A day ago, a new bipartisan bill, the Keep Innovation in America Act, was signed into law by House Representatives Patrick McHenry, Republican of North Carolina and ranking member of the House Financial Services Committee, and Tim Ryan, aiming to amend the Infrastructure Bill in the part relating to cryptocurrencies.

Summary

Infrastructure Bill and crypto, the changes needed

The bill seeks to clarify what were defined as minimum reporting requirements for “digital assets” in the bill recently signed by Biden.

The controversial tax reporting requirement on digital currency transactions has become a thorny issue.

In their proposal, McHenry and Ryan would define brokers in such a way that they would not be bound by recent tax reporting rules. This would ensure that developers or miners (in particular) would not be bound by the new provision.

Although lawmakers have tried to include a solution to the problem, in the meantime an amendment has been blocked by Senator Richard Shelby, for what he described as an unrelated reason.

Crypto sector apprehensive

Groups representing the cryptocurrency industry felt the great uncertainty that arose immediately after the signing of the new infrastructure bill.

Kristin Smith, the CEO of the Blockchain Association, said in a note:

“We applaud Congressman McHenry’s bipartisan efforts to clarify the overly broad and unclear language targeting encryption in the infrastructure bill”.

Perianne Boring, founder and CEO of the Digital Chamber of Commerce, said:

“This legislation will protect innovation in the United States and strengthen our status as a leader in blockchain technology. It takes a necessary step to protect consumer privacy by undoing a potentially intrusive part of the infrastructure bill that threatens to treat cryptocurrency users as criminals and force cryptocurrencies to share private information to engage in routine transactions”.

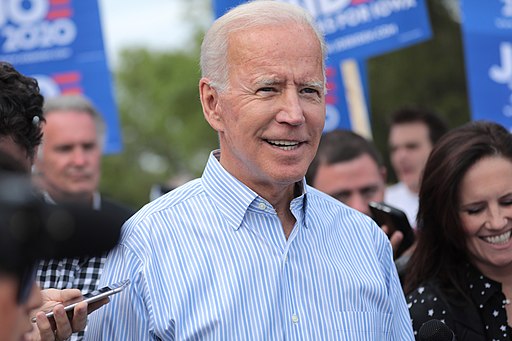

The Infrastructure Investment and Jobs Act was signed into law a few days ago by US President Joe Biden.

It has become law in its own right and has created a two-fold impact, especially on American business. The approved bill also includes a section on digital assets in relation to investments to be registered above a certain threshold.

Back in September, there had already been a tax amendment that marked transactions over $10,000 as traceable and to be reported to the IRS, International Revenue Service.

This comparison, which moves cryptocurrencies onto the same tax and financial footing as traditional assets, would lead investors to gravitate towards other countries, automatically relocating capital overseas.

This is not just a matter of facilitating a different type of finance, in this case decentralized, but not dissipating the possibility of having strong economic growth also resulting from the use of cryptocurrencies.

A group of ten congressional representatives presented a letter to Speaker of the House Nancy Pelosi in order to have a space for discussion and negotiation on the issue. Cynthia Lummis herself has spoken out on the subject, arguing that closing the door on digital currencies would be a serious mistake.

There is also the question of consumer protection and crypto investors. The chairman of the Senate Finance Committee has indicated that he will move to try to signal a parallel bill that would lead to a protective situation for those who invest in cryptocurrencies or engage in mining.

The effects of the Infrastructure Bill on cryptocurrencies

The $1.2 trillion bill signed by Biden also had an immediate impact on Bitcoin and Ethereum. The issue that some government representatives and senators are insisting on is how the figure of “broker”, referred to in the bill, can be defined in this specific case.

The risk and concern is that all those involved in mining and crypto exchanges could fall into this category.

The second point is to sanction the unconstitutionality of the $10,000 limit in the previously approved financial plan and under US law.

The infrastructure bill’s stellar budget ironically includes $1.2 trillion in funding to reactivate internet lines and connections in rural areas, as well as to increase the number of charging stations in all US states.

However, this is in line with the very strong and current dimension of digital assets that are increasingly driving the global economy.

Darren Soto has become the spokesperson for a group of ten congressional representatives asking for more clarification on the bill signed by the White House.

He thus posted on Twitter:

“We stand united to ensure more tax certainty for cryptocurrencies and work with the IRS on key reforms. Together, we will continue to support innovation and protect consumers”.

We stand united to ensure more tax certainty for #cryptocurrency and work with the IRS on key reforms. Together, we will continue to support innovation and protect consumers. pic.twitter.com/xu1Dj2GAqD

— Rep. Darren Soto (@RepDarrenSoto) November 16, 2021

It is clear that tones will continue on a confrontational level, at a time when many countries around the world are trying to find a solution to the use of digital currencies.

There are many political representatives even in the United States who share the expansive economic line, but few on the side of the real interests of the White House.