Over the weekend, there was a significant crash for Bitcoin. The euphoria that had characterized the crypto sector last week, as is often the case in this space, especially for Bitcoin, had warned that these sudden movements hide dangers around the corner.

Once again, after exceeding 10,000 dollars and the excessive euphoria that in recent days had brought the fear and greed index over 55 points, levels that had not been recorded since the end of February, the bears returned. This wave began late on Friday evening and extended until Sunday morning with declines that caused Bitcoin prices to plummet by about 20% in just under 48 hours.

This collapse comes only a few hours before the halving, a halving that has already affected the price increases from last Friday’s highs.

The strong downward movement has made the value of BTC crash, cutting in half the increase that Bitcoin was recording since mid-April last year. This fall has cancelled the increases recorded since May 1st and has increased tensions in view of the halving expected at the end of the day, at 22.00 CET.

The decline began with the first profit-taking in the $10,000 area and then exploded when the 9,500 broke. This led to a loss of more than 15% in one hour and therefore all the bearish movement was concentrated within an hour during Sunday night. The total drop from Thursday-Friday highs is about 20% while yesterday at 2 AM, in one hour, Bitcoin lost 15%.

The flash crash that occurred yesterday night affects the short term, while in the medium-long term sees prices fall back into a bullish channel that continues to accompany the rise of Bitcoin from the lows of mid-March.

Bitcoin drags behind the whole sector. On a weekly basis, in fact, there are few balances above parity. Bitcoin is still among the positives since last Monday’s levels, with a balance close to 1%. Among the big names, Chainlink (LINK) +5%, Leo (LEO) +1.5%, Neo (NEO) +11%, and Iota (IOTA) with +2% from last Monday’s levels are the only ones that manage to maintain a positive balance on a weekly basis.

The week starts with a prevalence of positive signs. It has to be said, however, that Sunday’s day has been totally coloured red, so today’s green signs are a reaction to the lows touched at the heart of the crash.

Yesterday’s collapse caused volumes to explode, which despite being Sunday saw total trading volumes exceeding 160 billion dollars in the first part of the day.

Yesterday, with over $3.5 billion, was the Sunday with the highest trading volume ever in Bitcoin’s history. Yesterday’s total volume is exactly the 11th record ever for Bitcoin, but it is the first-ever for a Sunday.

This indicates how halving is approaching with strong tension also with regard to speculation, which sees Friday, Saturday and Sunday increasing volatility to three digits. In fact, the explosion of volatility between Saturday and Sunday marks a +300% in less than 24 hours and since last night has fallen by 50%.

Volatility and prices are on a roller coaster. Daily volatility is increasing, but daily volatility on a monthly basis sees a slight increase of about 3 decimal points with a return just over 4%.

The strong bearish movement knocks down capitalization, which after pushing to $270 billion last Friday, today loses about $30 billion.

Bitcoin’s dominance remains close to the highs of the last three years, at 67%. Ethereum and Ripple are stable at last Friday’s levels at 8.7% and 3.6%, respectively.

Bitcoin (BTC) crash

On a technical basis, BTC’s crash sees a return of prices within the bullish channel that has been accompanying prices since last mid-March.

The momentary sinking to the $8,150 area on Sunday night was immediately recovered and now becomes the support level of the lower neckline of the bullish channel itself.

A possible break in the next few hours, in which a lot of volatility is expected with tonight’s halving, sees the next level of support identified in the area $7,500, which corresponds to the previous highs of early March, former level of resistance now support.

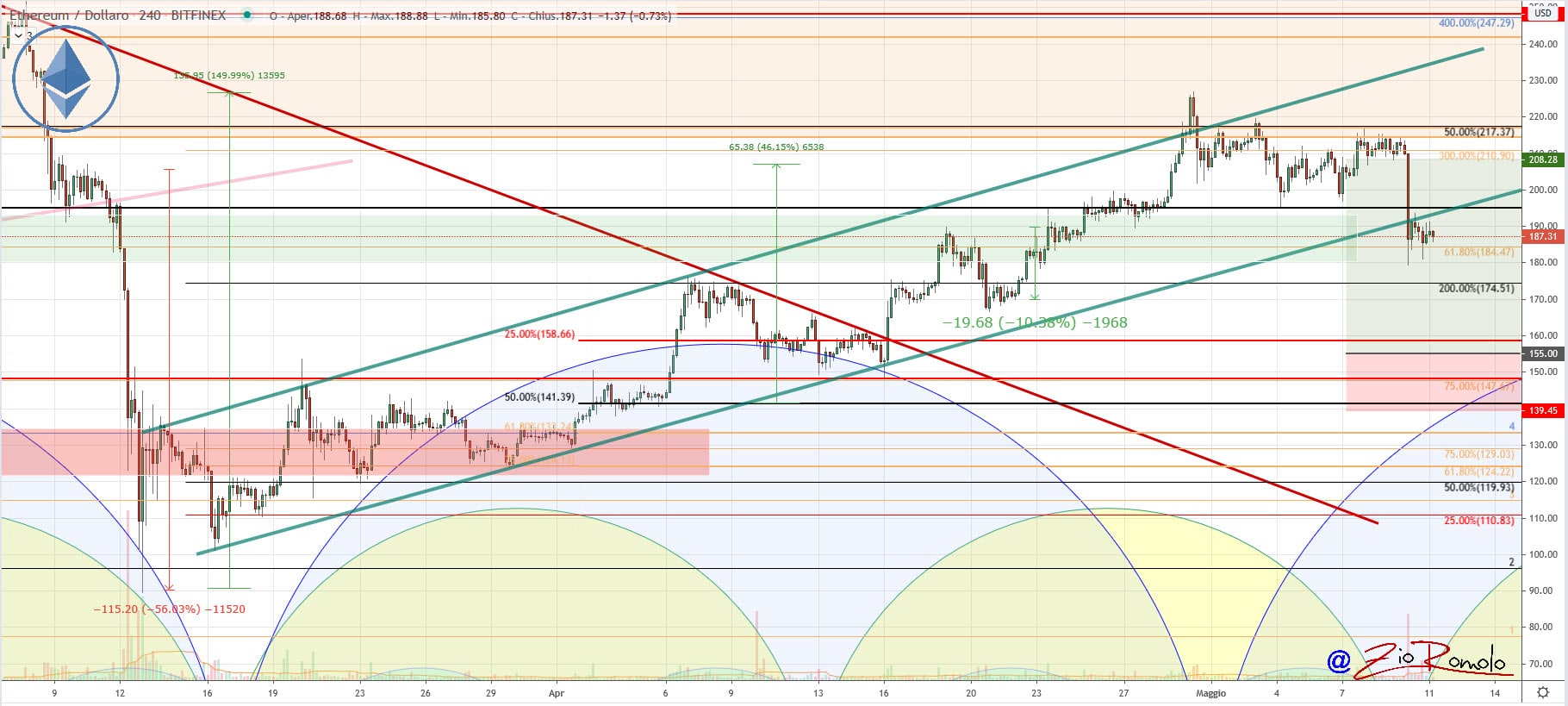

Ethereum (ETH) price

Yesterday’s Bitcoin movement is also reflected by Ethereum’s prices, which already showed a less evident increase compared to that of Bitcoin last week.

After the effort to go over $215, yesterday’s bearish movement drags behind ETH prices as well, which break the psychological threshold of $200 and push to test $180, under the neckline of the bullish channel started in mid-March and passes in the area $190, and which sees prices trying to recover in these hours.

For Ethereum it is necessary not to go below $175 in the next few hours to start evaluating a consolidation that could lead to the recovery of $200 in the short term. In case of sinking to $175, ETH would review the former target now support that had characterized the April holding in the area $155.