Summary

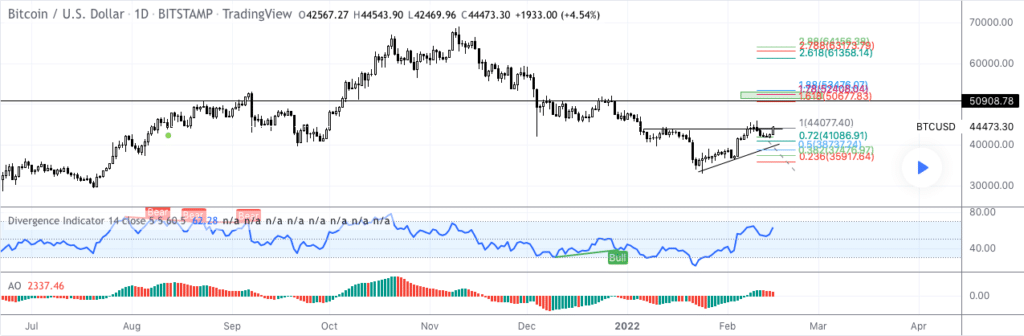

Bitcoin Analysis

Bitcoin’s price is finally back to trading above its 20-Day and 50-Day Moving Averages as bullish BTC market participants sent BTC’s price higher again on Tuesday. BTC’s price closed its daily session in green figures and +$2,000 for yesterday’s session.

The BTC/USD 1D chart below from PennyCryptos shows bitcoin bulls and bears battling at the 1 fib level [$44,077.4]. Overhead bulls have targets of 1.618 [$50,667.83] and a secondary target at the 1.78 fib level [$52,408.04]. The third target if bulls can eclipse the $54,5k level is of paramount importance if challenged, that target is 1.88 [$53,476.07].

Those seeking lower BTC prices are hoping to close below the $44k level on a significant timescale with a secondary target of 0.72 [$41,086.91]. The third target for bearish bitcoin traders is 0.5 [$38,737.24].

Bitcoin’s Moving Averages: 20-Day [$40,034.94], 50-Day [$43,846.55], 100-Day [$51,045.21], 200-Day [$45,714.83], Year to Date [$41,252.71].

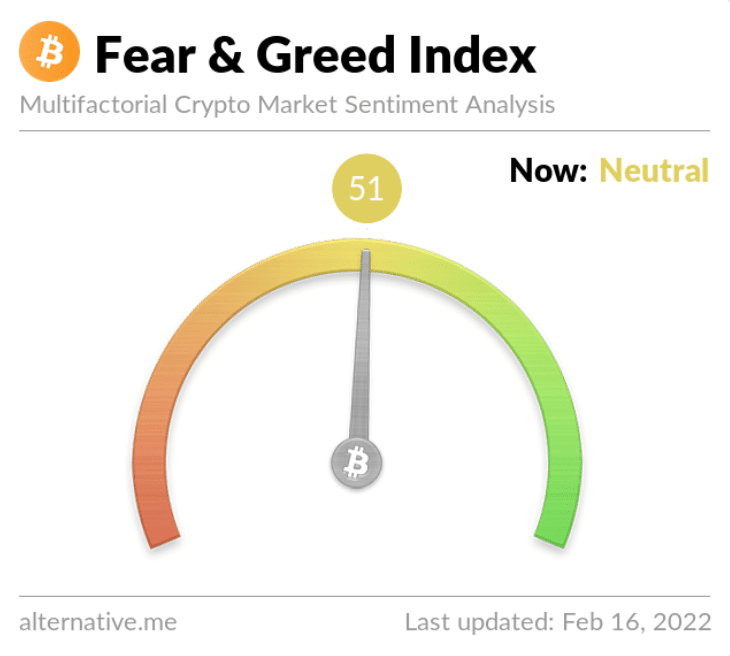

The Fear and Greed Index is 51 Neutral and +5 from Tuesday’s reading of 46 Fear.

BTC’s 24 hour price range is $42,601-$44,706 and its 7 day price range is $41,793-$45,481. Bitcoin’s 52 week price range is $29,341-$69,044.

The price of bitcoin on this date last year was $52,143.

The average price of BTC for the last 30 days is $40,332.

Bitcoin’s price [+4.7%] closed its daily candle worth $44,559.9 and in green figures for a second consecutive day.

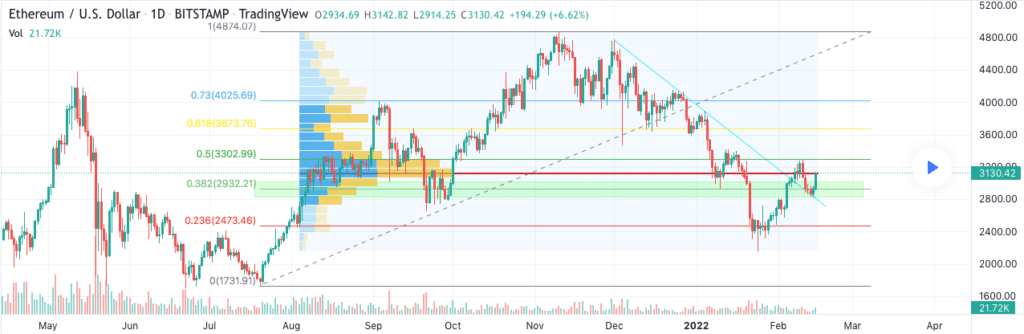

Ethereum Analysis

Ether’s price also marked-up on Tuesday and outperformed BTC’s price comparatively. ETH’s price concluded its daily session +$252.96.

The second chart we’re analyzing today is the ETH/USD 1D chart below from johanam31415. Bullish Ether traders have reclaimed the $3k level and ETH’s price is ranging between the 0.382 [$2,932.21] and 0.5 [$3,302.99]. If bullish ETH traders can break out to the upside and get candle close confirmation on the daily timescale above the 0.5 fib level, their next target shifts to 0.618 [$3,673.76]. There’s been strong resistance at the 0.5 fib level since bears flipped that level back from support for bulls to overhead resistance – so, breaking that level would be very bullish in the short-term.

From the bearish perspective, bearish Ether market participants need to send ETH’s price back below the 0.382 with candle close confirmation on a low timescale before taking aim at the 0.236 fib level [$2,473.36]. The third target for bears is a full retracement down to 0 [$1,731.91] which is the last major support for bulls before another major markdown in ETH’s price.

Ether’s Moving Averages: 20-Day [$2,814.39], 50-Day [$3,360.39], 100-Day [$3,733.37], 200-Day [$3,239.56], Year to Date [$3,020.38].

ETH’s 24 hour price range is $2,920-$3,190 and its 7 day price range is $2,850-$3,261. Ether’s 52 week price range is $1,353-$4,878.

The price of ETH on this date in 2021 was $1,782.

The average price of ETH for the last 30 days is $2,853.

Ether’s price [+8.64%%] closed its daily candle on Tuesday worth 3,181.93.

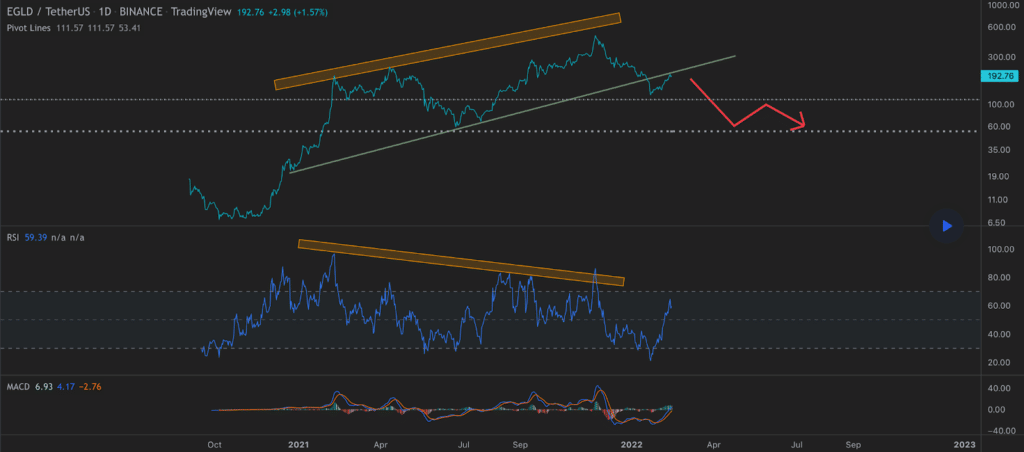

Elrond Analysis

Elrond’s price was also sent higher on Tuesday by bullish EGLD traders and finished its daily candle +$7.09.

The EGLD/USD 1D chart below from ARrolll is the third chart we’re examining today. Traders will note that bullish EGLD traders have lost a long term trendline dating back to October of 2021 and are now retesting the bottom of that former structure as overhead resistance.

The target for bearish traders to the downside is $60 if they can reject the bullish attempt to again flip that trendline from resistance back to support.

EGLD’s +36.69% against The U.S. Dollar over the last 12 months, +47.01% against BTC, and -23.48% against ETH over the same duration, at the time of writing.

Elrond’s 24 hour price range is $187.25-$199.62 and its 7 day price range is $172.39-$208.31. EGLD’s 52 week price range is $58.32-$545.64.

Elrond’s price on this date last year was $137.14.

The average price of EGLD over the last 30 days is $162.81.

Elrond’s price [+3.78%] closed its daily session on Tuesday worth $194.45 and in green digits for the first time in three days.