The two titans of the blockchain and cryptocurrency realm over nearly 6 years now have been Bitcoin and Ethereum.

Bitcoin launched on January 3, 2009 and proved that the world was ready for p2p money. Ethereum launched July 30, 2015 with an aim to enable scriptable smart-contracts.

ETH’s revolutionized decentralized financial products and increased the breadth of competitive DeFi protocols across the world. Each have been unbelievable technological advancements and investments thus far but which is the faster horse and which is the safer investment?

Bitcoin vs Ethereum in terms of Tokenomics

The edge regarding tokenomics is undeniably to Bitcoin. There will only ever be 21 million Bitcoin capped. There’s already 94,728,185 more ETHER in circulation than BTC that will ever exist. This clearly illuminates the hardness of Bitcoin as a sound money or store of value comparatively. It doesn’t rule out that ETHER can also provide a good store of value but the fact that it has yet to cap its supply and is inflationary does show weakness comparatively against BTC’s hardness.

With Ethereum’s 2.0 roadmap now layed out, the move from PoW to PoS and the hardness of ETHER will increase. With gas fees being sent back to the network and burnt in the future when implemented, some estimates predict a decrease of around 75% of future ETH issuance. Despite this ETHER can never be as economically sound from a SoV standpoint based on the basic laws of supply and demand.

The ability to change the rules of the game during the game is one aspect of Ethereum that will hold it back as money. Bitcoin’s rules have been absolute from a monetary standpoint, 21 million is the finite supply and is sacred.

Innovation

While Bitcoin has really focused on the SoV narrative, Ethereum is working on becoming a launchpad for the future of decentralized finance. Increasingly more protocols are being built on smart contract platforms and ETH is still the leader in smart contracts.

The economic activity headed towards the smart contract realm is vast. Projects such as ChainLink protect the value held in smart contractual agreements on Ethereum and could potentially enable ETH to flip BTC’s market cap at some point in the future.

Bitcoin has settled on being a SoV via small blocks and a highly robust level of network security. The base layer of BTC really doesn’t provide for the economic growth that we’re seeing on Ethereum. So, Ethereum wins the innovation column.

Head to Head Statistics Over This Bull Market

Comparing the two over this bull market shows that ETH currently has the advantage as an asset.

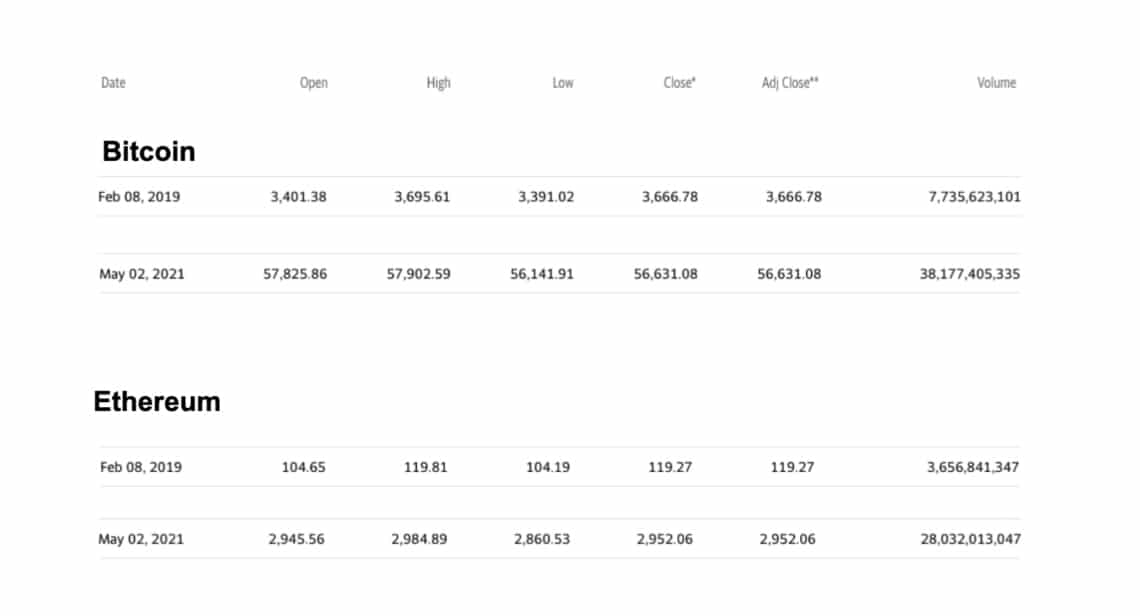

If we look at the date this bull cycle began, February 8, 2019 we can get a better grasp of which digital asset has performed better over this bull market cycle.

February 8, 2019 is the date where the pendulum began to shift back in favor of the bulls, so we’ll use that as an anchor to compare the assets. On this date, Ethereum had just broken back into triple digits and the Bitcoin bottom was clearly in at this point.

Since the daily close February 8, 2019 to May 3, 2021 Bitcoin has marked up 1444.43%. Ethereum over the same time frame has increased in price by 2375.10%.

Ethereum is undeniably in strong command of percentage gained over this period of focus. However, Bitcoin proponents will argue BTC held up better after the last bull market top, post reversal during the depths of the last bear market.

From Ethereum’s top price during the last bull market of $1,408 back to $84.31 was a 94.01% decrease.

Bitcoin peaked at $20,089 during the last bull market and decreased 84.11% before finding a bottom at $3,191.30.

Currently, Bitcoin still holds a massive edge in market cap dominance against the field: 44.6% but has now decreased 29% from its peak dominance of this cycle so far. Ethereum dominance has increased recently and is 16.6% at the time of writing.

Disclaimer: The author holds both Bitcoin and Ethereum and this should not be interpreted as financial advice in any regard. Statistical data pulled from Yahoo Finance.