposal and will certainly enjoy the funding generated by the project.

Thank you to @JiangZhuoer and other miners for supporting Bitcoin Cash development!

Although many previous attempts at stable infrastructure funding have been tried with mixed results, we are optimistic this plan could be a great success. https://t.co/y4t0HzzN4x

— Bitcoin ABC (@Bitcoin_ABC) January 23, 2020

The Bitcoin Unlimited team, which is the second most important client, does not seem to have expressed itself yet.

On Reddit, Jiang Zhuoer answers questions from the community which is very concerned about the governance model of this new Hong Kong-based company.

The questions everyone is asking are simple:

- Who will be responsible for this organization and how will it be decided?

- Will the miners, or their representatives, know better than others how to decide the priority and technical improvements that need funding?

- How will the organization be governed?

Those who do not believe in Bitcoin Cash and are not interested in its developments will be led to abandon the network, a risky decision that could migrate part of the hashing power to BTC or BSV based on profitability calculations and the long-term vision of the two blockchains.

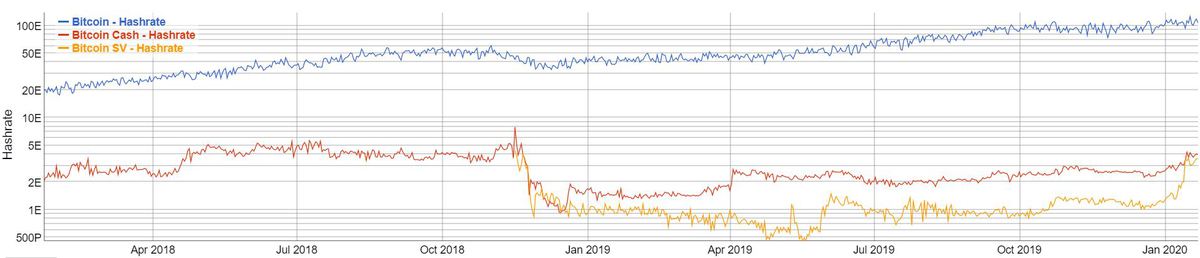

As can be seen from the graph, BTC’s computational power is much higher and on a logarithmic scale, BCH is being approached by BSV, a chain generated by a Bitcoin Cash fork.

Jiang Zhuoer’s forecasts are positive, the bull run is coming and this project will make BCH’s coin appreciate the improvements on developments made possible by the developers’ funding.