Summary

Bitcoin Analysis

Bitcoin’s price traded lower when it closed on Sunday than when it began the week for the seventh straight week in a row despite a strong rally during Sunday’s daily session. BTC’s price concluded Sunday’s daily candle +$1,215.

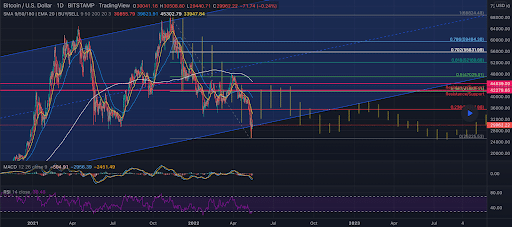

The BTC/USD 1D chart below from XRP-Jonny shows BTC’s price trading between the 0 fibonacci level [$25,225.53] and 0.236 [$35,514.88], at the time of writing.

The primary target overhead for bullish BTC traders is 0.236 followed by 0.382 [$41,880.33] and 0.618 [$52,169.68].

Conversely, the targets to the downside for bearish traders are 0.382, 0.236 [$35,514.88 ], and a complete retracement back to 0 [$25,225.53].

Bitcoin’s Moving Averages: 5-Day [$29,757.78], 20-Day [$36,825.83], 50-Day [$40,149.62], 100-Day [$40,926.88], 200-Day [$46,772.85], Year to Date [$40,561.20].

BTC’s 24 hour price range is $29,572-$31,347 and its 7 day price range is $26,600-$34,337. Bitcoin’s 52 week price range is $26,600-$69,044.

The price of bitcoin on this date last year was $46,582.9.

The average price of BTC for the last 30 days is $45,130.5 and BTC’s price is -24.7% over the same time frame.

Bitcoin’s price [+4.04%] closed its daily candle worth $31,319 on Sunday and has finished in green figures for the last three days.

Ethereum analysis

Ether’s price finished in green figures for a third straight day on Sunday and finished +$89.66.

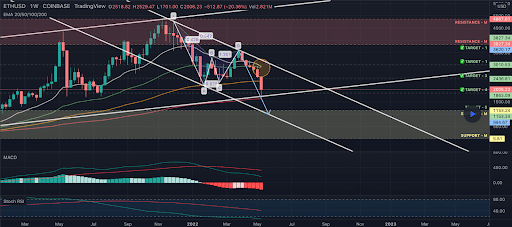

The ETH/USD 1W chart below shows what looks like an imminent crossover of the EMA 20 and the EMA 50. This chart from priitzzy also shows that ETH’s price touched a long-term trend line on the weekly time frame.

If bearish Ether traders are able to break that trend line to the downside and push ETH’s price below the $1,713 level, there isn’t much resistance until under the $1k level.

Ether’s Moving Averages: 5-Day [$2,123.96], 20-Day [$2,711.80], 50-Day [$2,895.02], 100-Day [$2,965.56], 200-Day [$3,376.81], Year to Date [$2,921.46].

ETH’s 24 hour price range is $2,008-$2,154 and its 7 day price range is $1,824-$2,543. Ether’s 52 week price range is $1,719.48-$4,878.

The price of ETH on this date in 2021 was $3,579.78.

The average price of ETH for the last 30 days is $3,129.05 and ETH’s price is -31.5% over the same duration.

Ether’s price [+4.36] closed its daily candle on Sunday valued at $2,146.

ATOM analysis

Despite a solid rally during Sunday’s daily session, ATOM’s price finished lower for the seventh straight week and is -27% for the last 7 days, at the time of writing. ATOM’s price concluded Sunday’s daily session +$1.60.

The ATOM/USD 1W chart below by abdulganibareen shows ATOM’s price in a larger downtrend on the weekly time frame with the primary target for bears at the $10.73 level.

ATOM’s Moving Averages: 5-Day [$11.31], 20-Day [$18.07], Year to Date [$22.60].

ATOM’s price is -49.96% against The U.S. Dollar for the last 12 months, -25.04% against BTC, and -14.55% against ETH, over the same duration.

ATOM’s 24 hour price range is $10.37-$12.39 and its 7 day price range is $9.02-$15.96. ALGO’s 52 week price range is $8.57-$44.45.

ATOM’s price on this date last year was $24.30.

The average price of ATOM over the last 30 days is $18.30 and the price of Cosmos is -49.04% over the same timespan.

ATOM’s price [+14.84%] closed up nearly 15% on Sunday and worth $12.38. Sunday’s daily candle close in green figures was the third consecutive for ATOM.