L’ultimo giorno di agosto celebra il mese con una prevalenza di segni positivi, mentre Bitcoin (BTC) invece è poco pimpante, anche se comunque rivede gli 11700 USD, dimostrando di rimanere in forma anche quando cede la scena.

Così come accaduto lo scorso mese, sono le Altcoin a ruggire guidate da Ethereum, che torna a rivedere le quotazioni di metà agosto in area 430 dollari.

Tra le prime 100 oltre il 60% sono in territorio positivo.

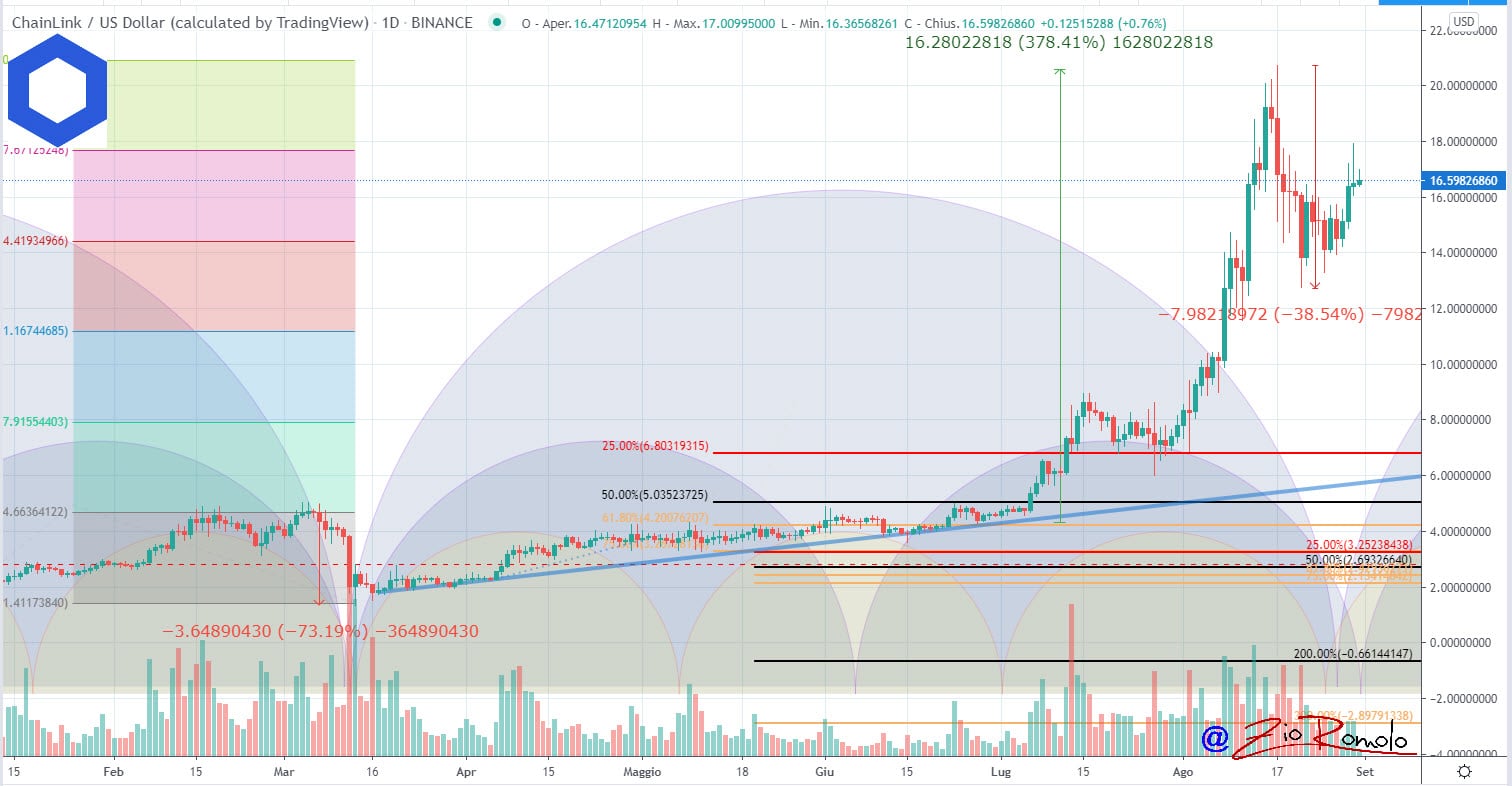

Tra le Big solo Chainlink (LINK) cede terreno con un -1,3% dai livelli di domenica mattina. Una frenata che non mette in difficoltà il recente rialzo che nel weekend ha visto i prezzi recuperare i 18 dollari.

Nonostante i recenti attacchi della società di gestione patrimoniale Zeus Capital, che accusa nuovamente il team di Chainlink di manipolare i prezzi, il token mantiene la quinta posizione in classifica tra le maggiori capitalizzate.

Delle prime 25 è Ethereum (ETH), insieme a Litecoin (LTC), a mettere a segno il miglior balzo della giornata, entrambe oltre il 5,5%.

La capitalizzazione totale risale oltre i $370 miliardi con buoni volumi di scambio stabili oltre i $130 miliardi.

Nelle ultime 24 ore è Ethereum a scambiare il volume più alto con oltre 1,5 miliardi in controvalore in dollari statunitensi, con Bitcoin che si ferma a 1,3 miliardi USD.

Il ritorno dell’interesse per le Altcoin si registra anche dalla dominance di Bitcoin che scende al 57,5%, il livello più basso degli ultimi 14 mesi. Al contrario, Ethereum risale al 13%, mentre Ripple rimane stabile al 3,4%.

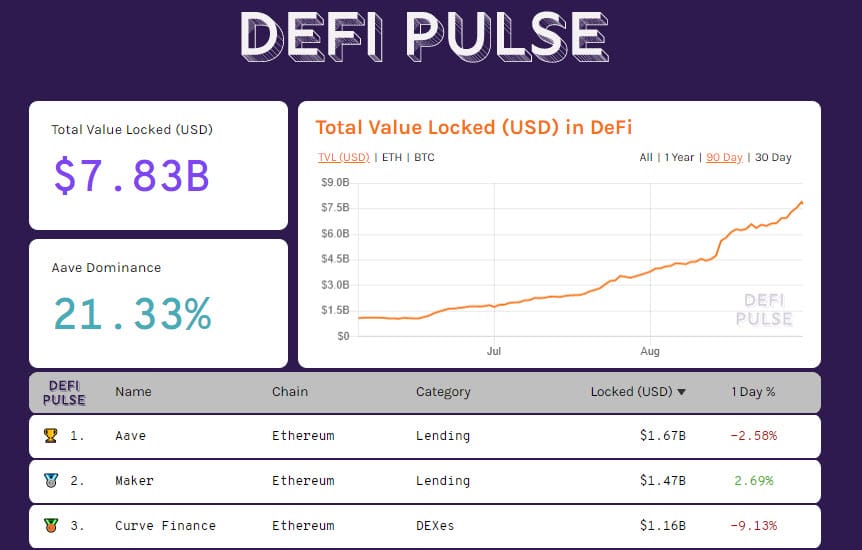

DeFi sempre da record

Continua a ripida salita del collaterale bloccato nella DeFi. Nuovo record assoluto con oltre $7,8 miliardi immobilizzati nei vari progetti.

Continua a crescere anche Aave (LEND) che raccoglie oltre $1,6 miliardi, il 21% di tutto il capitale collateralizzato nella DeFi.

Segue Maker (MKR) a $1,4 miliardi.

Ethereum rompe il muro dei 5 milioni di pezzi depositati per ottenere ulteriore rendimento.

Anche Bitcoin con oltre 55,2 mila pezzi tokenizzati registra il nuovo record.

Bitcoin (BTC)

Il timido ritorno degli acquisti evidenzia una reazione del supporto degli 11200 USD, mettendo momentaneamente da parte i timori di un ulteriore allungo ribassista a testare il supporto di medio periodo in area 10500 dollari.

Nei prossimi giorni è importante capire se l’assenza di vendite permetterà agli acquisti di spingere i prezzi sopra i 12000 dollari, resistenza da abbattere con decisione per aprire le speranze di un nuovo massimo annuale oltre i 12500.

In caso contrario rimane necessario confermare la tenuta dei recenti minimi.

Ethereum (ETH)

Tornano alla carica gli acquisti spingendo i prezzi oltre i 430 dollari e scacciando il pericolo di ulteriori affondi di breve periodo.

Ad un passo dai recenti record dell’anno registrati a metà agosto è importante confermare la tenuta del supporto psicologico dei 400 dollari.

Se questa ipotesi sarà confermata la prossima fermata al rialzo è per rivedere i massimi di agosto. In caso contrario sarà necessario mantenere il supporto dei 380 dollari, minimo di martedì 24 agosto.