Ethereum developers and enthusiasts hope ETH price is poised to close out 2020 the same way it has performed all year long. Since 2015, Ethereum has really become the precedent for crowd funded projects and over the last few years has emerged as a launching pad for much of the space’s decentralized financial protocols.

ETH price analysis

The second most favored cryptocurrency by market capitalization, ETH price is up 146.7% this year, +17.8% the last 30 days and +13.5% over the last 7 days. Ethereum is down 68.3% from the all-time high of $1,448 made on January 13, 2018.

At writing, the 24 hour low is $453.03 and high is $472.48. Despite already great returns in 2020, the argument can be made that for almost two months ETH has been setting up for much higher prices; moreover, $500 and beyond easily look reachable and have only been halted previously by brief pullbacks caused by Bitcoin’s affliction on alts and the wider crypto market when it surges.

With Bitcoin charging today over $16,000 and closing the day with the 13th highest candle close in history [$16,320] ,the vast majority of the cryptocurrency alt market has taken a step back again. However, with more trust from institutional investors in Bitcoin and Ethereum than ever, there’s many bets being made on Ethereum’s potentially bright future.

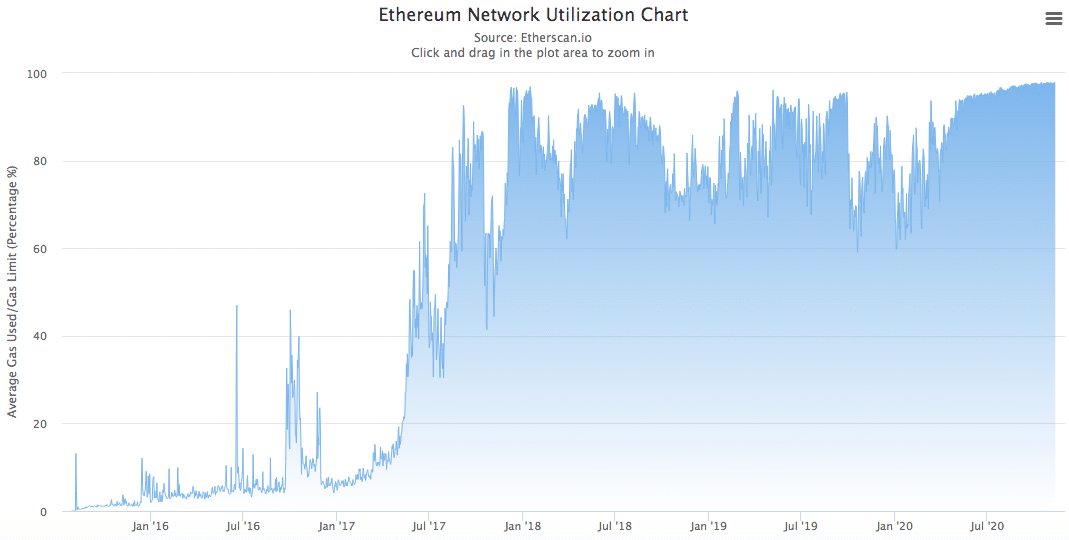

The boom of decentralized financial protocols in 2020 built atop ETH was the largest contributing factor to the network’s all-time usage highs which are represented in the below chart in gas fees this year.

ETH 2.0. is on its way

The 2017 crypto bull run mania quickly generated concerns over the ETH network being overly saturated during peak network activity. Those concerns yielded a roadmap to Ethereum 2.0, which is the forthcoming solution to ETH’s scalability concerns heading into a new decade. If Ethereum developers get their preferred outcome, ETH can continue onward contributing toward web 3.0 development and the fourth industrial revolution.

The introduction of sharding and other scalability advancements are features to increase transaction throughput with ETH 2.0 and are on the roadmap. Whether or not ETH 2.0 will be successful is yet to be revealed but the future usage and popularity of the network depends upon a highly scalable chain with robust advancements.

Ethereum 2.0 Phase 0 is set to launch December 1, 2020 and is a huge network upgrade. Ethereum 2.0 will launch as a separate network initially and merge ETH from a proof-of-work (PoW) chain to a proof-of-stake (PoS) chain incrementally through a detailed network roadmap.

Just this week ETH finally reached 10% of the threshold needed to begin the launch of 2.0. The current figures for the threshold are 60,928 ETH staked with the current contract 11.6% of the way to the threshold. That’s currently $28,140,815 staked of a necessary $230 million to begin launch.

Despite ETH’s great success over it’s first five years, with only a few weeks remaining before the scheduled launch and far beneath the threshold it could suggest the market is split on 2.0’s scaling potential or roadmap.

The concern for ETH stakers could be staking the 32 ETH minimum requirement and the network not scaling properly. Ethereum stakers must stake their ETH during the entirety of Phase 1 to Phase 2 completion. The duration of those two phases is not fixed. With the nature of markets, the possibility exists that ETH could turn bearish in between phases. Thus, there are justified concerns of getting caught with staked coins heading into a downturn since the Phase 2 completion process is at the whim of Ethereum developers.

It will be interesting to see how ETH enthusiasts weigh the pros and cons of staking their ETH and helping the network attempt quite the feat over the coming weeks. One of the space’s oldest guards, Ethereum is the blockchain industry’s most popular programmable smart contract platform and is approaching a pivotal moment.