The strong collapse of BTC begins to raise doubts about whether Bitcoin is like gold, a good shelter par excellence.

Several analysts are pointing out that the Bitcoin movement is in line with what is happening and has happened on the stock markets. Yesterday the Italian index closed with the worst loss ever, even the U.S. index asked for a highly volatile session with losses that had not been recorded since 1987.

But yesterday was also a bad day for gold, which with the collapse of prices yesterday recorded a loss of about 9% from the highs recorded only 5 days ago, March 8.

With yesterday’s collapse, gold, a sovereign risk protection asset, also marks one of the most intense bearish movements ever, and this highlights how yesterday was a historic day for the tensions that are affecting the sector in terms of social and health. All this has had a negative impact on Bitcoin.

It is nothing new for Bitcoin to have these strong fluctuations on a daily basis, but this has happened in a different and new context.

This is the first time that cryptocurrencies are in a phase with the financial markets under stress. Bitcoin had to prove to be like gold, which even though it lost 9% is back to the levels of the beginning of the year. Bitcoin, however, wiped out a year of gains.

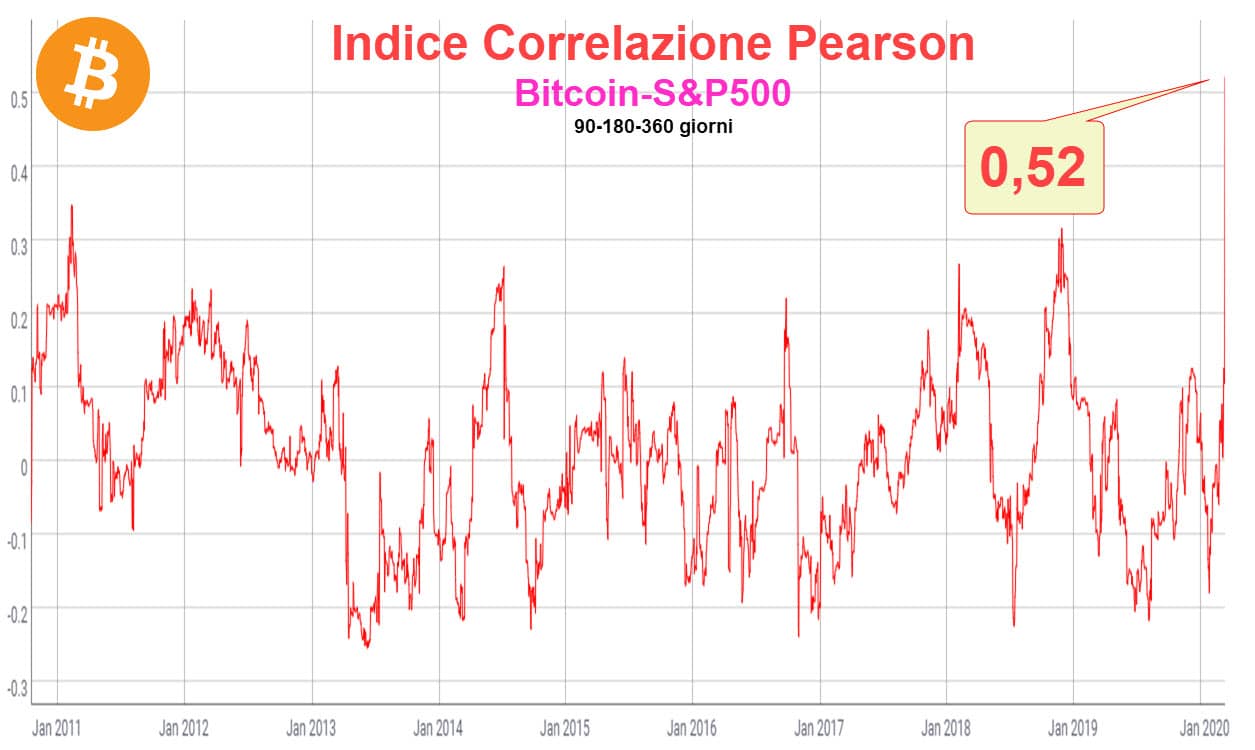

We need to differentiate what is happening in recent days between BTC and gold. Bitcoin has been dangerously aligned since mid-February to the stock indices and in particular the US benchmark S&P 500 index.

It is a mirror movement, a photocopy, unlike what is happening with gold. Bitcoin has undertaken a loss of value from the highs recorded on February 12. This shows that the movement of the last few hours is due to speculation and cover-ups that move capital and balances very quickly in a context already set downwards, unlike what happens when looking at the graph of gold.

Gold had a loss similar to that of these days even between the middle and the end of February when, after updating the records of the last 7 years, going close to $1,700, and then plunging to $1,560 on February 24, it then recovered its quotations until yesterday’s movement.

At the end of February there was a similar movement for Bitcoin too, only that gold recovered to its period highs, while BTC continued in a slow and steady descent exploded in the last 48 hours. This differentiates it from gold which has maintained and continues to maintain a positive balance since early 2020 despite the sinking of the last hours. What happened on Bitcoin changes the appearance and perception by investors.

In a stock market in full sell off, one can expect a knock-on effect on other assets due also to the liquidity seekers’ cover-ups to meet margin call requests. But as happened yesterday for gold and for a few days on both gold and BTC, from a safe haven asset you can expect a decline in value, even 9% in a few hours, not a meltdown of equal magnitude as occurred in the last few hours on Bitcoin.

It’s true that Bitcoin is not the first time that it experiences sudden downward movements, but in such a violent scenario, from March 6th-7th highs (which coincide with the higher highs of gold, while BTC recorded lower highs than mid-February) Bitcoin marks a loss in 5 days of over 50%. This raises some doubts. But this is not the time to get carried away by irrationality considering that the losses concern the whole cryptocurrency sector.

Even Ethereum, with the loss that pushed prices to the December 2018 lows, is in a totally changed technical picture compared to last week.

It will be necessary to understand and evaluate with attention and interest when volatility will start to return, if the quotations will have found a base from which to start again, or will give confirmations of weakness and a real bearish trend and not only of speculative cover-ups.

This would change the structure that was set up until recently.

Recommending to buy at a time of weakness when there is such an important reversal is never wise. It is good to wait to understand technical and fundamental developments in terms of prices, to assess what may develop in the coming weeks, also in virtue of the approach of halving, that everyone expects and that will change the approach and use that can differentiate the inflationary aspect that remains unchanged on Bitcoin, while instead the new and likely fiscal policies will further affect the fiat currency, primarily the dollar.