Bitcoin’s weekly close under $9,350 marks the third consecutive week downwards, characterizing the week just ended with 5 days out of 7 in the red. An event that has not been recorded since November 2019.

A closure that despite seeing prices continue to slide, testing area $9,000 over the weekend, does not become worrying. If we consider the rise in the last quarter started in mid-March and taking as reference the highs of early June, the current movement can be classified as a retracement.

Taking these two extremes, lows and highs, prices see a loss of about 25%.

What is puzzling, however, and which is in some ways not very comforting, are the low volumes recorded over the last week.

On Sunday, trading volumes, for the first time since mid-February, fell below one billion dollars in value. This highlights how, despite fears and unfounded concerns over last Friday’s options expiration date, which recorded the highest open interest ever, it did not lead to the movements many were expecting.

This should be interpreted as an increase in interest in derivatives that professional traders use as a risk hedge.

Today sees a prevalence of positive signs for over 75% of cryptocurrencies.

On a weekly basis, starting from last Monday’s levels, among the top 20, only four coins are above parity. Best of all is the Leo (LEO) token, +6%, followed by Chainlink (LINK), +4%. Followed by Cardano (ADA) and Crypto.com (CRO) just above parity.

Crypto.com is among the best of the day recording a 5% jump, like Cardano. CRO regains the 12 cents and after suffering last week’s declines due to the tensions and insolvencies of Wirecard’s bankruptcy, today is heading for the highs recorded at the beginning of last week, which coincide with the highest levels of the last year (since July 2019).

With this upward leap, Crypto.com regains the 10th position, going to attack the 9th position in the ranking of the most capitalized cryptocurrencies, currently held by Eos. The difference between the two capitalizations is $50 million.

Among the best rises of today, there is one of Bitcoin’s forks, Bitcoin Gold (BTG), which flies 25% up to 45th position. This fork has now become of little interest, since it never gave cause for concern about the intentions that motivated the fork in October 2017 at the 419,406th block of the Bitcoin blockchain.

Good rise for Bancor (BNT), +15% in the DeFi universe. Also Ren (REN) and Synthetix (SNX) do well, both rising by 8%.

DeFi sees a record of the tokens locked, rising to new highs that exceed 1.630 billion in dollar value.

Compound (COMP) continues to maintain its leadership with over $625 million locked, 38% of dominance.

The declines of the last few days cause the market cap to slide to 255 billion dollars, levels already recorded in mid-June and which coincide with the lowest level of the last month.

Bitcoin’s dominance remains just under 65%. Ethereum drops to 9.6%. XRP is stable and continues to remain at the lowest levels in the last 3 years, just over 3%.

Bitcoin (BTC) downwards and pending

BItcoin marks the entry into the weakest part of the current monthly cycle which began with the lows at the end of May, a monthly cycle which is expected to close, and thus be the beginning of the next cycle, within the current week.

It is important to monitor the evolution and trend of the price of Bitcoin, which if it were to maintain $8,800-8,900 on a monthly basis, the signal would change to positive.

The volatility of Bitcoin continues to fall, with the lowest lows in the last quarter at 2.2% daily on a monthly basis, the lowest level since the beginning of the year.

This is an indication of an explosive directional movement in the near future. It will need to be determined whether it will be upwards or downwards.

Previously prolonged fluctuations at the lowest levels of volatility on a monthly basis have accompanied strong upward excursions in recent years. So it is necessary to pay close attention to what will happen in the coming days.

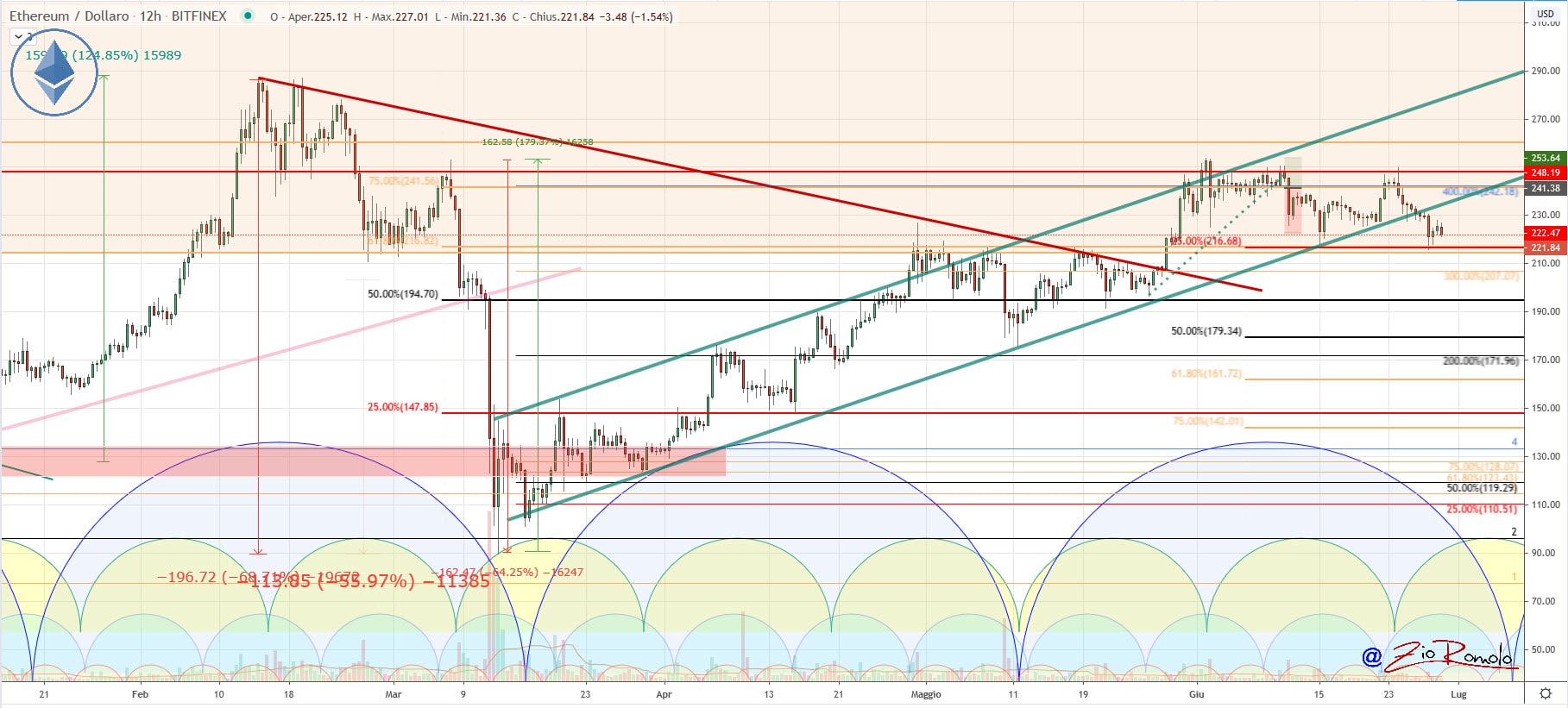

Ethereum (ETH) leaves the bullish channel

With the breaking of 230 dollars, lower neckline, Ethereum leaves the bullish channel that accompanied prices since mid-March.

At the moment, the trend is not worrisome, as the decline sees the 25% of Fibonacci retracement tested, which takes as a reference the lows of March and the highs of late June.

The 215 dollars tested on Saturday see for the second time in the last month the testing of the former resistance that between April and May had rejected the bullish attacks. For the whole week, the $215 remains a level to be monitored carefully.

In case of a break-down, the next support is below the psychological threshold of 200 dollars, between 195 and 190 dollars. Ethereum awaits the closure of the monthly cycle that began in mid-May and is expected to end by the first ten days of July.