The 2022 Nobel Prize in Economics has been awarded to Americans Ben Bernanke (former Fed Chairman), Douglas Diamond and Philip Dybvig. This was announced by the Royal Academy of Sciences in Sweden, explaining that “their discoveries have improved the way society deals with financial crises.”

Summary

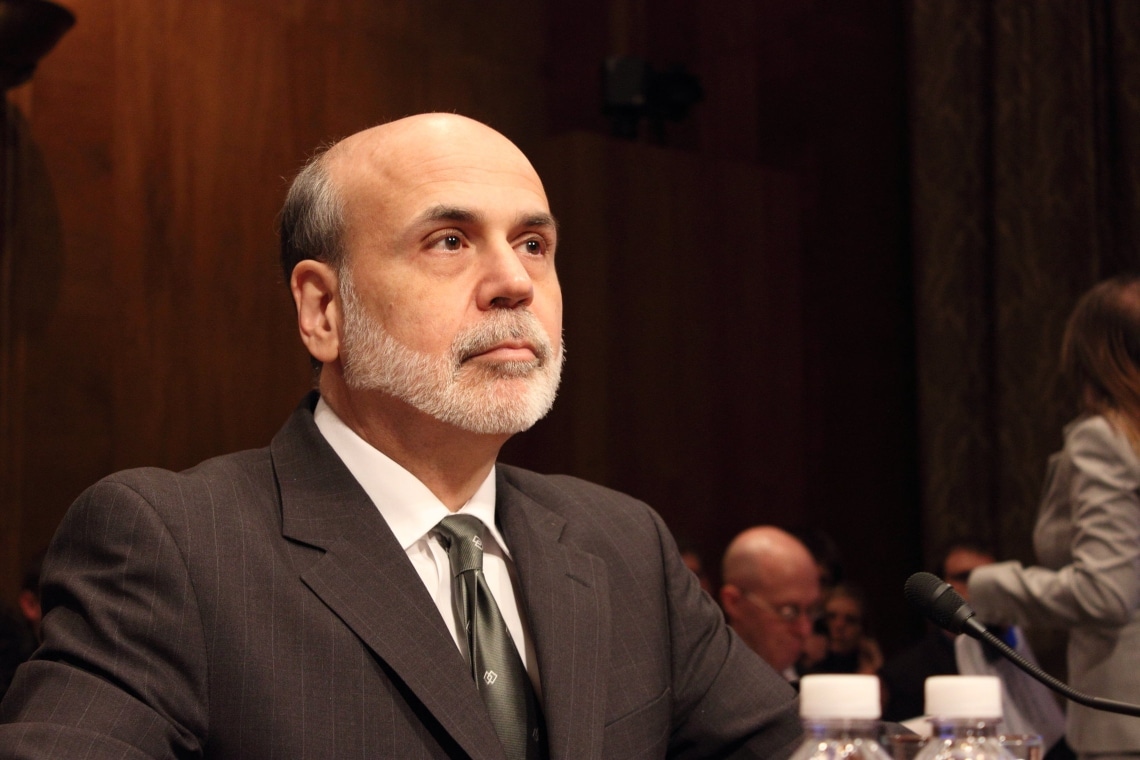

Ben Bernanke receives Nobel Prize in economics

Just as an economic crisis very similar to, if not worse than, that of 2008 looms on the horizon, though with very different characteristics, the Nobel jury decides to award the prestigious prize for economics to the man who was one of the absolute protagonists of that crisis: then-Fed Chairman Ben Bernanke.

BREAKING NEWS:

The Royal Swedish Academy of Sciences has decided to award the 2022 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel to Ben S. Bernanke, Douglas W. Diamond and Philip H. Dybvig “for research on banks and financial crises.”#NobelPrize pic.twitter.com/cW0sLFh2sj— The Nobel Prize (@NobelPrize) October 10, 2022

The former Fed Chairman won the prize along with two other American economists Douglas Diamond and Philip Dybvig, respectively professors at the Universities of Chicago and Washington, thanks to their research on banking and the financial crisis:

“For the economy to function, savings must be channelled to investments. However, there is a conflict here: savers want instant access to their money in case of unexpected outlays, while businesses and homeowners need to know they will not be forced to repay their loans prematurely. In their theory, Diamond and Dybvig show how banks offer an optimal solution to this problem. By acting as intermediaries that accept deposits from many savers, banks can allow depositors to access their money when they wish, while also offering long-term loans to borrowers.”

With regard specifically to Bernanke’s contribution to the economy and the resolution of the very serious crisis of 2008, the Nobel Prize jury explains that:

“Ben Bernanke analysed the Great Depression of the 1930s, the worst economic crisis in modern history. Among other things, he showed how bank runs were a decisive factor in the crisis becoming so deep and prolonged. When the banks collapsed, valuable information about borrowers was lost and could not be recreated quickly. Society’s ability to channel savings to productive investments was thus severely diminished.”

Former Fed Chairman’s story

Ben Bernanke, 68, was Fed Chairman between 2006 and 2014, under the presidencies of George W.Bush and Barack Obama, he faced one of the worst financial crises in history, which began in the US and expanded to the entire world.

He continued the super-expansive policies of one of his predecessor Alan Greenspan, appointed to head the Fed for no less than five terms, whose expansive economic policies, paradoxically, are cited as one of the contributors to the bursting of the subprime mortgage bubble at the origin of the 2008 financial crisis.

Bernanke initiated a policy of near-zero rates and massive purchases of Treasury securities, in what is referred to as quantitative easing, through which he managed to avoid a financial depression similar to that of the 1930s.

Also important though debated was his role in the bailout of some banks whose failure could have caused a ripple effect throughout the US financial system. Many considered the “sacrifice,” causing Lehman Brothers to fail, an unnecessary gamble according to many observers. However, the expansive policy and its intervention in the real economy certainly averted a real financial Armageddon, but it initiated an expansive policy that generated a great debate about the role of Central Banks and those of the big banks and financial institutions in the real economy.

A debate that also led to the creation in 2009 of Bitcoin, the first digital currency, completely disintermediated and free of constraints of any kind, created precisely to prevent a repeat of a crisis like that of 2008.