At a time when Bitcoin’s price seems to be heading upwards, analysts are divided.

JPMorgan fears that Bitcoin could once again reverse its course and fall in price.

In a report a few days ago by Nikolaos Panigirtzoglou, the analyst noted a price difference between the CME’s Bitcoin futures prices, and Bitcoin, a gap known as backwardation.

“This is an unusual development and a reflection of how weak bitcoin demand is at the moment from institutional investors that tend to use regulated CME futures contracts to gain exposure to bitcoin”.

However, for some analysts, this figure does not necessarily indicate a drop in the price of bitcoin.

According to DTC Crypto Trading,

“So the ‘analyst’ at JPMorgan says that backwardation on BTC while price is moving up is a sign of the bear market. No clue who ‘analyzes’ this but they might want to hire better people. Pretty much every time BTC has had a sustained period of backwardation, price moved up”.

Bitcoin, positive analysts and negative sentiment

In fact, the price of Bitcoin is now approaching $40,000 again, following the news that Tesla may again accept BTC payments when the use of renewable energy sources is increased.

According to an analyst at Tradingview, there are similarities between what has been happening in recent weeks and what happened between August and September 2020, when the price of Bitcoin fluctuated between $10,000 and $12,000, and then started the upward trend that took it to $65,000 in April.

The chart shows a similar trend with a head and shoulders movement, which could preclude a vertical climb, even towards $70,000. This would mean breaking the $65,000 record set in April.

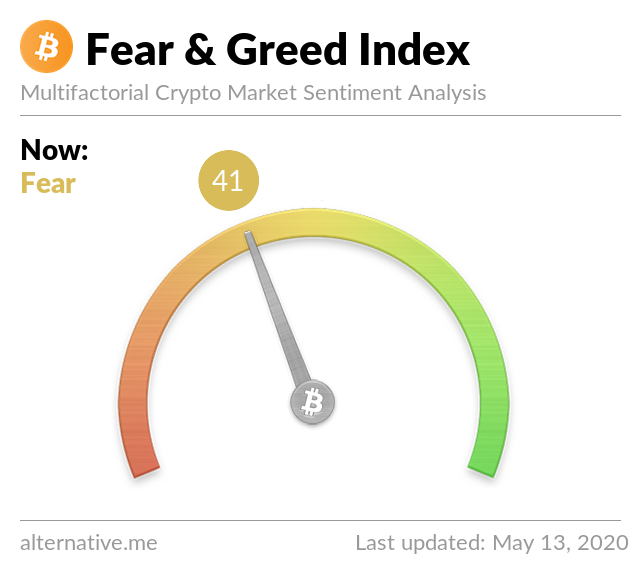

In reality, trader sentiment is far from calm. As the fear and greed index shows, the current value is at 28, which still signals a feeling of fear. However, this is an improvement on the extreme fear of the past few days, when the index was as low as 15.