Bitcoin Price

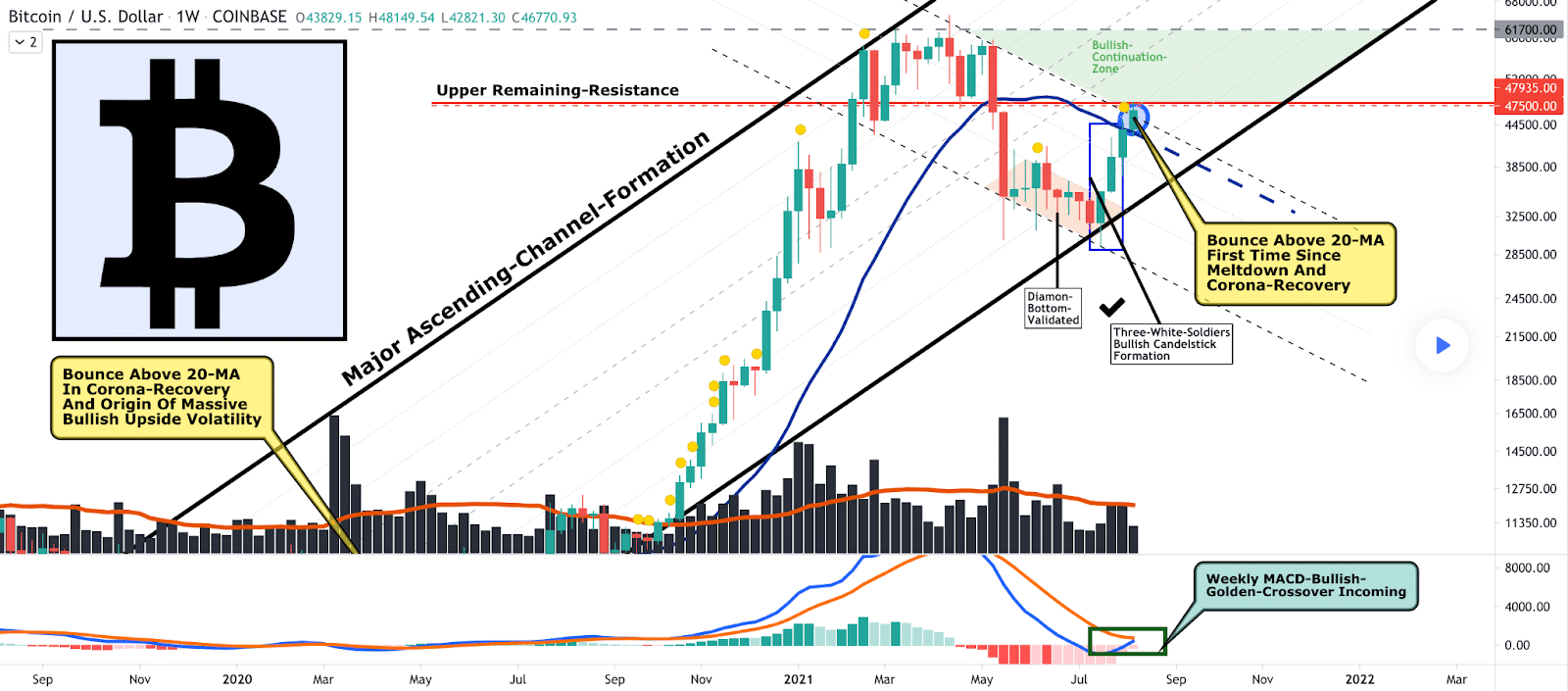

Bitcoin’s price continued to ascend over the last week and also managed to get a potentially impactful bounce above the 20-MA. BTC’s price hadn’t bounced above this level since the March 2020 covid liquidity crisis, and VincePrince’s chart below illustrates this nicely.

BTC’s now in a multi-month major ascending channel that looks to be setting up the industry’s digital gold standard for six figures in the near future.

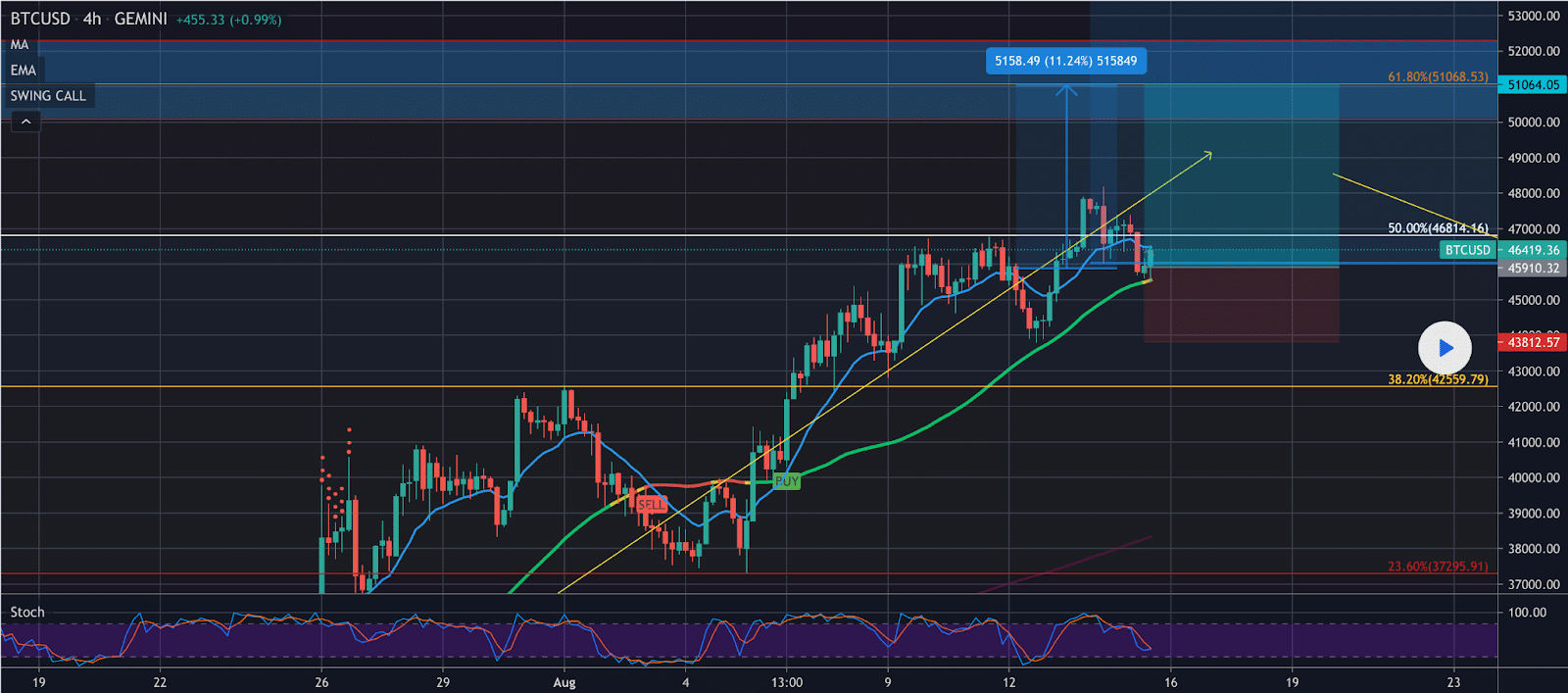

The below 4hr chart from CryptocurrencyMagnet shows the first interim target for bitcoin is $50k, which is a key psychological level for bulls to penetrate. Above that, $51,158 is the first target above $50k that could come quickly once $50k is cracked.

The key levels to control for bulls right now are between $47k-$61k and between $41k-$47k. If bears manage to push the price beneath the second level of control and then beneath $40k, there’s a good probability that a longer bear market could be forthcoming. The duration of the next bear market is likely to be longer than the industry’s seen since late 2019.

BTC’s Fear and Greed Index is reading 72; it’s +1 from yesterday’s reading and is still in the Greed portion of the index.

Bitcoin’s 24 hour range is $45,471-$47,858 and the 7 day range is $43,054-$47,858. BTC’s 52 week range is $9,964.1-$64,374.

Bitcoin closed Sunday’s daily/weekly candle worth $47,031 and in red digits for the 2nd consecutive day.

On the weekly timescale, however, Sunday’s candle close marked a 5th consecutive higher weekly close.

Ethereum Analysis

A year ago, if your Ether target for this cycle was $7,5k or $10k, you might’ve gotten some weird looks, but ETH is tracking for potential new ATH and heights that would’ve been hard to believe not long ago.

The chart below from Aziraphale shows that the party for Ether bulls begins above $4,330 on the 1D chart. The chart posits that ETH is in the midst of the 5th wave to much higher prices that could send Ether to some of the formerly unlikely targets above $5k.

If bulls control the level above $2,270 moving forward, they could indeed be in for a great close to 2021. If bears hope to invalidate the above targets bulls have set, then they’ll need to push Ether’s price beneath $2,277.

ETH’s now comfortably above the MA50 [$2,382] as well as the MA200 [$2,268].

Ethereum’s price range for the last 24 hours is $3,112-$3,299 and for the last seven days is $2,934-$3,323. Ether’s average price for the last 30 days is $2,517.

ETH / BTC pair is +17.7% for the last 30 days, -6.78%% for the last 90 days and +92.47% for the last 12 months.

Ether had a daily/weekly close on Sunday of $3,308. Ether’s finished on the weekly in green figures for five consecutive weeks.