The American fund Unbounded Capital, in its letter to investors in reference to the development of 2020, was particularly optimistic about Bitcoin SV (BSV) and its price.

The year-end report, in fact, begins by explaining that the fund has invested in BSV with an “early stage” equity investment.

“Unbounded Capital invests in the Bitcoin (BSV) ecosystem via early stage equity in companies building on top of Bitcoin as well as asset and derivative exposure to Bitcoin itself. We envision businesses leveraging Bitcoin playing a predominant role in shaping how people interact with and use the internet in the coming decades, and are working to help entrepreneurs achieve that vision.

Bitcoin (BSV) is enabling the next generation of business. BSV as an asset has asymmetric upside and the network has spurred an explosion of entrepreneurial creativity. Unbounded Capital matches deep understanding of Bitcoin with extensive VC and entrepreneurial experience to help build the Bitcoin economy through identifying, funding, and then guiding the best Bitcoin-native businesses.”

However, given the assumption that one is familiar with the topic and the differences between the two technologies – Bitcoin and Bitcoin SV – and between the two assets, Unbounded Capital explains that it invested only in BSV in April 2019.

The price of BSV

BSV had gone from a value of $100 to $450 in the space of less than a month in January 2020.

This price spike was probably due to news circulating that Craig Wright, creator of Bitcoin SV, had moved some bitcoin that had been mined in 2009 and had never been moved and that only Satoshi would have access to. The news was denied but in any case, the price of BSV benefited.

Unbounded Capital’s report on Bitcoin SV

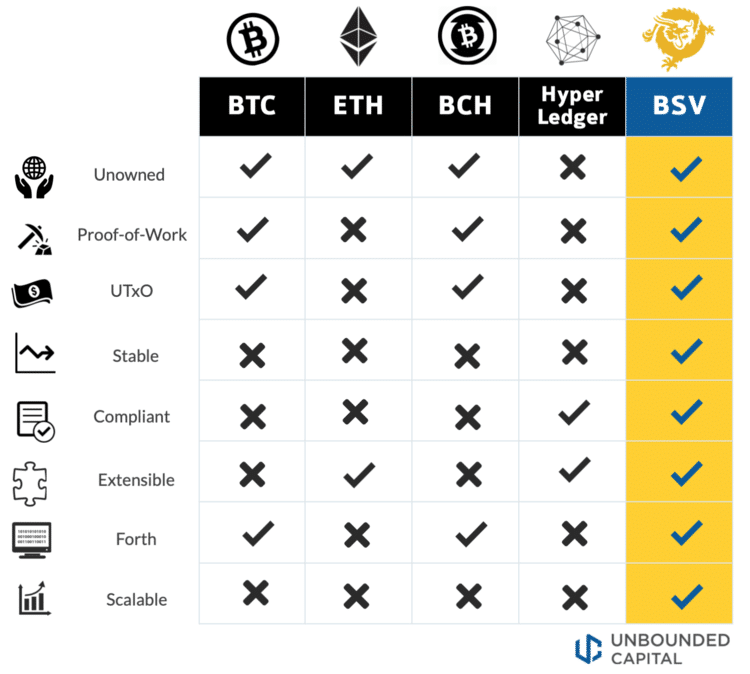

In addition to tracing the history of Bitcoin SV over the course of 2020, the report goes further and states how BSV’s technology is superior to that of other blockchains, sharing the following chart.

In short, it is very clear that Unbounded Capital is backing BSV and Craig Wright wholeheartedly and indeed, speaking of the case against Kleiman, the American fund explains:

“Craig Wright moved some of his bitcoin mined in the early days of the network’s existence. He submitted to the court in Florida required by his ongoing lawsuit with Ira Kleiman, under threat of perjury, that a bounded courier arrived with some of the key slices required to access Bitcoin wallets with 850k Bitcoin. He maintained to the court since then that while he has some of the key slices, he does not have enough of them to access the wallets. While we think this in a legalistic sense is true, we believe it is likely that, in the probable event that he wins his case against Kleiman, he would likely get access to remaining key slices”.

Bitcoin SV in 2021

The report then concludes by making predictions about the price of BSV over the course of the year, explaining that the fund is

“more bullish than ever on the BSV ecosystem and BSV the asset, with a bullish disposition for crypto markets in the near term”.

According to Unbounded Capital, in fact, this is a highly scalable and secure blockchain and the price of BSV could go up for specific reasons, as the report mentions:

- “February 16th court date for the Wright v McCormack Libel Case.

- Technical improvements to BSV’s transaction processing capabilities which will expand throughput by orders of magnitude

- Private insight into exciting soon-to-be-launched developments from BSV businesses which will impact large existing markets”.

The fund, according to the website, currently only invests in Bitcoin SV and projects based on this blockchain.