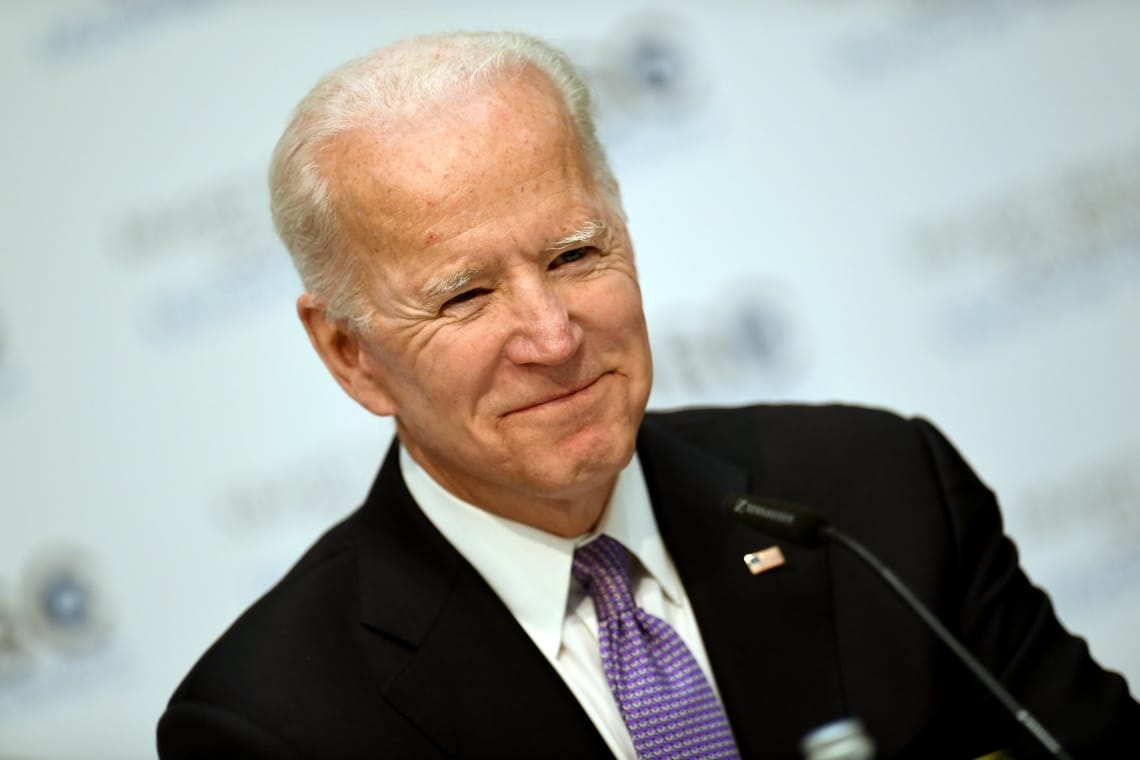

Following yet another disaster of the asset that has seen millions of investors holding the bag (FTX), US President Joe Biden, draws attention to the need to create clear regulation of the crypto market.

Summary

Joe Biden’s thoughts after the collapse of crypto exchange FTX

FTX and the native FTT token of now former child prodigy Sam Bankman-Fried (SBF) have left deep wounds in the cryptocurrency industry.

The exchange platform triggered a chain reaction that infected other exchanges (and thus other contributors) in different ways and undermined investor confidence.

It all stemmed from rumors that the company did not have the necessary hedges for the funds on the exchange.

As a result of massive user withdrawals, the platform crashed to the point of being forced after confirmations of less-than-optimal financial statements (and thus corroborating the accusation made initially) to declare Chapter 11.

The debacle of FTX and the Alameda Research company, both related to SBF, brought investor mood to lows and this resulted in a drastic drop in all crypto.

In a cascade, other directly or indirectly connected exchanges have blocked operations on their platforms for fear of suffering common fate, and this series of events has outraged savers and traders around the world who invest and believe in the world of cryptocurrencies.

Crying out for certain laws and protection for all, investors have been vocal and this combined with the FTX debacle has led G20 heads of state to move to meet the demand.

In Indonesia where the G20 was held, the heads of state of member countries took up this concern and wanted to push for international rules to “keep tabs” on Bitcoin and cryptocurrencies from an investment protection perspective.

“It is crucial to raise public awareness of risks, strengthen regulatory outcomes and support a level playing field, while reaping the benefits of innovation.”

This is what is stated in the document drafted by world leaders.

Back in October, the Financial Stability Board (FSB), promoted the implementation of firm rules to be adopted worldwide in order to protect insiders and taxpayers in the crypto world.

The idea was to subject cryptocurrencies to the same rules that govern classical finance.

“We welcome the approach proposed by the FSB to establish a comprehensive international framework for the regulation of cryptocurrency activities based on the principle of ‘same business, same risk, same regulation. It must be ensured that the cryptocurrency ecosystem, including so-called stablecoin [pegged to traditional currency], is closely monitored and subject to strict regulation, supervision and oversight to mitigate potential risks to financial stability.”

According to Janet Yellen, US Treasury Secretary, the FTX failure:

“demonstrates the need for more effective supervision of the cryptocurrency markets.”

“This is a wake-up call, rather than just a bump in the road, or even the end of the road.”

This is the authoritative opinion of Cristiano Bellavitis, a teacher at Syracuse University on cryptocurrency and blockchain.

“The industry is huge financially but has very limited regulation. The same problems would not have occurred in the traditional financial system. The collapse of FTX will reduce trust in the cryptocurrency industry, but this industry and blockchain technology are here to stay. More Clearer regulation and rules will only strengthen what this industry can do.”

Regulation coming from the United States?

The consensus is that the world of cryptocurrency should therefore be subjected to common laws that will prevent the loss of resources and credibility of such a promising market that attracts so many investors around the world.

US President Joe Biden in the past had repeatedly promoted international regulation of this asset, and as time went on, the regulation party grew.

Three Arrows Capital, Mt Gox, Luna and now FTX have done nothing but burden a market that could have done more and that despite what has happened is still giving to taxpayers.

At the G20, Joe Biden simply blew on the fire and pointed out that the soaring cryptocurrency market is a very powerful magnet that attracts monstrous investments and therefore needs to be regulated on par with classical finance.

The leaders of the world’s most influential countries endorsed this sentiment of the US president and jointly signed a memo aimed at starting a path to global regulation that protects everyone and puts the same stakes in place for every latitude.

While waiting for this path to come to fruition individually, various countries and communities have already moved toward tightening.

Europe for example with MiCA and America itself have the most comprehensive regulations in this regard, especially with regard to savings protection but much more and better can be done.

The ultimate goal of the regulation party’s motion is just that: to instill confidence and peace of mind in traders who believe cryptocurrencies are a market worth investing in.

The news of the US president’s willingness to go in this direction was immediately picked up, especially on Twitter, which is the social media of choice and most used by industry enthusiasts.

Among the news outlets that first spread the news was Bitcoin Magazine, which immediately tweeted the gist of the speech citing an article taken from Forbes.

“JUST IN: US President Joe Biden leads “critical” call for global Bitcoin and crypto regulation after FTX collapse – Forbes.”