There are many possible applications for using Bollinger Bands to decide whether to buy or sell Bitcoin.

This indicator is named directly after its inventor John Bollinger, who analyzed the behavior of prices in moving away from or approaching their moving average.

To do this Bollinger thoughtfully inserted two bands, calculated as the standard deviation of the simple average of prices, trying to find a way to enclose and contain prices within well-defined bands.

Summary

How do Bollinger Bands work

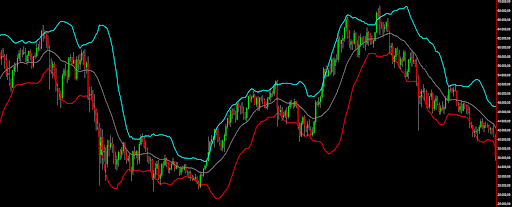

The two bands, upper and lower, can become the entry “trigger” for a trading strategy: an exit of prices from the bands identifies a burst of volatility such that prices should either continue their run in the direction taken or reverse their predetermined course and make a reversal, should an exit from the bands be followed by a sudden re-entry within them.

It is a well-known fact that Bitcoin, i.e., the leading cryptocurrency by market capitalization, tends to stay in trend for quite some time before reversing its course. Based on this construct the Bollinger bands are going to be used in trend-following mode. Hence, it will be necessary to wait for a price exit out of the upper band to place long orders, and an exit out of the lower band to enter short.

When operating with an indicator, the time frame to choose will also be of extreme importance. Therefore, a comparison of the most commonly used timeframes is urgently needed, performing an optimization that identifies the best results.

How to use Bollinger Bands to buy Bitcoin

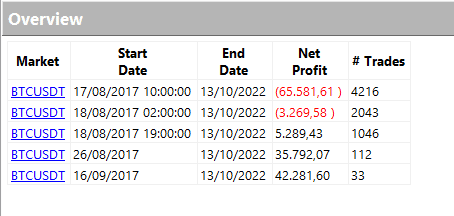

By setting as the window for the backtest the years from August 2017 to the present, i.e., the data that Binance provides for spot Bitcoin, the results that are obtained are very different from each other. The fixed size used is $10,000 per trade.

The timeframes chosen vary from 15 minutes up to daily.

In Figure 2, it can be seen that as the timeframe increases, the signals provided by Bollinger bands are more effective. In fact, the best cases are obtained with 480-minute (4-hour) and 1440-minute (daily bars) timeframes.

In descending order: 15 minutes, 30 minutes, 60 minutes, 480 minutes, 1440 minutes

The 15-minute timeframe, i.e., the first in the list, loses systematically, an indication that perhaps the faster the timeframe, the more it would be the case to operate with a mean reverting strategy, as opposed to trend following. It is a different matter for timeframes from 60 minutes to 1440 minutes (i.e., the last 3 in the list in Figure 2) where positive results are noted.

At this point, a spontaneous focus arises on the best timeframe in so many respects, the 480-minute timeframe, which in the historical period under consideration makes a very good profit, with a respectable average trade. The statistical sample, or more simply the number of trades, is also higher than the daily timeframe, which makes only 33 trades in the historical period considered.

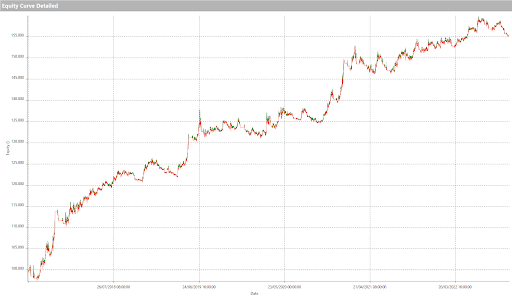

Therefore, 480 minutes is chosen as the reference timeframe, and stop-loss and take-profit are added which can somewhat protect the account from excessive drawdowns.

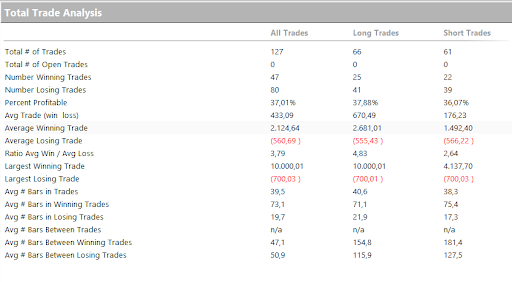

With stop-loss set at $700 (equal to a 7% hike in position value) and a very ambitious take-profit (target) at $10,000, this produces the results visible in Figures 3 and 4.

The profit curve is upward sloping and the average trade exceeds $400, which is a very good 4% price excursion on the position’s countervalue.

Making predictions on Bitcoin

In conclusion, we have seen how Bollinger bands can also be used on Bitcoin, as they are able to identify, on the most suitable time frames, market trend starting points that could be used as entry triggers for devising trading strategies.

However, there remains some doubt about the stability of the results, since as the timeframe changed, the profits obtained by the system were changeable, to say the least. While it is undeniable that the movements became more airtight as the timeframe decreased, it is considered appropriate to put the strategy to the test of time by letting it run on out-of-sample data in order to fully evaluate it.