The last week of January has been very eventful for the financial markets, and now, all eyes are on the price of silver. This is also confirmed by eToro market analyst Edoardo Fusco Femiano.

The movements of WallStreetBets have triggered price pumps of “undervalued” stocks such as GameStop, AMC, American Airlines, BlackBerry, Nokia.

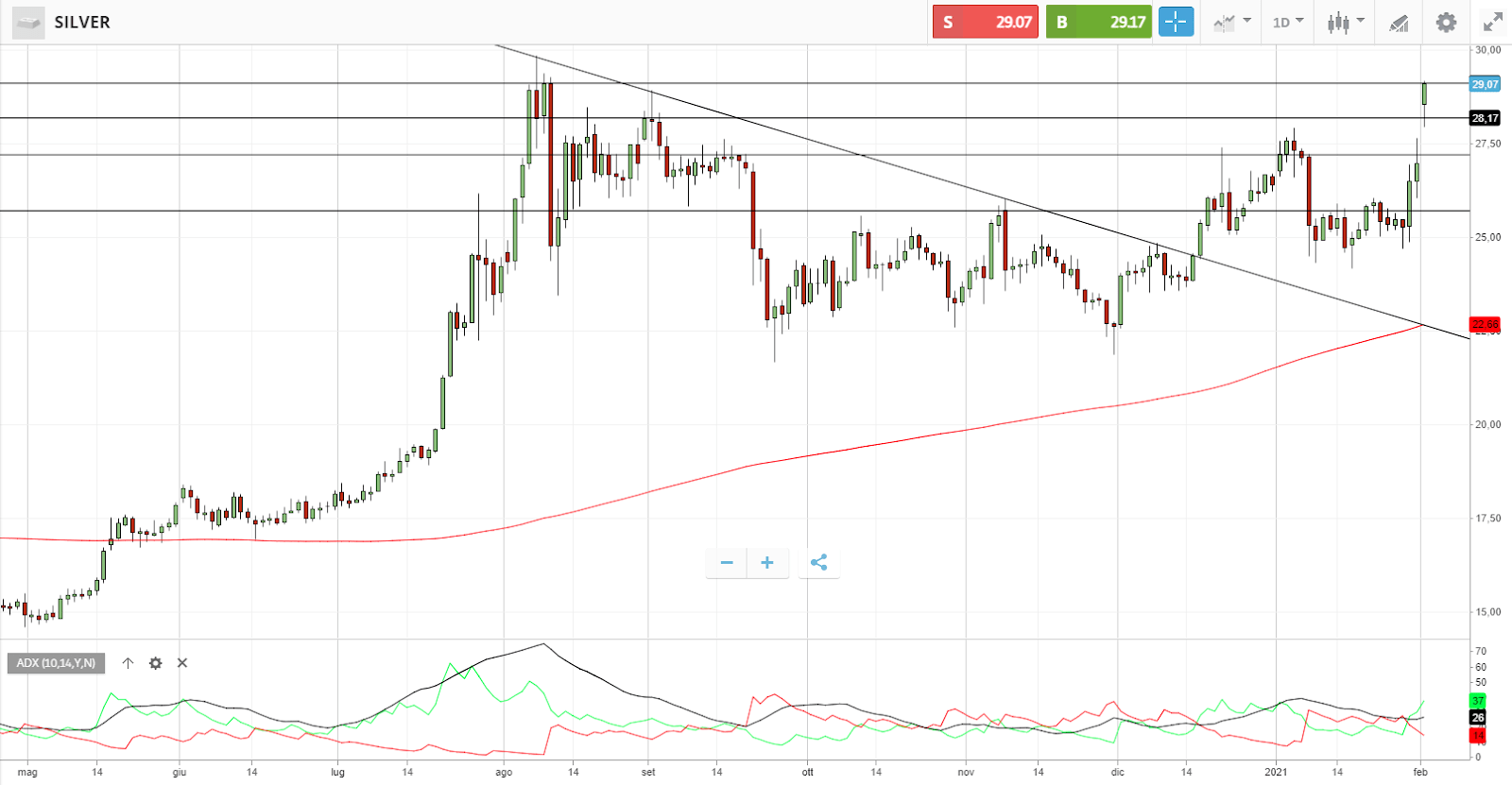

Now the bettors on Reddit seem to be projecting a rise in the price of the second most precious metal after gold, which is currently trading at $29, the highest since July.

But beware of enthusiasm. Edoardo Fusco Femiano explains:

“As this movement sees volatility expanding we recommend caution on breakout entries. A breakout of the $29 area is likely at this point but, for operations with a multi-day time horizon, a consolidation above the current highs is recommended. Otherwise, a pullback area could be the $27.5 area. The key medium-term level is still the $25.7 area. Confirmation of the ADX index above the $25 level would further support the bullish impulse shown today”.

Analysis of financial markets: price volatility and silver

The eToro analyst also looks at monthly and weekly trends. What emerges is that the month of January closed lower for the S&P 500 index (-1.1%), while the weekly close is down -3% despite the high volatility of these days.

The week ahead, however, is full of expectations, starting from the US unemployment rate to purchases in the manufacturing and services sectors in Europe and the United States. There are also expectations for the quarterly results of Amazon and Google, but also for BP, Pfizer, Amgen, ExxonMobil and UPS.

The eToro analyst explains:

“The volatility of these hours is making sentiment rather fragile. Of note in this early part of the week is the consolidation on gold’s supports and this morning’s gap-up in silver, which has now returned to its July highs in the $29 area”.

Watch out for General Dynamics

One stock that eToro is monitoring closely is General Dynamics, an aerospace and defence company that is the third-largest defence company in the world, known for producing tanks and submarines.

The company announced a quarterly net profit of one billion dollars, $3.49 per share on revenues of over $10.5 billion.

According to Edoardo Fusco Femiano.

“The stock trades on a Price/Earnings multiple at these prices of about 12.5, below its historical valuation of 14. As a result, the current dividend yield is at its highest in ten years (3.2%) and about double the S&P 500 currently. For these reasons, the expected annual return until 2025 for the stock is theoretically over 10%. The stock currently trades at a discount relative to historical metrics and is technically set downwards. A decline towards the $140-$130 range would offer further upside and yield potential for long-term investors.”