Bitcoin price is going down on average $1,173.75 each day since it began retracing after a new ATH just 12 days ago of $64,804.72.

Bears currently have the ball and Bitcoin is a momentum driven asset. Yet the history of Bitcoin as the world’s most volatile asset has long time bulls still confident this is just a short term consolidation phase before the next leg up to a six figure Bitcoin for the first time in the history of the asset.

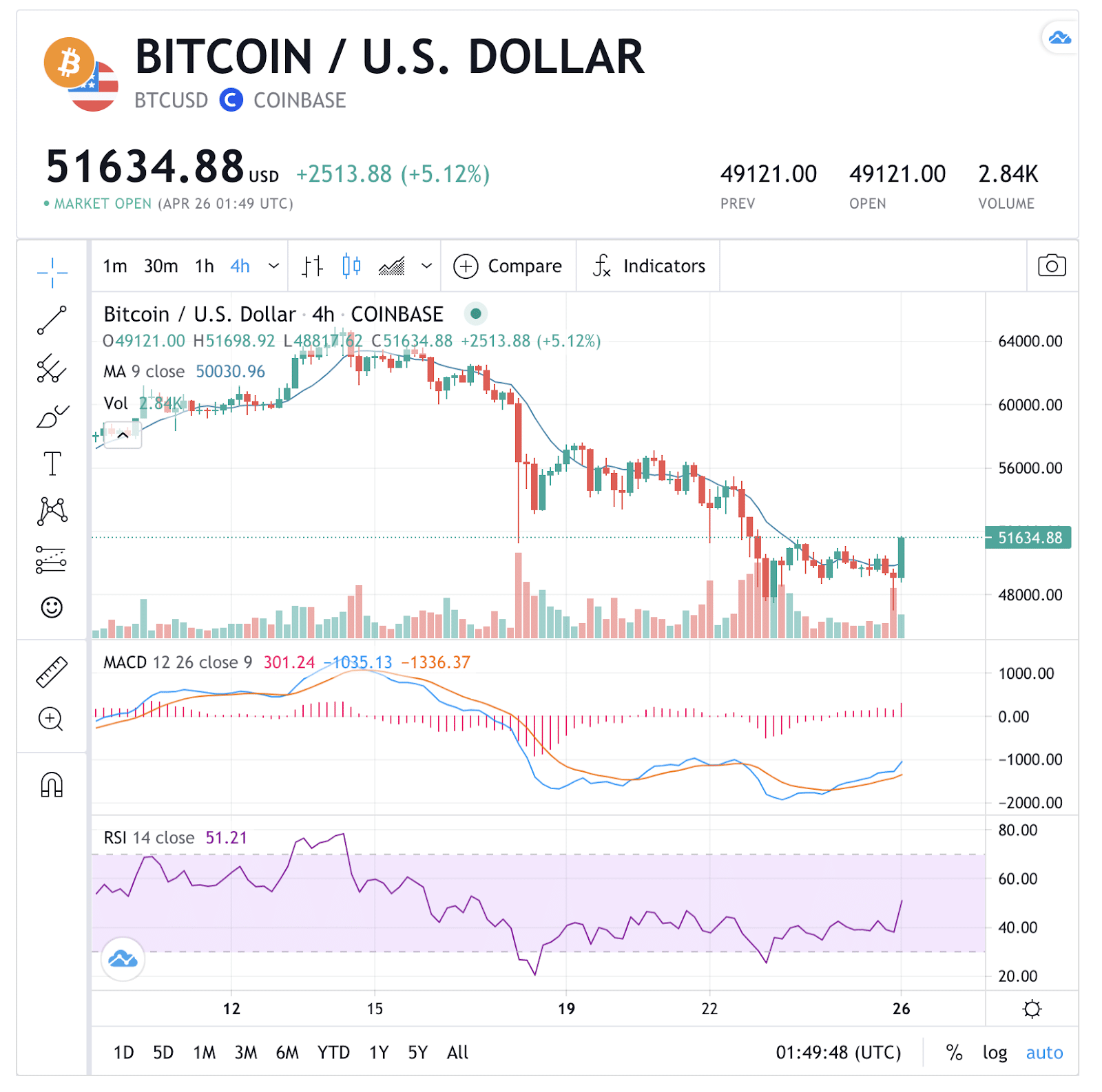

At the time of writing, BTC traded most of the day above $50,000 and opened the day at $49,947.58. Trading was pretty quiet until right before the weekly close when the BTC price dumped below $50,000 and actually touched $47,079.14. The bounce that ensued off of the 24 hour low sent the price back above $51,000 which is an important psychological battlefield for bulls and bears alike.

Even Bitcoin dominance is going down

Bitcoin dominance has also been declining steadily since it peaked near 74% in early January of this year. While BTC dominance has been in decline since early this year the price has steadily risen and this pullback in BTCD still pales in comparison to the spread after BTCD peaked during the 2017-2018 bull market.

From the peak BTCD dropped as much as 50% during that bull run and if BTCD were to replicate the prior run then BTCD still has a roughly 25% markdown yet to come.

It has been 349 days since Bitcoin’s 3rd block halving that saw the block reward reduced from 12.5 new coins per block to 6.25. This is another statistic that a lot of bulls like to cite in regards to the likelihood the pattern continues and BTC still has months of upward price action yet.

The RSI on Bitcoin hit its lowest levels this week since the April 2020 black swan event when the legacy market crashed and then days later the crypto market sold off.

That event however marked a local bottom for the BTC price under $4,000 and since the parabolic ascent of Bitcoin has been on. The last obstacle to end any doubt that a new bull market was underway for certain was the former ATH eclipsed in December 2020 [$19,730].

Bitcoin price and the futures expiration date

At the time of writing [9:53 PM EST] the current RSI is 51.21 and at its highest levels in days.

Bitcoin has sold off 3 out of the 4 months to begin this year like clockwork at the end of the month. There is a lot of speculation to why that has occurred but the most notoriously cited explanation is the expiration of futures contracts and options on Bitcoin.