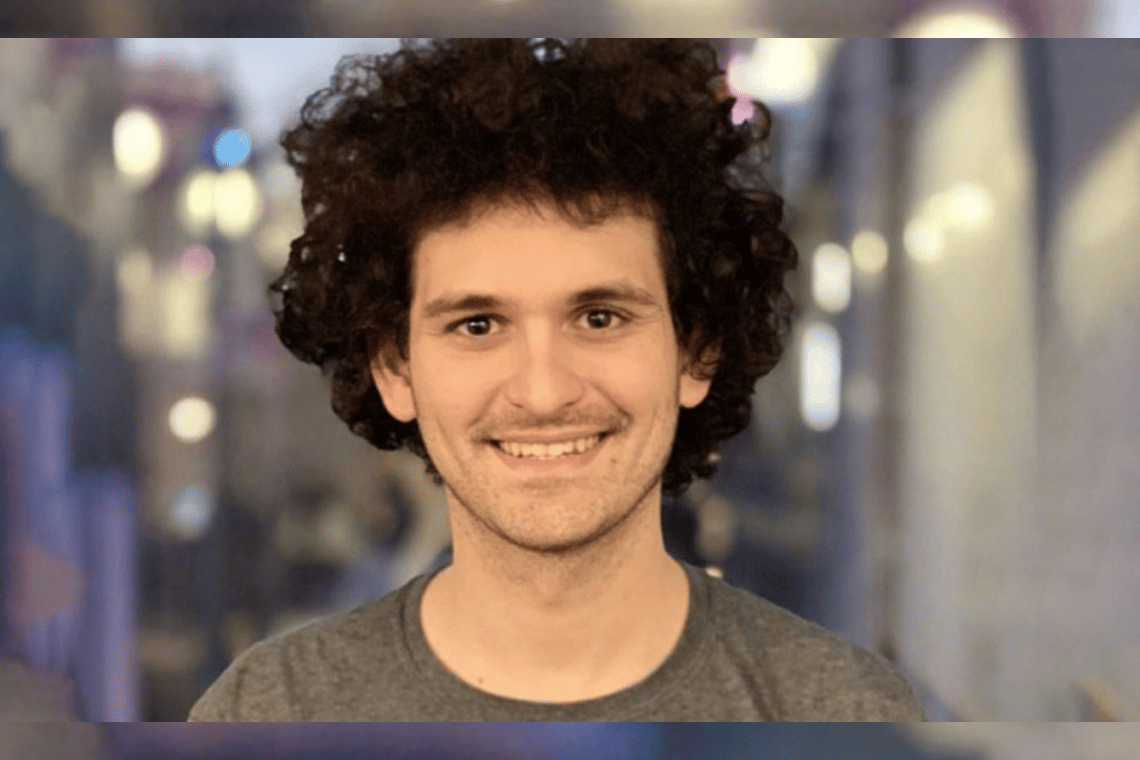

Everyone has been wondering: will the founder of crypto exchange FTX, Sam Bankman-Fried (SBF), speak out or not? That was the big question on the minds of attendees at Wednesday’s DealBook Summit.

In the end, the fallen cryptocurrency tycoon made good on his promise in his first public appearance since the collapse of FTX, his trading exchange. Andrew Ross Sorkin of The Times questioned him for over an hour in an interview that generated headlines and tweets around the world.

DealBook, as it does every year, held its conference in New York, a day packed with high-level discussions with leaders from the worlds of politics, business, and culture. Among them, in addition to SBF, we saw: Janet Yellen, US Treasury Secretary; Mark Zuckerberg, CEO of Meta; Mike Pence, former US Vice President; and others.

Summary

Everything SBF, founder of FTX, said at the DealBook Summit

SBF famously addressed many questions, and dodged many others as well, at the DealBook Summit in New York. Specifically, after the conference, he wrote the following on his Twitter account:

Expanding on DealBook:

When I filed, I'm fairly sure FTX US was solvent, and that all US customers could be made whole.

To my knowledge, it still is today.

I was expecting that to happen. I'm surprised it hasn't. I'm not sure why US withdrawals were turned off.

— SBF (@SBF_FTX) December 1, 2022

Specifically, the former CEO of FTX was asked about how his business failed last month. There is curiosity, a lot of it, around the topic because FTX’s collapse represented a multibillion-dollar meltdown that could take years to resolve in bankruptcy courts.

In addition, the FTX exchange ordeal also wiped out much of SBF’s personal wealth, going from billions to millions in the space of twenty-four hours. As SBF spoke, it became increasingly apparent that the lost fortunes would not be recovered. Until, finally, he admitted that he had made a mess of things.

In addition, Sam Bankman-Fried said that he did not knowingly mix FTX client funds with those of Alameda Research, the trading arm of the exchange, which acted as a market maker on FTX, facilitating client transactions and making its own very risky leveraged bets.

This is also reported in Blockworks‘ official Twitter account, which reads:

SBF: "I didn't knowingly commingle funds."

— Blockworks (@Blockworks_) November 30, 2022

More statements from the founder of crypto exchange FTX: admissions and exculpation

In the lengthy interview in which he was thrust into the spotlight for the first time since FTX’s collapse, SBF made important statements amidst admissions of guilt for what happened and exculpatory statements regarding his actions.

Specifically, he denied that he knowingly committed fraud, saying that he never tried to commit fraud against anyone. Moreover, he said that he did not realize the dangerous situation the companies were in until it was too late.

So far, therefore, SBF seems an innocent victim of his exchange’s collapse himself. Except that he later admitted that big mistakes were made, including poor if not nonexistent risk management and no oversight to protect customer accounts.

However, he acknowledged that he always told the truth:

“I don’t know the times I’ve lied. I have been as sincere as I know I am.”

He also stressed that the political donations he had made, of which documents showed sums totaling $40 million, were not intended as an attempt to buy access to lawmakers.

Reflections on the collapse of FTX and the crypto winter

Not only did SBF make statements about the FTX collapse and the consequences it caused: market turmoil, falling coin prices, and struggling companies. A crypto winter in its own right.

In fact, Bitcoin Archive‘s Twitter account reads:

JUST IN: 🇬🇧 FTX collapse won't diminish UK ambition to become global cryptocurrency centre – U.K. Economic Secretary

— Bitcoin Archive (@BTC_Archive) December 1, 2022

Thus, seemingly good news at least from the UK, which, although at a very difficult time for the blockchain world, is not deterred at all and still continues to believe in the power of cryptocurrencies.

Larry Fink, managing director of BlackRock, also spoke at the DealBook summit about the collapse of FTX, not holding back at all. In fact, he stated that in his opinion the executives might be guilty of some sort of misconduct of great consequence.

Moreover, he stated that venture capitalists, who helped finance the exchange, are at least partly to blame. Apparently, BlackRock had also invested large sums in FTX, $24 million to be exact.

Fink also predicted that the fall of FTX would cause venture capital firms to rethink where they would invest their money.

“It won’t go to all these things that have provided us with a good utility to get food faster or find a cab sooner. I think it’s going to be a much tougher science and require a lot more technical understanding.”

Finally, Janet Yellen, US Treasury Secretary, also had her say on all that has recently happened in the cryptocurrency universe.

In particular, Yellen called for greater regulation of the cryptocurrency industry, labeling the collapse of Mr. Bankman-Fried’s FTX a “Lehman moment” for the industry and reiterating her skepticism about the industry.

“I think everything we’ve experienced in the last couple of weeks, but even before, says this is an industry that really needs proper regulation, and it’s not.”

In addition, Yellen added that it was fortunate that the problems did not spill over into the traditional financial sector. Because, in her view, cryptocurrencies are big enough to cause substantial harm to investors and, in particular, to people who are not very well informed about the risks they are taking.