An analysis of recent crypto news and pricing regarding IOTA (MIOTA), Avalanche (AVAX) and Stellar (XLM).

Summary

IOTA, Avalanche and Stellar crypto assets in detail

It is worth mentioning that IOTA is an open-source project, which consists of a cryptographic token, next-generation, already distributed, thus non-minable.

Avalanche is a decentralized open-source proof-of-stake blockchain with smart contract functionality.

Stellar, on the other hand, is an open source currency exchange protocol founded in early 2014 by Jed McCaleb and Joyce Kim.

IOTA: the new Coordicide update

IOTA, a DLT project with a development center in Berlin, had high hopes for an innovative “Internet of Things” solution and huge price gains in the future after a massive run-up in late 2017.

Eventually, everything went wrong and the project came to a halt: most investors have had to watch IOTA’s price collapse since then. However, today IOTA with a new decentralization called “Coordicide“ could make its price explode.

The Coordicide update is essentially an IOTA 2.0 update, the most important step of which is the decentralization of the network. Indeed, the central coordinator in the Tangle was a big problem for IOTA, which had to be removed over time.

Currently, no date has been set when the central coordinator will be shut down completely. So far, Coordicide is still being tested in the Shimmer test network; if these are successful, it may soon be the right time for the project.

The “Stardust” update is designed to encourage the use of smart contracts. In addition, Shimmer also tests the connection to the Ethereum Virtual Machine (EVM).

The crypto community around IOTA, which has been anticipating the Coordicide update for several months, remains optimistic that the project will soon be able to deliver on the lofty promises made five years ago.

IOTA, with its decentralization and high scalability delivered by Tangle, is expected to be one of the most exciting projects of 2023.

In fact, in the next bull market, the price of MIOTA could rise further, given that a bear market explosion seems unlikely.

However, IOTA may perform better in the future during bullish phases. In any case, it is difficult to predict whether the price will ever reach its all-time high again from early 2018.

Growing subnet demand for the Avalanche (AVAX) crypto: a greater boost than IOTA and Stellar?

According to recent data, demand for Avalanche subnets grew rapidly in 2023. In fact, Avalanche’s NFT trading volume reached a one-year high.

The Avalanche ecosystem (AVAX) has expanded significantly since the beginning of 2023, and the increase in network development activity is a testimony to this.

According to a tweet by an analyst, the number of active developers working under various contracts exceeded 60 in March, the most in the year-on-year period. As it reads:

Too many in crypto are fading $AVAX and the strong narrative it's building on:

– Growing development (Hypersdk)

– Partnerships with top-tier gaming and AWS

– Growing $BTC.b deposits

– C-Chain growth

– Expansion into Layer Zero OTF and CosmosFade at your own risk. 🔺🧪 pic.twitter.com/Oy0R7XuuJQ

— Emperor Osmo🧪 (@Flowslikeosmo) March 18, 2023

Subnets are Avalanche’s preferred scaling solution because they allow users to create and run their own blockchain networks. According to Avalanche explorer, there are currently about 56 subnets on the Avalanche network.

GameFi has become one of the fastest growing sectors in the Avalanche ecosystem. The platform has recently entered into high-profile partnerships to increase its appeal in the play to earn landscape.

Blockchains, or app-specific subnets, provide a great incentive for gaming platforms, such as using a native token for transaction fees, which can ultimately reduce the cost of gaming.

Last month, Avalanche announced a partnership with Indian streaming platform Loco to launch an NFT game marketplace “Loco Legends” using its subnets.

The platform also partnered with Japanese gaming pioneer GRE earlier this month, which chose Avalanche because of its expertise in the Web3 world.

In addition, blockchain-based games on the platform have seen promising growth. According to DappRadar, top games such as DeFi Kingdoms, Pizza Game, and Avaxtars saw weekly growth of 19.5%, 5.48%, and 211.7% in their unique active users.

Focus on the price of Stellar (XLM): upward trend?

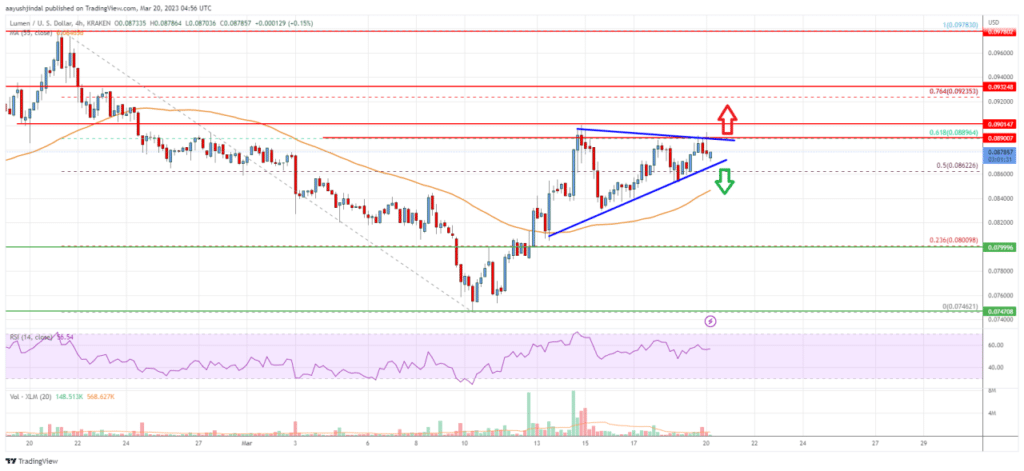

The price of Stellar (XLM) is facing important resistance near the $0.090 area against the US dollar. In fact, the price of XLM is now trading above $0.082 and the 55 (4-hour) simple moving average.

In addition, there is a key contract triangle forming with resistance near $0.0890 on the 4-hour chart. The pair could start a decent rise if it crosses the $0.0890 and $0.090 resistance levels.

Hence, the price of XLM needs to stay above the $0.084 support to rise further, and the XLM/USD pair has broken the $0.080 resistance zone to enter a positive zone.

Bullish traders pushed the price above Fib’s 50% retracement level of the main decline from the swing high of $0.0978 to the low of $0.0746. On the upside, the price is facing resistance near the $0.0890 area.

It is therefore close to Fib’s 61.8% retracement level of the main decline from the $0.0978 swing high to the $0.0746 low. As for the key contraction triangle, we see that the next major resistance is near the $0.0900 level.

A clear move above the $0.0900 level could send the price toward the $0.0932 level. Further gains could take the price toward the $0.1000 level or even $0.1020 in the coming days.

Initial downward support is near the $0.0865 level. Next important support is near the $0.0840 level, while major support is near the $0.0800 area.

Further losses could take the price towards the $0.0745 level in the short term, below which the price could even retest $0.0720 in the coming days.