Currently, the general outlook for the cryptocurrency market looks really complex:

We are facing a situation where restrictive central bank policies, international political tensions, and a stagnant housing market in the United States could negatively affect the price of Bitcoin and the rest of the crypto market.

However, fears related to a debt crisis and hyperinflation of the dollar have fueled the hopes of BTC HODLers to see the leading cryptocurrency back to its all-time high.

In March, Bitcoin’s price was up 23%, while the Nasdaq is up 17% in the first quarter of 2023.

Let’s try to take stock of the situation.

Summary

The macroeconomic situation in the world: are we entering a recession?

On the macroeconomic front, there are several interesting things to report.

Starting with the hottest and also the most important situation, it is important to note that despite the fact that inflation in the United States has reached almost uncontrollable values, the Fed’s efforts in curbing the devaluation of the dollar seem to be bearing the first fruits.

At the last FOMC, Jerome Powell announced a 25-basis-point hike in the federal funds rate from the previous 4.75% to the current 5%, and at the same time made it clear to investors that quantitative easing maneuvers could continue for the next few months.

In the meantime, the Fed has injected as much as $300 billion into the markets (this can be clearly seen from its balance sheet) fueling the latest rise in US markets and the price of Bitcoin.

We will see what the upper floors’ decisions will be at the next Federal Reserve meeting. It will be interesting to see whether there will actually be a further rise in interest rates or whether a stable inflationary situation will be reached.

The situation in the housing market in the US seems to be slightly more cheering. New buyers are entering the sector and this bodes well for a recovery of the economy in general.

However, residential construction is clearly in a stagnation: high mortgage rates and high interest rates for applying for credit from banks are providing uncertainty in interpreting the future of the housing market.

In the labor market, although US unemployment claims remain at historically low levels, there has been a slight increase in this figure in the recent period.

GDP has also weakened, suggesting a slowdown in the country’s economic growth and an increase in recession risk.

These concerns are also reflected in consumer confidence: according to the latest Michigan survey, there was a slight decline in March, the first in the past four months.

In any case, the February income and personal spending data give us hope that the Fed’s restrictive policies are making progress.

How the price of Bitcoin is moving in the face of this uncertainty

The price of Bitcoin is doing relatively well despite the somewhat undecided macroeconomic situation around the world.

At the time of writing, Bitcoin’s price is at $28,500, market capitalization at $551 billion and volume in the last 24 hours hovering around $16 billion.

Following the failure of Silicon Valley Bank and Bitcoin’s pump that brought it just below $30,000, the price has entered a range.

Confirmation of Bitcoin’s price action will require waiting for a break of either side, possibly with strong volumes.

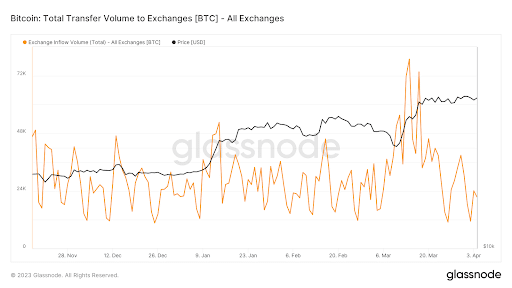

The issue of volumes turns out to be of fundamental importance in the future development of Bitcoin’s price. The low liquidity of cryptocurrency markets raises many questions about increased price volatility.

This could also be a factor that drove Bitcoin in the latest rise.

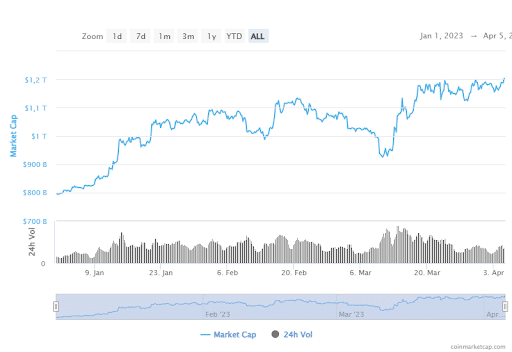

In any case, it bodes well for the trend in the graph of total cryptocurrency market capitalization, which has clearly been on the rise since the beginning of the year.

As for the derivatives markets, it is interesting to note that BTC and ETH options on the CME have reached a record high in volume, stating that institutional activity on these types of products is on the rise.

On the crypto news front, there has been a lot of meat on the fire in recent weeks. Notable news items include:

- the CFTC filing a lawsuit against Binance, the world’s leading cryptocurrency exchange, accusing it of violating multiple rules of the Commodity Exchange Act;

- Binance receiving a sting from a US court, which blocked its acquisition of Voyager Digital;

- Sam Bankamn Fried facing new charges, this time regarding bribery of some Chinese officials;

- MicroStrategy adding new Bitcoin to its wallet, to be precise 6,455 BTC;

- Galaxy Digital reporting a net loss of $1 billion in 2022: founder Mike Novogratz calls it “a formative year.”

Some on-chain metrics: where is Bitcoin’s price headed?

Even among Bitcoin’s on-chain metrics we can observe indicators that go in mixed directions. On-chain indicators are unlikely to affect the price of Bitcoin in the short term, but they provide us with a general picture of the situation that necessarily needs to be observed and interpreted.

Carrying out only and exclusively technical and fundamental analysis can be detrimental in the cryptocurrency market because many really important details go overlooked.

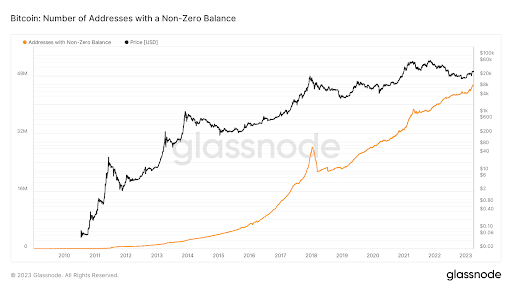

According to Glassnode data, addresses with non-zero balances have recently increased, reaching a new record high.

This stands to signify that worldwide adoption of the Bitcoin standard is steadily increasing and expanding as time goes on.

In contrast, the number of active addresses and the number of daily transactions made on Bitcoin’s blockchain have declined.

While in itself, this data is not a problem for the price of Bitcoin, it is important to understand how these indicators suggest that the interest and number of transactions carried out on the crypto market is slightly decreasing.

This figure supports the assertion we described earlier regarding the low liquidity of the markets.

Fewer transactions on Bitcoin’s blockchain and fewer active addresses necessarily translate into fewer movements of funds on centralized exchanges and consequently less liquidity that traders can take advantage of.