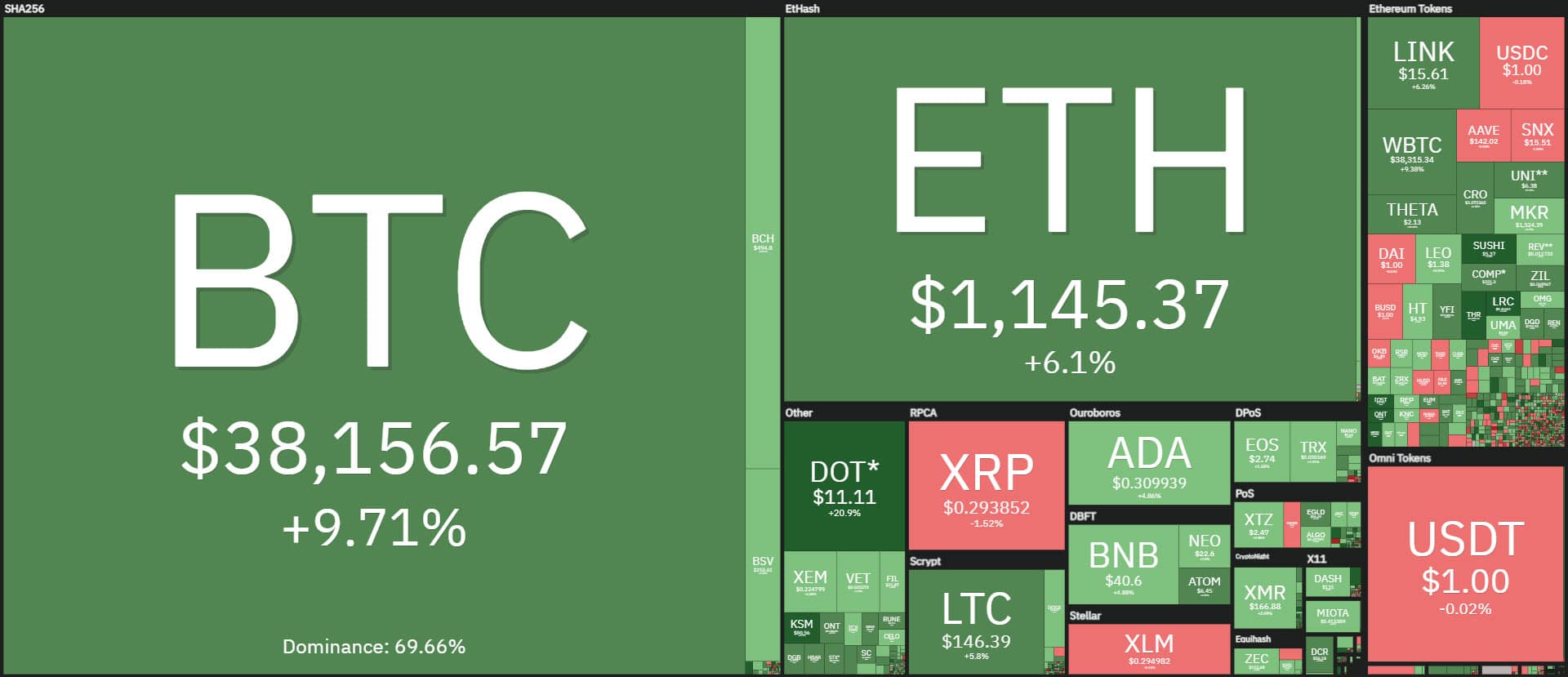

Today is seeing gains for Bitcoin and Ethereum, suggesting a return of bullish strength for both.

The positive close of yesterday ended the longest negative streak since May 2020 with four consecutive bearish days.

Yesterday’s close recovers all the losses of Tuesday, January 12th. This is happening in a context that in the short term remains weak but is starting to provide positive signals that should be confirmed in the coming hours or days.

Polkadot (DOT) is the best of the day

The day saw a clear prevalence of positive signs with over 80% above par. Among the big names in the top 20, there was only one red sign, that of Ripple (XRP), which fell 2%, highlighting the difficulties of the XRP token, which has once again become detached from the rest of the sector, as was the case until last autumn.

Among the big players, Polkadot (DOT) stands out with a flight of more than 30% to over $12, setting the highest peak in the last 8 months, taking the 5th position in the ranking of the most capitalized, surpassing both Litecoin and Cardano.

Such a powerful rise, if it were to continue in the coming hours, would put at serious risk the 4th position in the ranking now occupied by Ripple. Between the two there is currently a difference of about $2 billion. Polkadot climbs to the top of the podium as the best of the day.

It is followed by Loopring (LRC) with a 25% gain, the DEX continuing to gain trader attention by differentiating itself in terms of competitive trading fees.

The gains in recent hours have taken the market cap back above $1 trillion.

Total trading volumes continue to contract, standing at $380 billion over the past 24 hours. This is half of the volumes recorded last week.

Across the whole sector, it is Bitcoin that keeps trading in line with the volumes of the past few days, although lower, but still remaining above $13 billion. Ethereum, on the other hand, accounted for about half of yesterday’s trading at $5.8 billion.

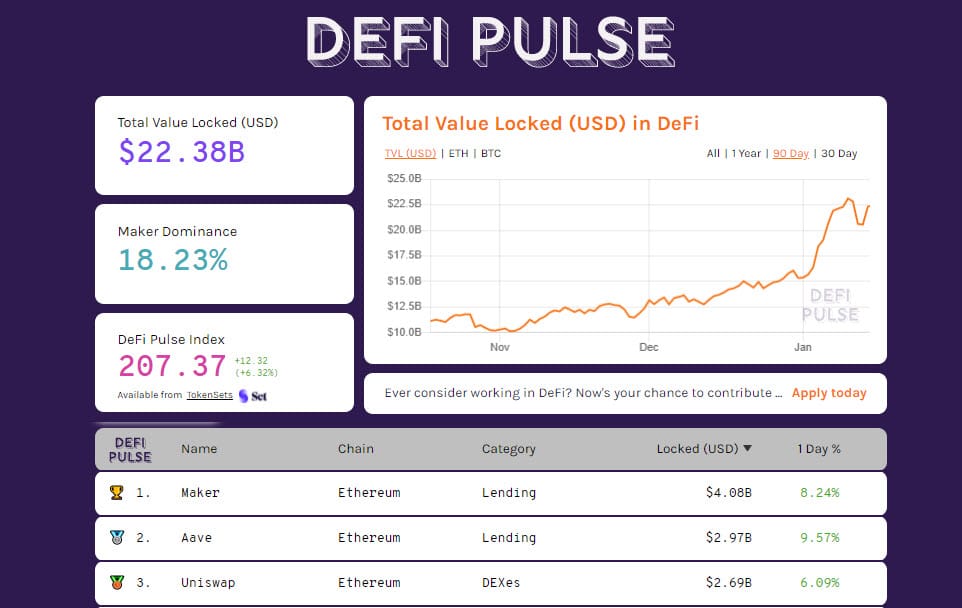

The strengthening of the value of tokens once again boosted the total value locked in DeFi to $22.4 billion. Maker continues to be the leader. The lending platform’s total collateralized value has risen to over $4 billion, representing a dominance of 18%. Aave confirms its position in 2nd place and Uniswap in 3rd.

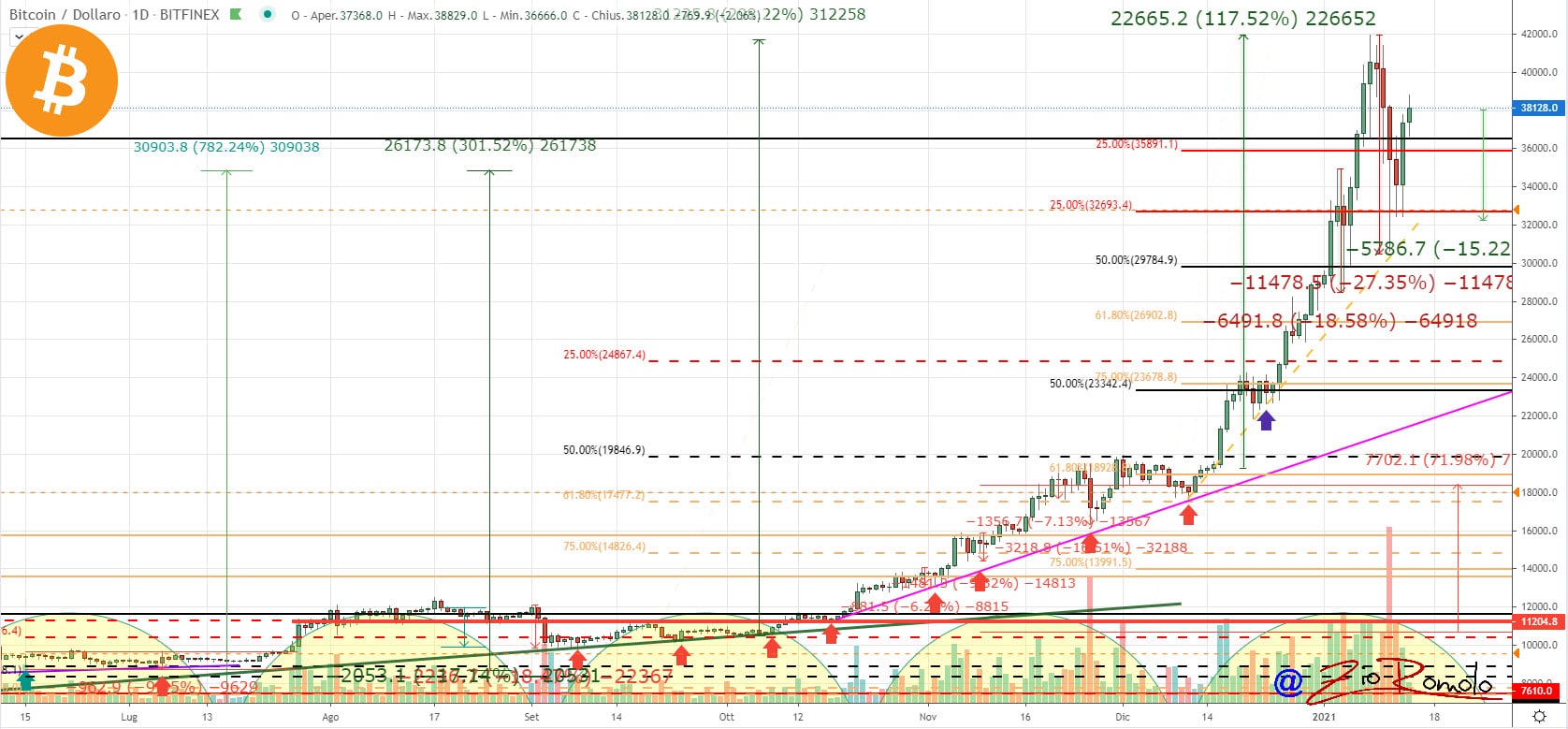

Bitcoin (BTC) and the return of bullish strength

The positive reaction with a strong return of purchases in the last 24 hours confirms the validity of the support of $30,200 that coincides with Monday’s low, as well as the bullish trendline that accompanies Bitcoin’s rise from the mid-December lows.

In the last few hours, the price of Bitcoin is back to a step from 39,000 dollars, a threshold that if exceeded will indicate that the current movement is no longer a technical rebound but a return of bullish strength.

Therefore, in the next few hours, this resistance will be monitored, while on the downside a return below $34,000 would be worrying.

Ethereum (ETH)

Ethereum confirms the general bullish trend even if with less intensity than Bitcoin, stopping the day’s rise at 6%. Prices are now back at $1,170. For Ethereum too, a continuation of the uptrend and a regaining of the $1,200 mark, which is about 3% from the levels of earlier in the day, would provide a signal that bullish strength has returned.

It is precisely the 1,200 dollars that is the technical and psychological area to be carefully monitored. On the downside, the only worry would be a return below 1,000 dollars. The last time prices closed below this level was on January 3rd.