Summary

Bitcoin, record daily close

Bitcoin’s price had its highest daily candle close in the asset’s history on Monday and BTC finished the day +$4,266.90.

The BTC/USD 1D chart below from swimmax shows how strong of an impulse BTC’s price made on Sunday before its weekly candle close.

BTC’s price broke out of a bull flag that had been flagging dating back to late October and that positive momentum was carried into Monday’s session. Bitcoin’s price made a session high on Monday of $67,713.

With the aggregate market cap cracking $3 trillion for the first time in the asset classes’ history already this week, BTC bulls look to be soundly in control and aiming for further upside.

Bearish BTC market participants really need to send the BTC price back below $60k and back inside the bear flag structure charted below. If they do succeed at breaking the $60k level, the next aim for bears is to crack $57,549 to the downside.

Bitcoin bulls, however, now have solid support resistance at the $57,5k level after carving support resistance out there last week for the first time – if bears manage to breach this level it will be a pivotal moment for this cycle’s fate.

BTC’s 24 hour price range is $63,632-$67,713 and its 7 day price range is $60,493-$67,713. Bitcoin’s 52 week price range is $15,177-$67,713.

The price of bitcoin on this date last year was $15,496.

The average price of BTC for the last 30 days is $61,128.

Bitcoin [+6.75%] closed its daily candle worth $67,526 and in green figures for a third consecutive day.

Ethereum Analysis

Ether’s price also made multiple new all-time highs during Monday’s daily candle and made a session high on Monday of $4,833. ETH closed its daily candle +$196.36.

The ETH/USD 1D chart below from caselinben illuminates where Ether’s price is during this new phase of price discovery. Overhead targets are now $5k, $5,2k, and $5,5k on the daily time frame for ETH bulls.

Ether bears conversely are looking to send ETH back below $4,625 and inevitably the $4,5k level which is a major level of inflection in this region.

ETH’s 24 hour price range is $4,642-$4,833 and its 7 day price range is $4,303-$4,833. Ether’s 52 week price range is $443.72-$4,833.

The price of ETH on this date in 2020 was $455.36.

The average price of ETH for the last 30 days is $4,120.

Ether [+4.26%] closed its daily candle on Monday worth $4,808.09 and in green digits for a third straight day.

Avalanche Analysis

Avalanche’s price also marked-up considerably on Monday and also had its highest daily candle close of all-time. AVAX finished Monday’s daily candle +$3.46.

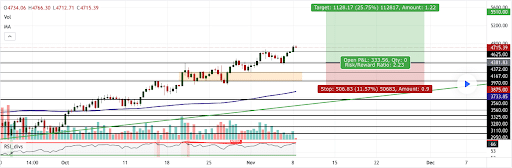

The AVAX/USD 4HR chart below from Mboersma0324 shows AVAX’s inverse head & shoulders pattern and the targets to the upside for AVAX bulls now that it’s broken out above it’s previous ATH of $79.05.

Bullish AVAX targets overhead are $94.6, $100, $105, and $110. Bearish AVAX market participants will hope to send AVAX back below the 0.618 fib level and eventually below $79.05, a major level of inflection.

AVAX’s 24 hour price range is $85.01-$96.46 and its 7 day price range is $64.44-$96.46. AVAX’s 52 week price range is $2.82-$96.46.

Avalanche’s price on this date last year was $3.41.

The average price for AVAX over the last 30 days is $65.69.

Avalanche [+3.95%] closed its daily candle on Wednesday worth $91 and in green figures for the third day in a row.