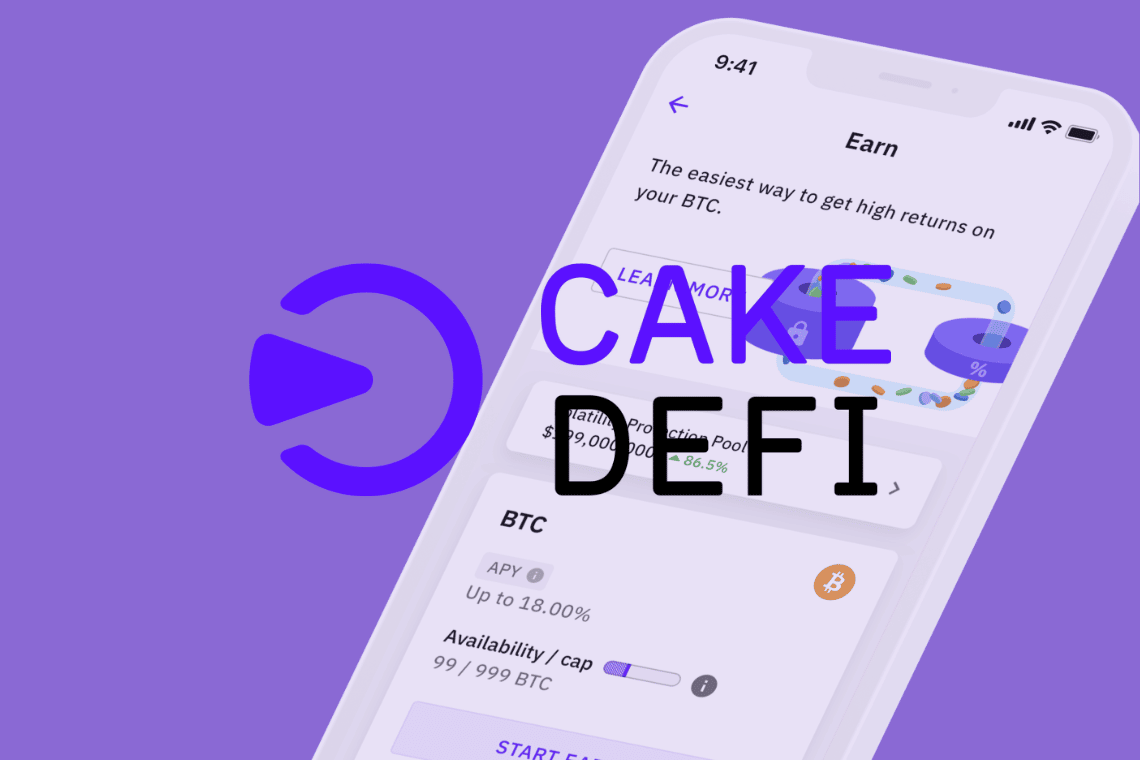

Cake DeFi has announced the launch of a new product: Earn, dedicated to the remuneration for different types of crypto deposits.

Summary

Cake DeFi’s new product, Earn

Cake DeFi is a transparent and innovative fintech platform.

It provides its users with decentralized financial services that allow them to generate attractive returns on their digital assets.

The company is managed and registered in Singapore and is therefore subject to the laws and regulations applicable in Singapore.

The new Earn service is presented as a hybrid product suitable for crypto investors who want to make a return on their assets while, at the same time, trying to lower their risk percentage.

As such, Earn allows users to earn competitive returns on their crypto assets with low volatility.

It presents itself as a one-sided liquidity mining service that provides daily rewards, protecting, as much as possible, users from market volatility.

Statements from Cake DeFi’s co-founder.

Dr. Julian Hosp, co-founder and CEO of Cake DeFi, said:

“Our latest product EARN was launched to address today’s market needs. With the crypto winter settling in, investors have become increasingly risk-averse, especially since many Centralized Finance (CeFi) platforms have become insolvent or are facing liquidity issues. As a Centralized Decentralized Finance (CeDeFi) platform, our business is to provide our users with good yields on their crypto investments with complete transparency. You can always trust Cake DeFi because you can always verify. E

ARN will allow users to get unbeatable returns on Bitcoin which they can track transparently on the blockchain.

The Volatility Protection feature will also protect them against impermanent loss, especially in such times of market volatility.”

Cake DeFi’s Earn is thus a fully transparent product that will allow users to generate competitive returns while at the same time trying to protect them from market volatility and temporary losses.

Users will be able to allocate Bitcoin (BTC) or DeFiChain (DFI) to receive rewards in the native coin every 24 hours, with approximately 10% annual percentage yield (APY).

Returns in Earn will also be auto-compounded to generate even greater returns.

How does EARN seek to protect users from market volatility

The volatility protection feature of Earn aims to protect users from temporary losses by covering potential losses during drastic fluctuations in cryptocurrency prices.

Taking the best of both worlds, Earn combines the high returns of Liquidity Mining with the low volatility traditionally associated with cryptocurrency lending.

It is a new and unique way to generate cash flow from the allocation of existing crypto assets without counterparty risk and protection against temporary losses.

Users will also have full transparency of their investments as they are allocated directly on the DeFiChain blockchain.

To be more specific, users will get 1% coverage for every 24 hours they participate in the Earn product.

Thus, the longer a customer invests in Earn, the broader their coverage will become.

E.g., a user who allocates and maintains funds in Earn for 100 days will receive 100% volatility protection on those same funds.

That said, it should be noted that the volatility protection depends entirely on the pool balance. This means that full coverage is not guaranteed even if a user obtains 100% coverage under the conditions described above.

Cake DeFi’s track record

During the recent period, the platform has grown rapidly.

The best quarter for the project was Q2, evidence of which is the exponential increase in customers, funded accounts, and payments.

The data are clear, the number of customers recently exceeded one million and the platform has paid out a total of $375 million in rewards through the end of Q2 2022, despite the gloomy market outlook.

Now Cake DeFi’s immediate priority is to continue to grow its customer base, seeking to improve financial inclusion to make DeFi more accessible to both consumers and businesses.