Between August 5 and 9, Elon Musk sold part of his Tesla shares for a total value of $6.9 billion. This marks the record for the largest billion-dollar sale.

Summary

Elon Musk sells $6.9 billion worth of Tesla shares

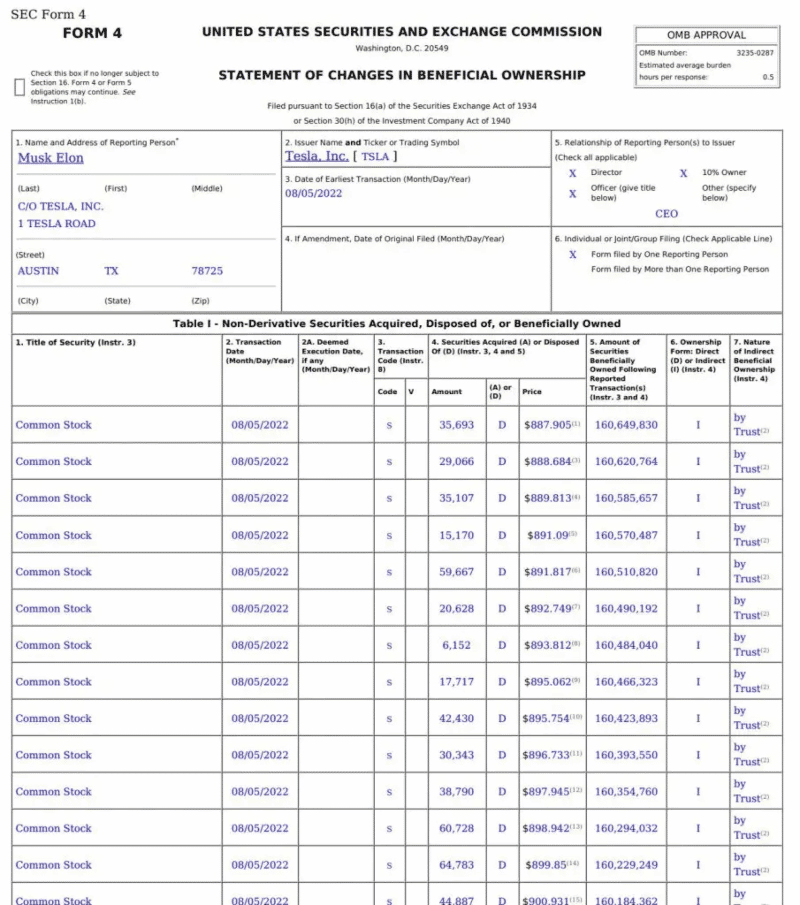

In recent days Elon Musk has filed six “Form 4“ documents, which are required by the SEC for this type of transaction.

From what we gather, 7,924,107 shares were sold, at a weighted average price of $869.09. The liquidation has a total value of $6.9 billion and is the largest in history so far.

Obviously, it did not happen all at once but was divided into several transactions carried out over several days: on 5, 8 and 9 August.

This made it possible to avoid generating too much selling pressure on the stock and to find all the necessary counterparties to finalize the operation.

The goal is clear: to accumulate as much liquidity as possible in case the Delaware court decides to force Musk to complete the acquisition of the social. If this were to happen, the CEO of Tesla would avoid a massive selloff of the stock at the last minute, which could generate unexpected panic in the market.

Yes.

In the (hopefully unlikely) event that Twitter forces this deal to close *and* some equity partners don’t come through, it is important to avoid an emergency sale of Tesla stock.

— Elon Musk (@elonmusk) August 10, 2022

Immediately afterwards, a user asked the famous entrepreneur if he was willing to buy back the shares he sold in case the takeover does not go through, and he received a clear and concise answer:

Yes

— Elon Musk (@elonmusk) August 10, 2022

Despite having “dumped” Tesla shares worth a total of $32 billion in the past 10 months, Elon Musk still remains the largest shareholder, with a 14.8% stake.

In any case, should the deal fail, the intentionally withdrawn party will have to pay a $1 billion fine.

The reputation of Tesla’s CEO

The world’s richest man has been the center of attention during the past few months, both in the crypto ecosystem and in the financial markets and social networks.

His clear interest in Bitcoin and declared love for Dogecoin have made him a very influential figure for the market, so much so that he has even earned the nickname “Dogefather”.

However, interest skyrocketed from the moment negotiations with Twitter began, after he bought 10% of the company last April.

This transaction caused the stock to gain more than 27% in the market and made Musk the largest shareholder. Initially, investors and the community were responding well to the ideas Elon wanted to bring to Twitter. Among the most popular was certainly freedom of speech, a desire expressed by users in one of the much-loved votes:

Do you want an edit button?

— Elon Musk (@elonmusk) April 5, 2022

In recent months, however, the relationship between the social network and the famous entrepreneur has become increasingly complex. Following a heated fight against the board, especially over the poison pill issue, Elon Musk decided to acquire Twitter in full. This way he would make it private and it would be easier to make any kind of changes without too many obstacles.

The $44 billion deal was later suspended because of the unreliability of the data provided by Twitter regarding the number of bots and fake accounts on the social. This curbed Elon Musk’s wishes, which was not taken well by the other side. In fact, just a month ago, Twitter sued Tesla’s CEO, with the goal of forcing him to finalize his acquisition of the social platform.

Now what remains is to wait for the results of the hearing, but in the meantime, Musk is running for cover to be ready for any outcome.