Summary

Bitcoin down

Bitcoin’s price dipped on Monday [-$842] and began the new week with a bearish engulfing candle on the daily time frame.

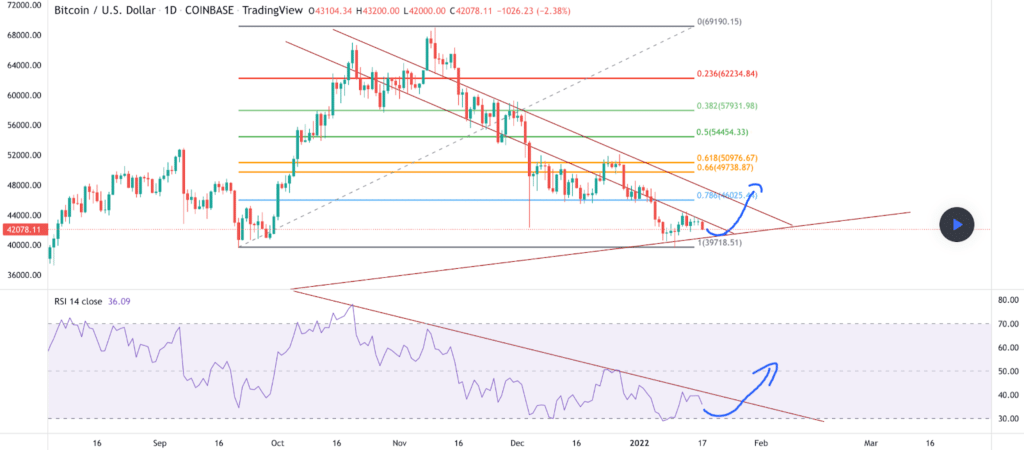

The BTC/USD 1D chart below from NightRocker shows that it’s again decision time for bitcoin’s price.

As traders will note there’s very little support between $42k and the 1 fib level [$39,718.51]. If bearish BTC traders have their way they’ll soon be testing that fib level again and if they successfully crack that level the trip down to $30k could be harsh and abrupt for bitcoin bulls.

If bullish BTC market participants can somehow hold the low $40k level and rally to the 0.786 fib level [$46,025.44] their secondary target is the 0.66 [$49,738.87]. If bulls can send BTC’s price above the 0.66 fib and the last stop before the $50k level, the third target overhead is the 0.618 [$50,976.67].

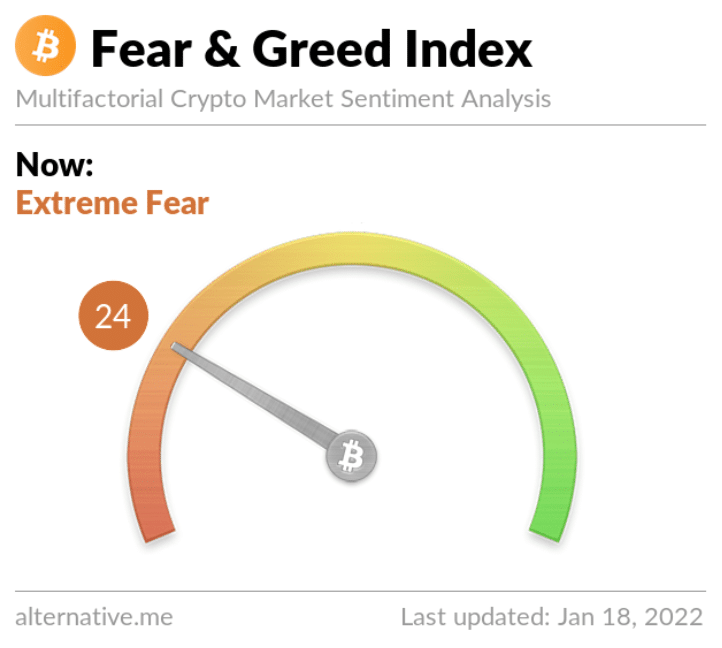

The Fear and Greed Index is 24 Extreme Fear and +2 from Sunday’s reading of 22 Extreme Fear.

Bitcoin’s price is trading below all important moving averages: 20-Day [$45,466.38], 50-Day [$51,052.74], 100-Day [$52,219.], 200-Day [$47,331.7], Year to Date [$43,262.17].

BTC’s 24 hour price range is $41,640-$43,256 and its 7 day price range is $41,628-$44,142. Bitcoin’s 52 week price range is $28,991-$69,044.

The price of bitcoin on this date last year was $35,804.

The average price of BTC for the last 30 days is $45,828.

Bitcoin’s price [-1.95%] closed its daily candle worth $42,242 and has alternated green / red daily candle closes for the last 6 days.

Ethereum analysis

Ether’s price followed BTC’s price lower to start the new week and closed its daily session on Monday -$137.22.

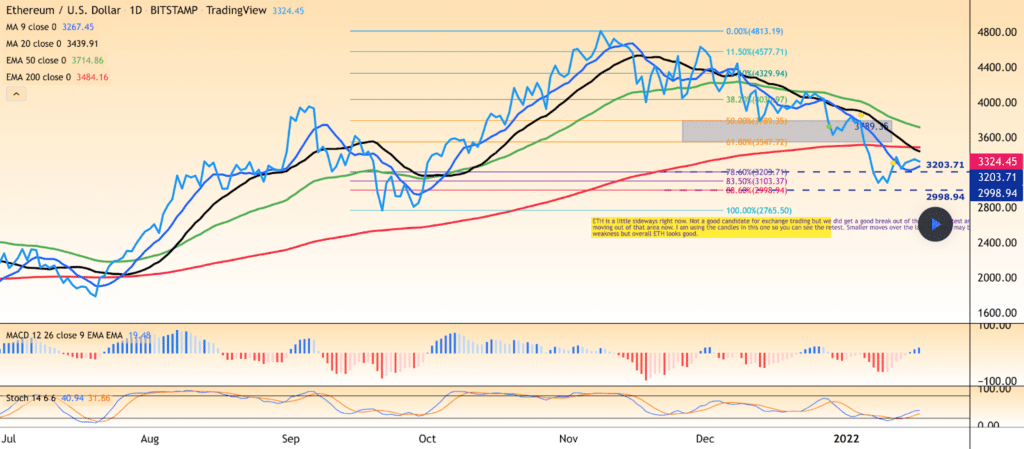

The ETH/USD 1D chart below from stikytrading shows Ether’s price bouncing between the 88.6% fib level [$2,998.94] and the 61.8% fib level [$3,547.72]. Bullish Ether market participants are still hoping to crack the 61.8% fib and test the 50.00% fib level [$3,789.35] but over the last few days bids have been rather weak from bullish traders.

Conversely, bearish ETH market participants still appear to be in possession of the Ether market momentum and are trying to crack the 88.60% fib level [$2,998.94]. If bears can crack that level a trip back down to test the 100%.00 fib level [$2,765.50]and a full retracement should enlighten market participants to whether a longer bearish trend is in store for ETH traders.

Ether’s price is trading below all important moving averages: 20-Day [$3,580.94], 50-Day [$3,988.23], 100-Day [$3,838.84], 200-Day [$3,245.21], Year to Date [$3,367.32].

ETH’s 24 hour price range is $3,156-$3,363 and its 7 day price range is $3,070-$3,395. Ether’s 52 week price range is $1,110-$4,878.

The price of ETH on this date in 2020 was $1,229.

The average price of ETH for the last 30 days is $3,640.

Ether’s price [-4.10%] closed its daily candle on Monday worth $3,209.25 and Ether bearishly engulfed to start the new week.

Polygon analysis

Polygon’s price closed its daily session on Monday -$.12 and in red figures for a second consecutive day.

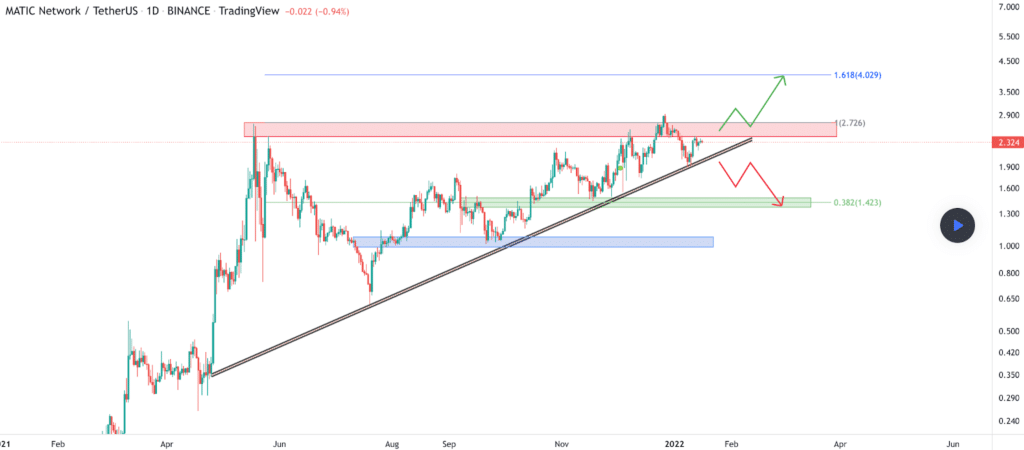

The first MATIC chart we’re analyzing today is the MATIC/USDT 1D chart from MohammadWaezi. This chart shows MATIC’s price bumping up against the 1 fib level [$2.76] and the bottom of that range at $2.34.

MATIC bulls are hoping if they do fail to crack the 1 fib level that they can maintain a long term trendline that dates back to March 2021. If they do fail to hold that trendline, the next stop below is the 0.382 fib level [$1.42].

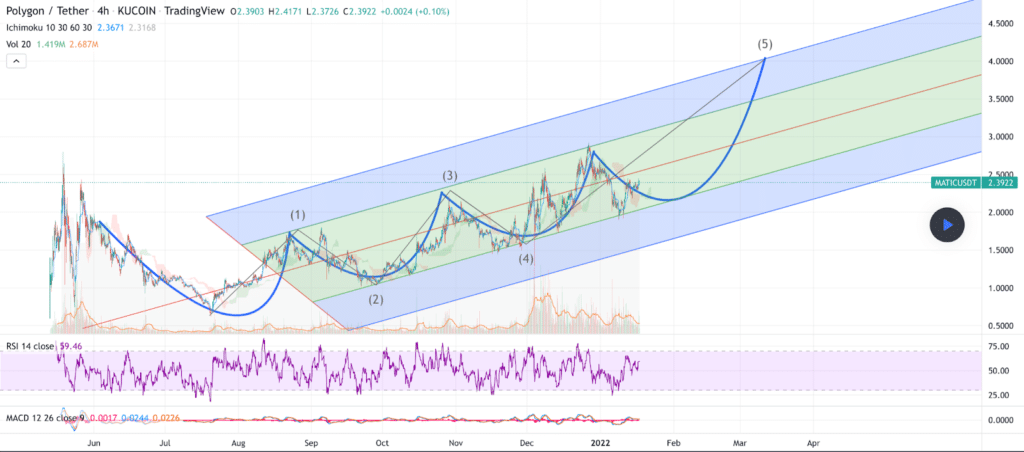

The second chart we’re looking at today is the MATIC/USD 4HR chart below from doublejay. Traders will note that MATIC’s price on the 4HR is trading in a long term ascending channel that dates back to July of 2021. If MATIC’s bulls are able to maintain this ascending trend and a 5th wave of its current harmonic is forthcoming, a trip up to test the $4 level would become more probable.

MATIC is +6,267% against The U.S. Dollar for the last 12 months, +5,383 against BTC, and +2,378% against ETH, at the time of writing.

Polygon’s 24 hour price range is $2.17-$2.44 and its 7 day price range is $2.07-$2.44. MATIC’s 52 week price range is $0.02-$2.92.

Polygon’s price on this date last year was $.036.

The average price for MATIC over the last 30 days is $2.37.

Polygon’s price [-4.76%] closed Monday’s daily candle worth $2.21.