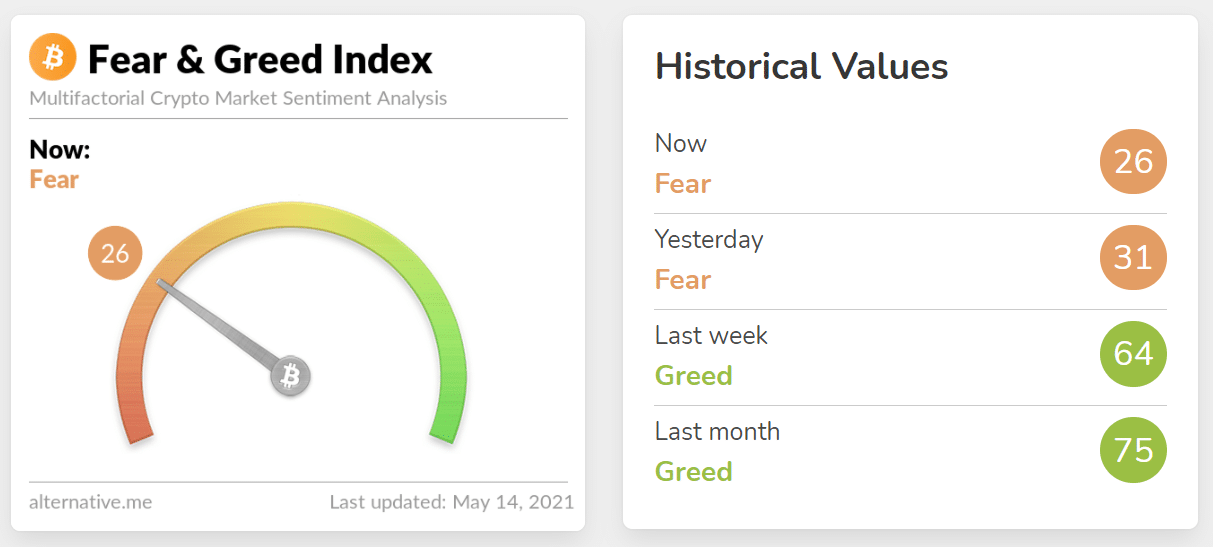

Yesterday, 16 May, the Greed and Fear Index hit an annual low of 20, which is particularly negative. This index provides an estimate of Bitcoin traders’ sentiment, an analysis determined by the pessimism or optimism of the market.

And obviously, after Elon Musk’s tirade on the subject of Bitcoin and acceptance of this payment method for the purchase of Teslas, sentiment has fallen to its lowest level of the year. This level of Fear has not been seen since March 2020, while just a few days ago the index had a score of 72, which was extremely greedy and positive.

Today, however, the index seems to be recovering slightly and is currently at 41, which is moderate fear. Currently, the price of Bitcoin is around $44,000, a drop of 23% in the last week, although it is still a high price if we consider that it has risen 360% in a year.

Pompliano also has his say

It is also worth considering that altcoins seem not to have been affected much by this drop and therefore according to some analysts these values are only momentary and we would still be in a bull run phase.

Sometimes you have to go down to go up. https://t.co/fB3hgW8e9A

— The Wolf Of All Streets (@scottmelker) May 16, 2021

The various influencers in the crypto world, in fact, seem optimistic or at least remind their followers that BTC is not dead and indeed many have opted to “buy the dip”.

BREAKING: Amid the chaos, Bitcoin simply continues to produce block after block after block…

— Pomp 🌪 (@APompliano) May 16, 2021

How does the Greed and Fear Index work

As mentioned above, this index provides an idea of the sentiment of Bitcoin investors at any given time, whether it is optimistic and therefore whether BTC is set to rise, or pessimistic and therefore whether BTC is set to fall in value.

This index was created based on various data such as asset volatility, volumes, social media mentions, Bitcoin’s dominance over altcoins, Google searches according to Google Trends data and surveys.