Today is Friday the 13th and for those who are superstitious it is proving to be a Friday of terror for Bitcoin and the cryptocurrency market is struggling with a major crash. It is one of the days that will enter the Bitcoin statistics because it shows one of the worst declines occurred in a few hours. It’s not a flash crash but a short-circuit that occurred on Bitcoin and then dragged behind the whole sector.

The strong downward movement already started in the day yesterday, which showed losses for more than 20%, in the night has extended further with a short-circuit that has further aggravated the bearish dynamics in particular of Bitcoin, which from the opening levels of yesterday, with the decline that developed in the European night, saw prices plummet below $ 4,000, highlighting a decline that in a few minutes has extended even more than 40% on a daily basis.

In addition to bringing prices back to the levels of March 2019, the movement opens a phase quite different from what only 15 days ago seemed to be decidedly opposite to today.

The strong bearish movement from the mid-February highs sees BTC’s prices plummet by 60%. The recovery of these last few hours brings prices back to a high volatility with movements between $5,000 and $6,000 dollars, highlighting an underlying nervousness, but that, past the next few days, will undoubtedly have to be analyzed with more possibilities in a cold mind to understand what is happening.

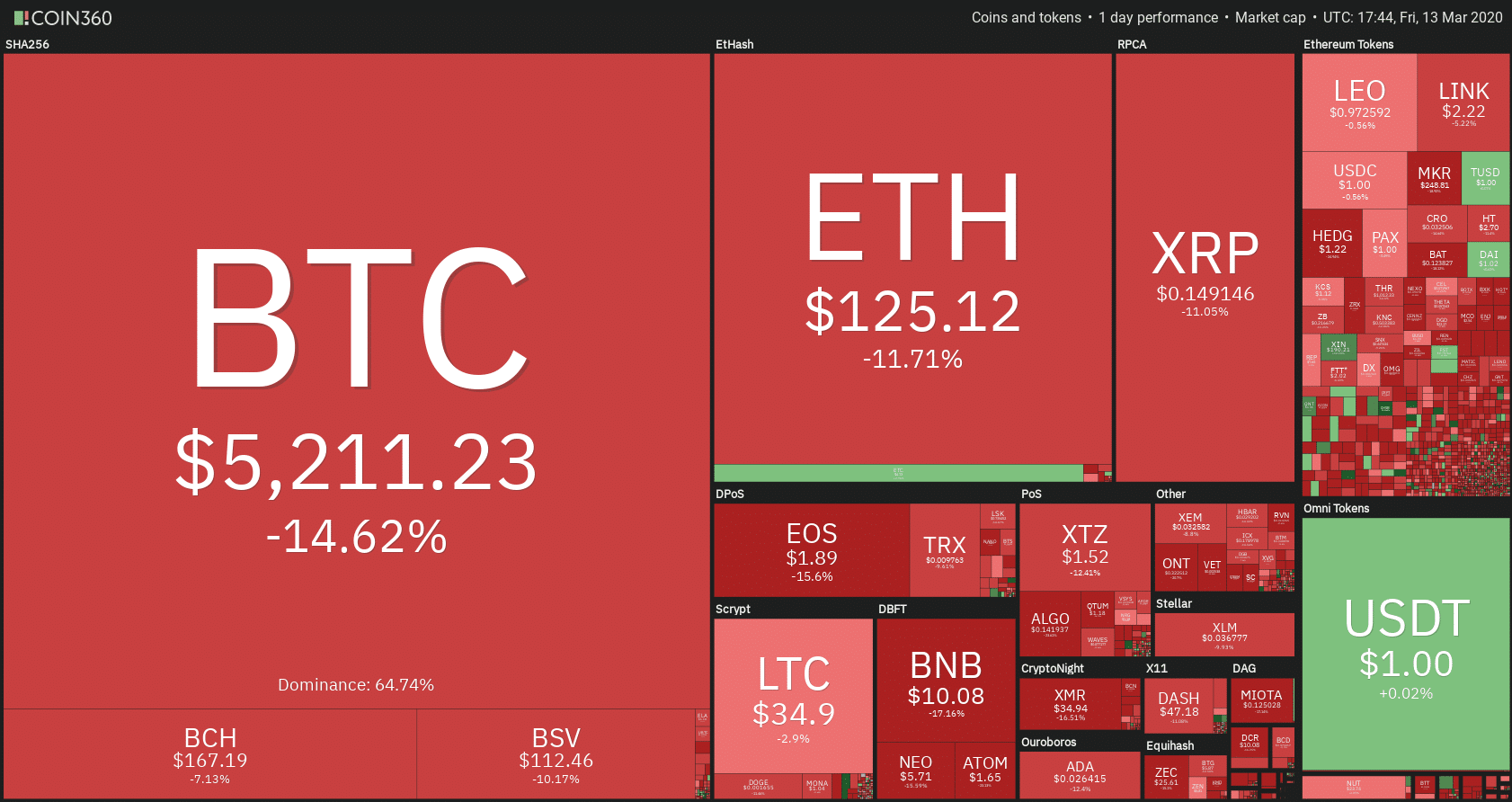

Bitcoin is dragging behind everything else in the industry in particular the main altcoins highlighting a day where red signs prevail.

On a daily basis taking as a reference the prices of yesterday afternoon at the moment there are some green arrows, few, but more than 90% of the cryptocurrency are in negative.

Litecoin (LTC) stands out among the big ones with an increase of more than 3% from yesterday afternoon’s levels.

Bitcoin also today has a double-digit loss of more than 10%, Ethereum (ETH) registers a -8% and Ripple (XRP) -6%. These are precisely values to be circumscribed in a very narrow time context because the fluctuations of the day remain wide.

The decrease not only changed the structures created since the beginning of the year and valid until a few days ago, but also the technical aspect.

The market cap falls below $155 billion dollars, a level not recorded since April 2019. It is impressive to observe how the total capitalization has lost around 50% from the levels that were recorded only a month ago. On February 15, total capitalization was over $300 billion.

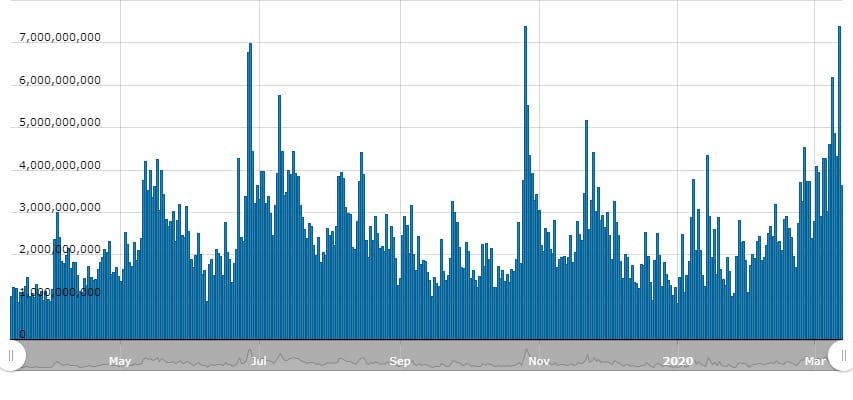

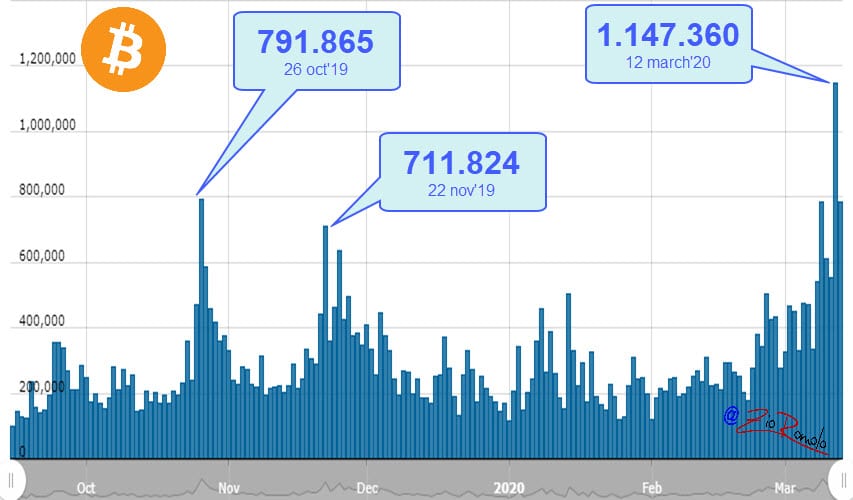

These are numbers that undoubtedly denote and highlight the consistency of the loss in value of the same sector. All this has happened with very high volumes, with trades never recorded. Total volumes over 24 hours go up to over $240-250 billion. Peaks never recorded also for Bitcoin with trades on the major exchanges that touch the $2 billion dollars. Records also for Bitcoin traded at an absolute historical level that go beyond the previous records of last October and November.

The Bitcoin Collapse (BTC)

Bitcoin breaks all the supports that until a few days ago were of reference. In such a delicate structure is better to wait for the evolution of the next few hours before going to identify new levels of operational reference.

Ethereum (ETH)

Ethereum sinks with the movement of the night with a drop of about 60% from the mid-February highs and brings the quotations back to December 2018 levels.

It is dangerous to break the mid-December low of $120, an area reached with the rebound that has regenerated with the night’s recovers and continues today, bringing ETH back to December 2019 levels.

It will be important to understand over the weekend if Ethereum will have the strength, the basis for defending what is the long-term support, the minimums of December 2019.