Interviewed on the international news channel RT, Jeffrey Tucker and Peter Schiff discuss the effects of Covid19 on the American economy and the role of Bitcoin.

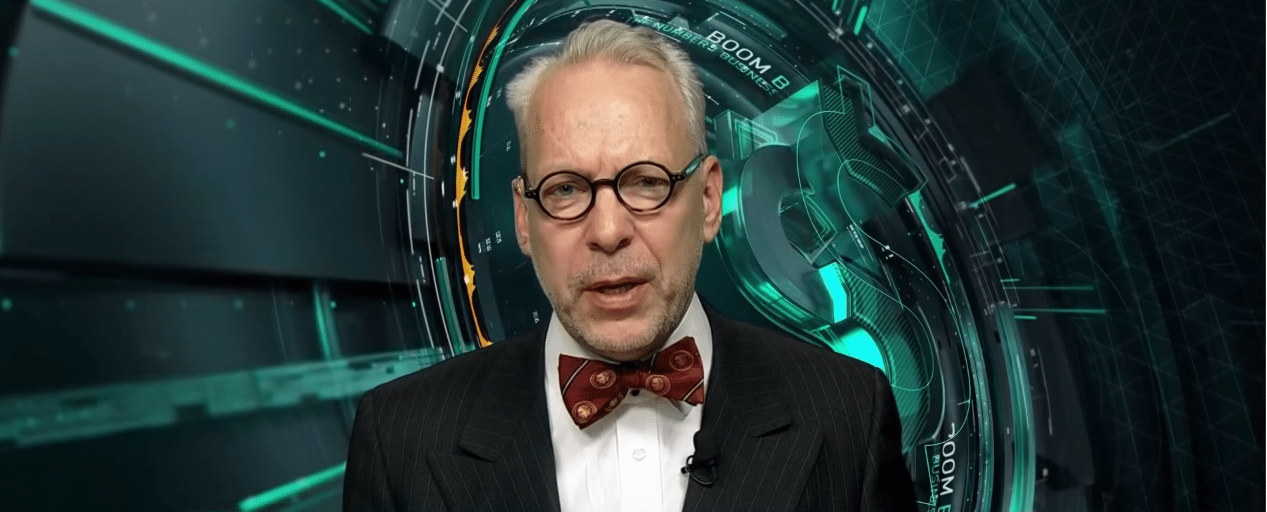

Jeffrey Tucker blames Bitcoin’s core devs for not allowing the protocol to scale:

“Bitcoin is not performing well because the core developers lost time and didn’t want to follow the path outlined by Satoshi Nakamoto. Hodl forever is not a rewarding technique.”

Tucker, editor-in-chief of the American Institute for Economic Research is a libertarian and economist of the Austrian School of Economics, he has always honoured Bitcoin and praised it to this day.

His doubts arise from the awareness that without the use as a means of exchange, Bitcoin will never be able to meet the technical-economic requirements for success.

Tucker emphasizes the negative effects of Trump‘s US government choices by declaring:

“This total shutdown is causing a panic that is leading people to seek the most liquid resource at the moment, cash.”

According to the economist, neither Bitcoin nor gold can compete with cash at times like this. The panic reaction leads people to disinvest, convert into liquid currency while waiting for the waters to calm down.

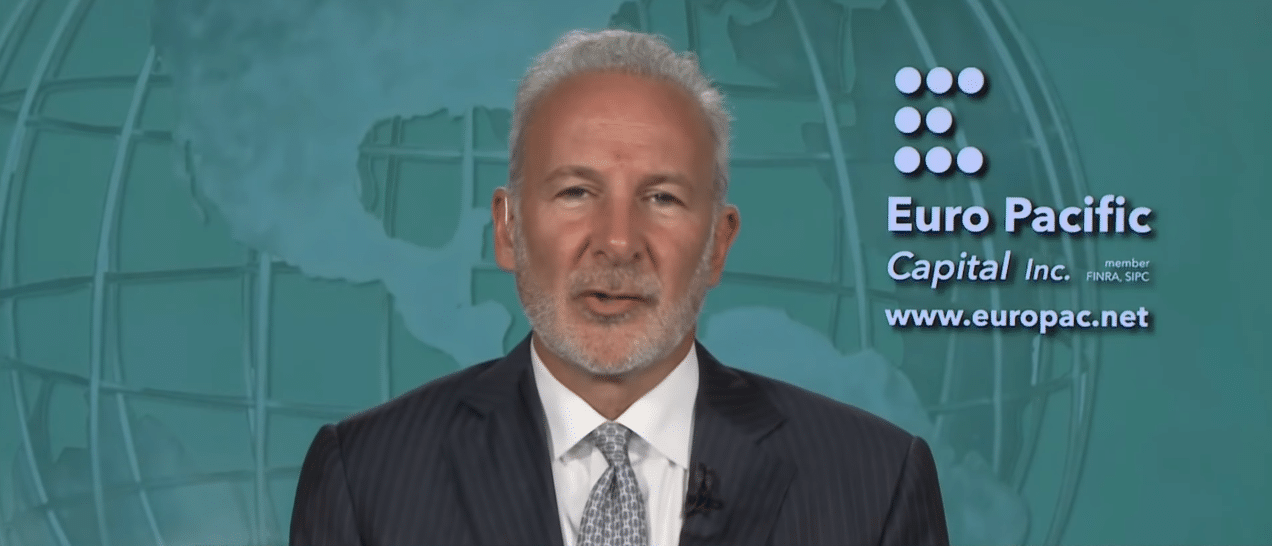

Peter Schiff, on the other hand, targets the fiscal stimulus policy, the Fed, and does not refrain from his attacks against Bitcoin:

“It’s not the virus people should be worried about, but the collapse of the public debt bubbles. Bitcoin is not a means of exchange, the narrative of digital gold has failed”.

Peter Schiff has repeatedly expressed bullish opinions about long-term investments in stocks and foreign currencies in countries with sound fiscal and monetary policies, as well as global commodities including physical precious metals, and has expressed bearish opinions about the US economy and the US dollar.

Known also for finding it very difficult to use a Bitcoin wallet, Peter is once again sceptical.

I just lost all the #Bitcoin I have ever owned. My wallet got corrupted somehow and my password is no longer valid. So now not only is my Bitcoin intrinsically worthless; it has no market value either. I knew owning Bitcoin was a bad idea, I just never realized it was this bad! pic.twitter.com/6SJvDJOZU6

— Peter Schiff (@PeterSchiff) January 19, 2020

His interpretation is that fiscal stimuli and the inevitable printing of new money resulting from them are the real problems we are going to face.

The amount of money in circulation will be very high and the supply of goods very low. The prices of goods could rise sharply.

Artificial stimuli are paid for, Covid19 is a health and economic problem but it triggered a latent problem, that of debt.

Countries’ debt positions are reaching unacceptable levels.

The quantitative easing measures put in place by the Federal Reserve frighten many economists and pave the way for more emphasis on cryptocurrencies.

Despite the difficulties highlighted by the two libertarians, the paradigmatic features of this technology, after the panic, could be appreciated by the markets and offer an alternative.

The narrative linked to the sector should not be judged in moments of panic, however, it will be reinforced when the effects of this crisis will become more evident and people emerging from the dynamics of fear will have to deal with the results.