SPONSORED POST*

Since this time last year, Ethereum has risen in value by 750% and some analysts predict that it will do even better than Bitcoin in 2021, due in large part to its superior technology, including its broad functionality and rapid transaction capability. Like Bitcoin, Ethereum has had a great year but it is not a safe-haven asset. Rather than providing a cushion for investors, it is a risk-on asset that tends to fare better when the stock market is doing well. Above all else, investors need to keep in mind that the crypto markets are remarkably volatile. 2021 could well see a continued rise in value if more retail and institutional investors come on board, but even a single big hack could undermine investor confidence and lead to a price collapse.

What If You Could Eliminate the Risk of Crypto Market Volatility?

There is course one way in which you could trade digital currencies without any of the risks associated with crypto market volatility and that is with crypto arbitrage.

Crypto arbitrage is acknowledged by both the crypto and traditional financial communities to be one of the lowest-risk forms of investing and it is now used all over the world, by banks, hedge funds and investment firms. The reason is that it does not generate revenues from crypto market volatility, but instead, exploits price inefficiencies across exchanges. This means that the strategy takes advantage of the fact that briefly, a cryptocurrency can be available at different prices simultaneously.

To see how the strategy works, let’s take ArbiSmart, one of the best-known, regulated, crypto arbitrage platforms on the market as our example. ArbiSmart’s system is fully automated and connected to 35 exchanges, which it scans 24/7, monitoring hundreds of coins at once. When it finds a price inefficiency, it buys the coin on the exchange where the price is lowest and then, in an instant, sells it on the exchange where the price is highest to make a profit before the market adjusts and the temporary price discrepancy can resolve itself.

Are There Any Other Dangers Specific to the Crypto Space to Consider?

Any time you enter the crypto arena you are taking a risk with your capital not just because of the extreme volatility of the digital currency markets, but also owing to the lack of oversight and resulting high rates of fraud. The benefits of anonymity and speed, associated with decentralized technologies make it attractive to criminals, looking to take advantage of unsuspecting investors. Also, crypto is evolving rapidly, and word over, legislators are struggling to catch up and regulate this newly emerging asset class and implement critical consumer protections.

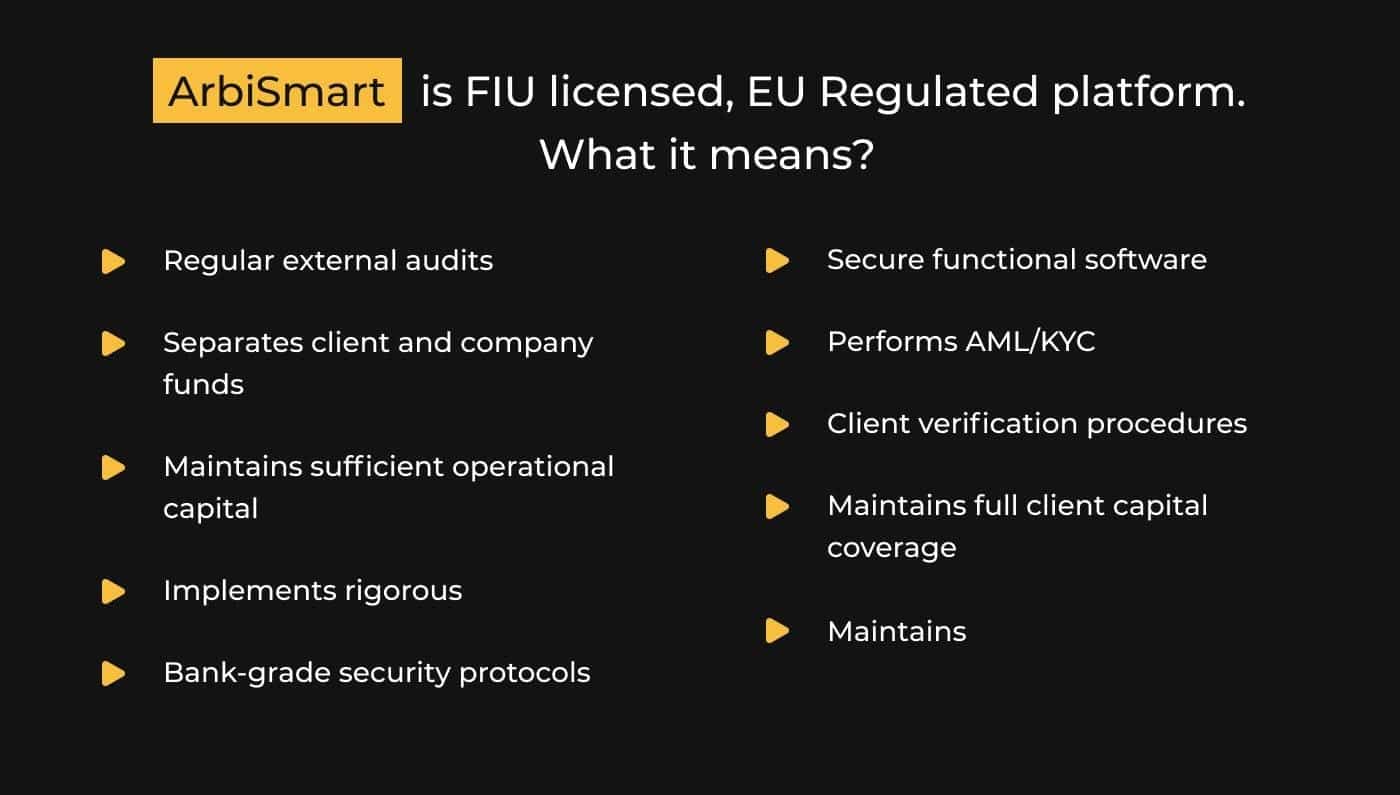

To be safe, your only recourse is to choose to invest with a fully regulated platform, as this provides essential safeguards to shield your capital, and your personal information. For example, ArbiSmart is FIU licensed. This means that clients benefit from the fact that since the company is EU regulated, it submits to regular external audits, separates client and company funds, maintains sufficient operational capital, implements rigorous, bank-grade security protocols, maintains, secure functional software, performs AML/KYC, client verification procedures and maintains full client capital coverage.

Another way to protect your savings is to know who you are trading with. You should go online and check what other investors are saying about the company you are considering investing with on social channels like Reddit and Telegram and on consumer review sites or look for references to the company in leading industry publications to ensure they have no history of legal troubles or security breaches. Finally, check out their website and get in touch to get answers to any questions you may have. This will give you a good idea of how accessible and well informed their support team is.

For example, a quick search shows that ArbiSmart has a solid online reputation, with a 4.3 star Trustpilot rating, positive press coverage and multiple, direct support channels, including Telegram, Twitter, chat, Messenger, email, phone, Whatsapp and more.

So, we’ve established that with crypto arbitrage, you can reduce the risks associated with crypto trading to close to zero, but what kind of profit can you expect to make on your ETH?

How do the Profits Measure Up?

Every type of investing offers a different risk to return ratio. A bank will guarantee the security of your funds but is unlikely to offer more than 1% interest per year, on average. Then of course stocks can offer around 10% ROI, but with greater risk, considering the vulnerability of the market to a range of economic, social, and political factors. While the crypto markets can offer sky-high returns, they involve incredible risk, and just as fast as you earn a profit, you can lose all your gains in the blink of an eye. However, with crypto arbitrage you get the best of both worlds, with close to zero risks and excellent returns. In addition, compared to cryptocurrency trading on short-term market action, one of the primary advantages of crypto arbitrage is the predictability of your profits.

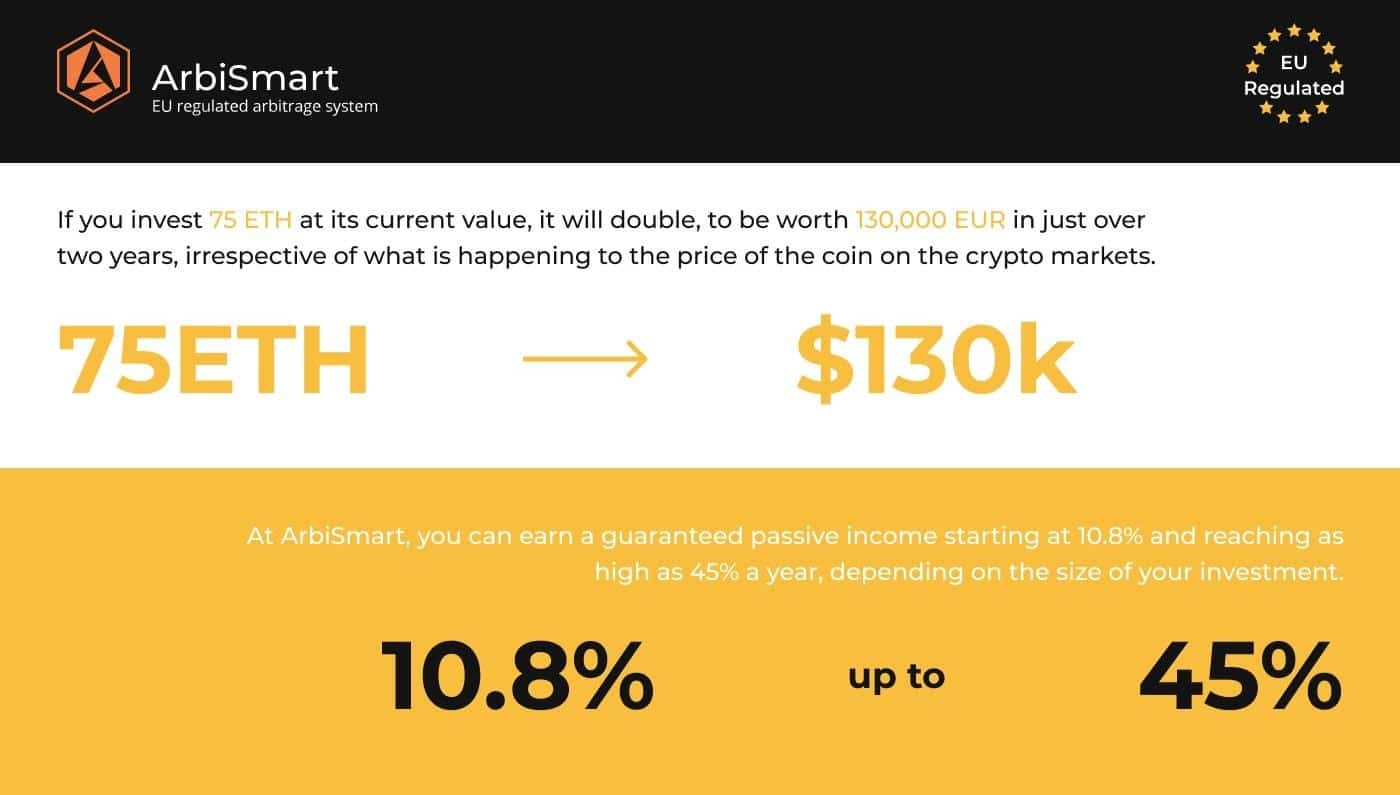

To understand, let’s go back to our ArbiSmart example. At ArbiSmart, you can earn a guaranteed passive income starting at 10.8% and reaching as high as 45% a year, depending on the size of your investment. By looking at the company’s website, you can see precisely how much you can expect to earn per month and per year, based on your account level.

For example, if you invest 75 ETH at its current value, it will double, to be worth 130,000 EUR in just over two years, irrespective of what is happening to the price of the coin on the crypto markets.

Keep in mind that in addition to profits from crypto arbitrage trading you also earn compound interest as well capital gains from the rising value of RBIS, ArbiSmart’s native token. Once you sign up and deposit funds, in either fiat or crypto, your investment is converted into RBIS for use on the platform, although funds can be withdrawn at any time in EUR, GBP, ETH, BTC or USDT. The RBIS token has already gone up by 210% since it was introduced in 2019 and it is projected to rise by 3,000% by the end of 2021, based on the platform’s current rate of growth.

If you want to double your ETH, without having to commit any time to your investing and without having to worry about sudden price reversals wiping out your gains, crypto arbitrage offers a steady, reliable and generous passive income at minimal risk.

Learn more about arbitrage in its various forms, or start investing, and put your ETH to work on your behalf right away.

*This post has been paid. The Cryptonomist didn’t write the article nor has tested the platform.