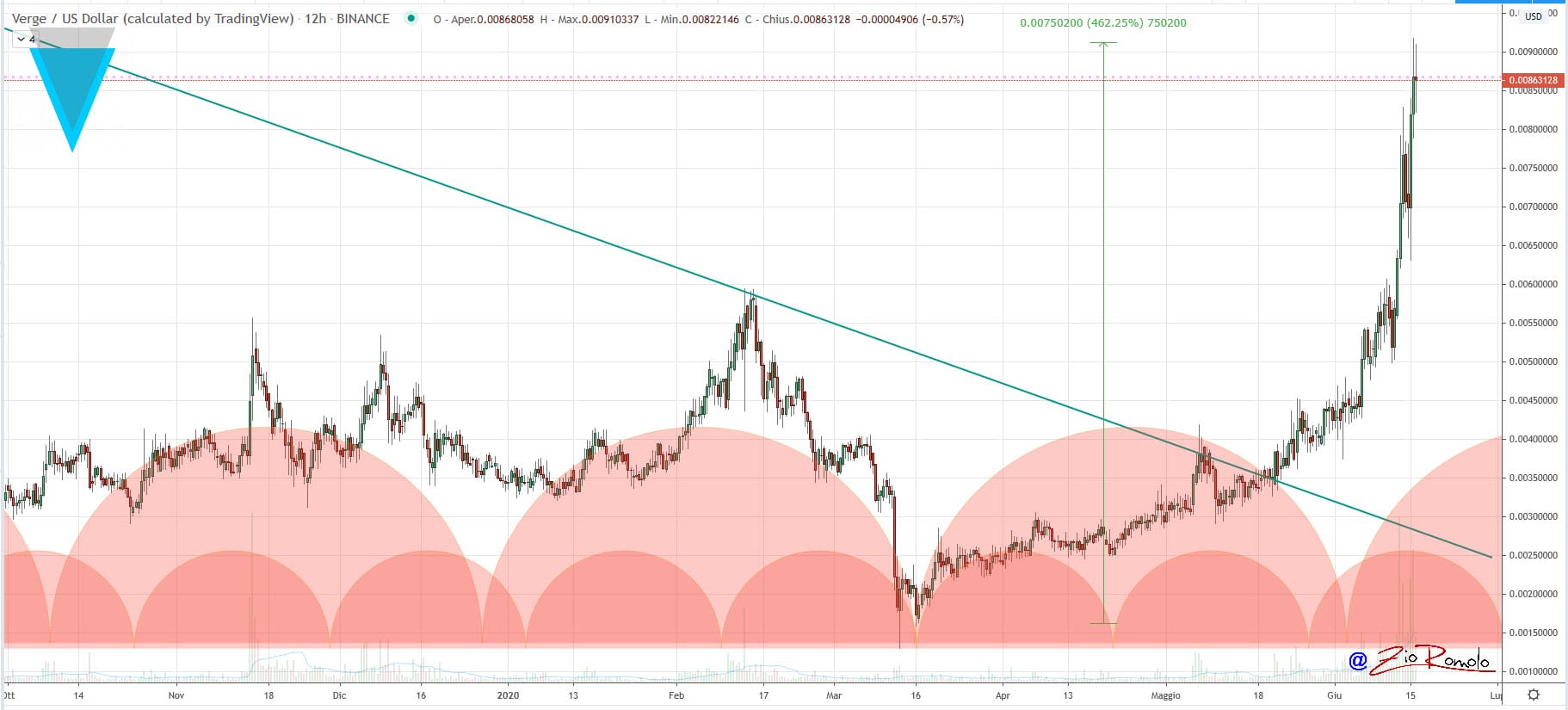

Today Verge (XVG), with its best upward movement, achieves a performance of more than 30%.

Coupled with the good work done in recent weeks, Verge multiplies its value by 5 times since the lows of mid-March, with a performance of 460%.

Precisely in mid-March, Verge scored an all-time low of $0.0016. With the rise of the last few hours, Verge revised the $0.0092, levels that had not been seen since the end of June 2019.

In the meantime, as happens in crucial phases, it is Bitcoin to mark the pace by achieving an increase of almost 5% in the last 24 hours.

Among the top 10, Cardano (ADA) is doing well, scoring a climb close to 10%. Cardano regains the 10th position despite the good performance of Crypto.com (CRO) that today rises by 3%.

Scrolling through the ranking of the top 100 today, only three coins are moving below par today. The worst is Flexacoin (FXC) in 69th position, which loses 9%, followed at a distance by the Leo (LEO) token, -1.3% to 1.16 dollars. The third worst, the last to record a bearish move, is Divi (DIVI) in 88th position.

Among the best of the day, there are the tokens of the DeFi universe. These are rises that exceed 20%, as in the case of Ren (REN), Zilliqa (ZIL), Aave (LEND), Maker (MKR).

VeChain (VET) is also doing very well and is climbing up again after the profit-taking that characterized the weekend.

VeChain today scored a +15%, trying to attack the $0.0095. With last week’s highs, VeChain has seen the highest rises since late June 2019.

Going beyond the 100th position, the Eidoo (EDO) token is once again making a comeback today, jumping more than 20% in the last 24 hours, returning above 61 cents, the highs that were reached during last Sunday’s bearish movement, when Eidoo was among the few to row against the trend.

With the 60 cents back, Eidoo returned to the levels of July 2019. On a weekly basis, Eidoo earns over 30%.

The crypto performances of the week

Taking into account not only today but the week, there is still a general prevalence of red signs.

Among the top 30, only VeChain scores +21%, and ZCash (ZEC) with a risky +2% keeps above parity.

Volumes in the last 24 hours continue to rise with about $80 billion traded across the board. Bitcoin trades twice the volumes recorded over the weekend.

Ethereum is also doing very well, as yesterday’s 24-hour trading day brought more trades than the first two days of June.

The rises of the last few hours bring the market capitalization back to 270 billion dollars with a further fractional gain of Bitcoin dominance that rises to 65.3%.

Despite Ethereum’s rise in the last few hours, gaining 3%, similar to Ripple, +3.5%, both lose further ground in market share.

ETH returns below 9.5%, missing the 10% mark, a level touched last week, while Ripple remains at the lowest level in the last 3 years with 3.15%.

Bitcoin (BTC) price

After the sinking that was recorded during the night yesterday, with a slip that led BTC to test the static support of $8,800-8,900, today the prices of BTC are over $9,500, former support which has now become resistance.

It is necessary for BTC to recover the $9,800-9,900 as soon as possible to put behind it an uncertain start to the week accompanied by a bearish pace. If prices were not accompanied by new purchases in the next few hours, a return below last night’s lows at $8,900 would be worrying, with a next target in the $8,400-8,500 area.

Ethereum (ETH) price

Ethereum brings prices within the bullish channel that has been accompanying it since last mid-March.

In these last hours, Ethereum returns above $230, the threshold that corresponds to the lower neckline of the bullish channel.

Yesterday morning’s sinking to test the former resistance, now support, of $215 remains a reference level in the coming days. In case of violation of these values, the next downward target is positioned around area 185-190 dollars.

A recovery of $250, which corresponds to the highs at the beginning of June, would attract new purchasing volumes.