The mining reward of the Bitcoin Cash network has been cut in half as a result of the new halving that took place successfully today.

The code has run as planned and from today, first among its forks, 6.25 BCH will be extracted at each block.

On April 8th, 2020, the third halving when considering the parent chain and the first for Bitcoin Cash, took place at the 630,000th block.

BSV and BTC will follow in the next 30 days.

During the event, followed by the community via live streaming, Jihan Wu, the founder of Bitmain, a leading ASICS manufacturing and mining company, has reappeared.

There is a debate about the possibilities that are opening up in the cryptocurrency world in light of the latest financial turmoil.

“Money print policies will benefit the crypto sector, inflation will be strong and money will go into Bitcoin Cash”.

These are the words of Jihan, a figure criticized and feared in the world of Bitcoin. Under pressure from the media, he has chosen to move away from the spotlight but seems to have returned with a renewed sense of belonging to the Bitcoin Cash community.

His statements seem to be strongly rooted in the strength of the ecosystem developed on BCH, as a result of SLP tokens and the DeFi tools that are also being introduced on this chain. The monetary function remains in first place as Peer to Peer Electronic Cash but now tech allows a greater openness towards other sectors.

“Much higher probability to gain value for BCH when the speculation is finished”.

There are 9 BCH miners moving away from the BCH chain including Antpool, Btc.com, Btc.top, Viabtc, SBI Crypto, Huobi, Pool.Bitcoin.com, Poolin, P2p Pool and 7.6% of the hashrate is in the hands of invisible miners.

All in all, the Bitcoin Cash community has been waiting for this important halving day and many supporters have shown enthusiasm in recent weeks.

There may still be volatile price actions, as well as changes in hashrate and difficulty in the coming months.

The cryptocurrency rose to a maximum in a four week period of $265 at the beginning of Tuesday and was last seen trading close to $276.

Some observers believe that the halving, which creates a supply deficit, could result in a major rally for BCH.

The above argument, however, does not take into account two important factors:

- revenue per block will fall by 50 percent as a result of the halving of the reward, and miners use cash by liquidating their holdings to covers the costs of extraction.

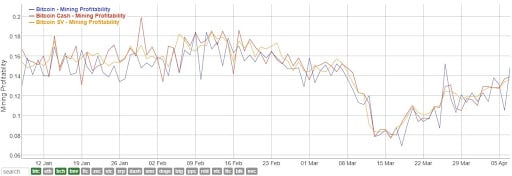

- in essence, halving the reward will reduce the profitability of mining and may force small or inefficient miners to close operations. The way these players will behave remains to be seen.

For example, Litecoin‘s halving took place on August 5th, 2019, as a result of which the price fell from $100 to $50 in the four months to December. The same hashrate, or computing power on the network, however, has increased.

BCH’s price trend is recovering after the crash caused by Covid19.

If the post-halving price increase is strong enough to compensate for the drop in revenue, small and inefficient miners will likely remain active and there would be less incentive to mine other cryptocurrencies on other blockchains or exit the industry altogether.

The more cautious miners will tend to escape from chains that have already been halved to those who still retain the 12.5 coin reward.

Because of this incentive to arbitrage between chains, the hashrate is expected to be volatile, although this is not expected to have a significant impact on the coin’s value.