In this article we will analyse the best techniques and best practices to achieve the future airdrop of zkSync.

Although the news of the zkSync airdrop has not yet been confirmed, rumours are growing about the possible release of a governance token within 1 year.

This is the perfect time to start some on-chain action and increase the likelihood of receiving the airdrop.

All the info below.

What is zkSync and what is zk technology?

zkSync is a Layer 2 scaling solution that scales Ethereum without compromising network security.

This type of Layer 2 offers fast transactions and low consumption: you can consume up to 1/100th of the gas of L1 and still have a capacity of over 2000 transactions per second compared to the 14tps of the Ethereum blockchain.

ZkSync is part of a group of scaling solutions called “rollups”.

In fact, rollups are generally divided into two categories: ZK (zero knowledge) rollups, such as ZKSync, and Optimistic rollups, such as Optimism and Arbitrum.

Rollups are a blockchain innovation that allows a group of transactions that occur off-chain (in layer 2) to be wrapped by validating a single transaction that occurs on the main substrate.

The difference between zk rollups and optimistic rollups is that in the former, the batch of transactions in layer 2 is approved by a cryptographic proof, called SNARK in the case of zkSync, which proves that all wrapped transactions are valid.

Optimistic rollups, on the other hand, act in a more ‘optimistic’ manner, in that they specify that all transactions wrapped in a batch are valid by default, while they can only be cancelled if there is evidence of fraud.

The zkSync technology was invented by Matter Labs, a company that aims to extend Ethereum through Zero-knowledge proofs, while preserving the principles of freedom and decentralisation.

There are currently two versions of zkSync, the 1.0 version called zkSync Lite, which does not have the ability to implement smart contracts, and the 2.0 version called zkSync Era, which has all the expected functionalities and is already on the mainnet.

Many expect a future airdrop of a governance token for the zkSync ecosystem, which could arrive in a year’s time.

The project was funded by the Ethereum Foundation and other venture capitalists such as a16z, Dragonfly, Coinbase Ventures, Blockchain Capital, 1kx and many others.

A total of $458 million has been raised.

How to get zkSync airdrop: zkSync Lite and zkSync Era bridges

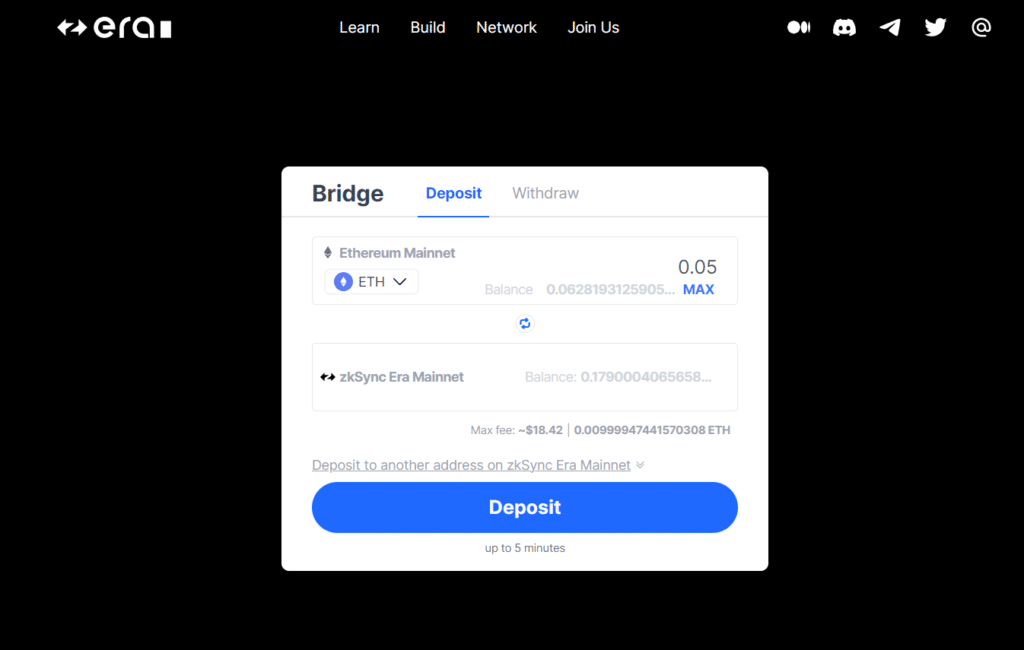

The first step in trying to get the future airdrop of zkSync is to use a bridge. Since zkSync has two different versions, zkSync Lite and zkSync Era, it is considered appropriate to transfer ETHs from the Ethereum mainnet to both blockchains.

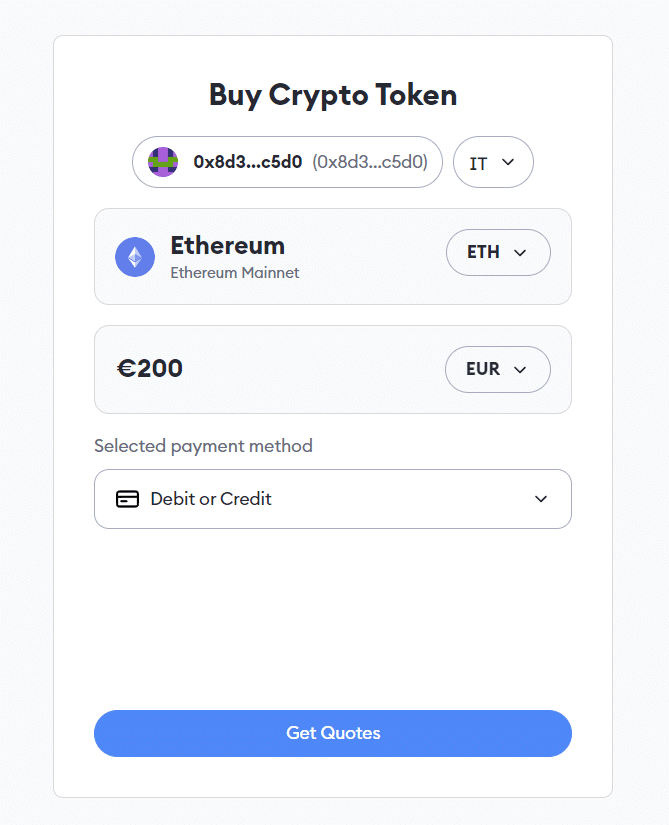

If you don’t have a non-custodial wallet, you should first download Metamask and deposit a few fractions of ether from centralised exchanges such as Binance and Coinbase, or buy crypto directly from the Chrome extension via credit/debit card or Sepa transfer.In general, transferring ETH from exchanges costs less in terms of fees than buying directly from MetaMask.

There is no pre-determined amount of ETH that will guarantee an airdrop, but generally speaking, the more value that is transferred, the higher the chances of it happening.

Even a few tens of ETH might be enough, but users who have bridged more ETH will certainly have a higher number of tokens in their gift, assuming this is one of the criteria the zkSync team decides to adopt.

In any case, even if the bridging factor is not taken into account for an eventual airdrop, it is essential to have funds on layer 2 to perform the next steps.

Bridge zkSync Lite: https://lite.zksync.io/

Bridge zkSync Era: https://bridge.zksync.io/

If you do not have enough ETH to use both bridges, or otherwise have limited resources, consider only the zkSync Era network, as it is the main network with the most functionality.

Remember to keep a fraction of ETH in your non-custodial wallet to pay for the bridging fees, about 10/20 dollars per transfer (depending on the cost of gas on the Ethereum main network).

If you want to try to pay as little fees as possible, take a look at this tool, which is useful for monitoring the trend of commissions on Ethereum.

These are generally cheapest on Saturday and Sunday mornings.

Finally, and most importantly, repeat the transaction on at least 2 or 3 different occasions and not all in the same month. A good option would be to bridge tokens every 2 months from now until next year.

Other useful information for the zkSync airdrop: providing liquidity and creating volume on DEX

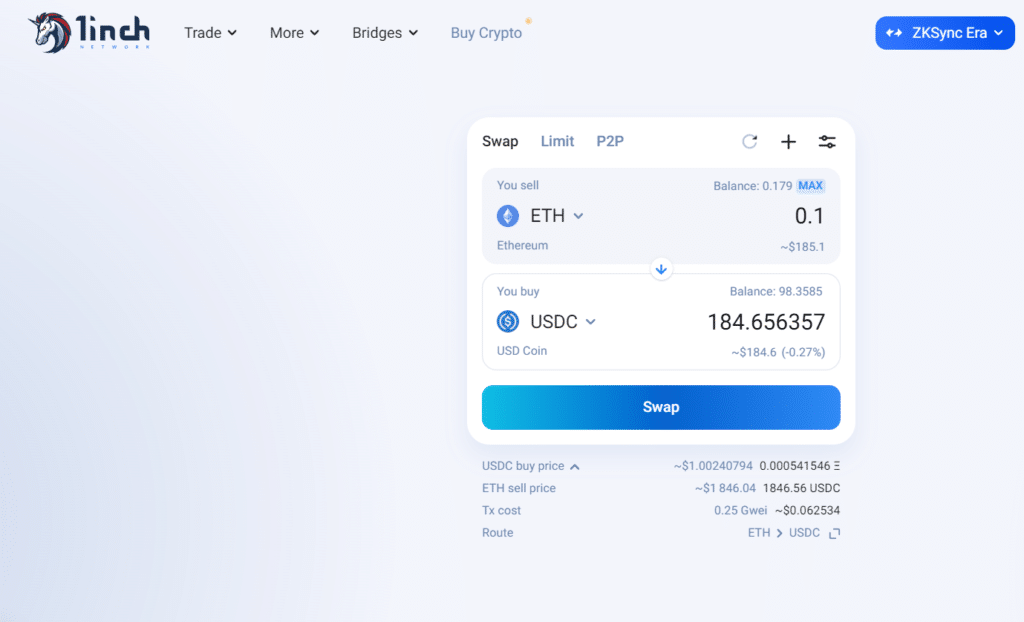

Other useful information to know in order to increase the likelihood of receiving the zkSync airdrop includes creating trading volumes on decentralised exchanges, and providing liquidity.

Naturally, when a blockchain infrastructure makes its market debut, the team works hard to increase liquidity on existing protocols and attract traders to trade on DEX.

This is an important step to understand: if we think a project is likely to release an airdrop in the future, after bridging funds on the blockchain or protocol in question, the next thing to do is to execute trades and provide liquidity to the protocols that have integrated the mainnet.

Going into specifics, the main DEX present on zkSync are Syncswap and 1inch.

It would be good to do at least 20 to 30 trades in the next 12 months: on both platforms.

There is no need to expose yourself to the volatility of cryptocurrencies, as you can trivially close out trades by reverting to coins such as USDC or making swaps between stablecoins.

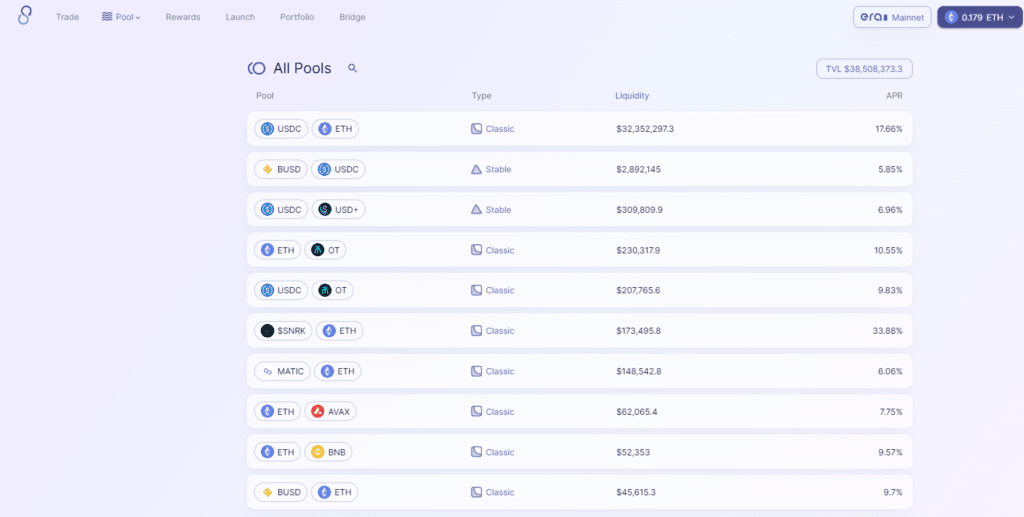

On Syncswap it is also possible to be a liquidity provider, which we cannot do on 1inch because it is a decentralised market aggregator.

By providing liquidity we can earn money from the commissions generated by the protocol and at the same time increase the chances of being airdropped by zkSync.

To do this, we need to click on the “pool”’ option in the platform, select the token pair we want to provide liquidity for, select the ‘deposit’ option and place the tokens in the 50/50 ratio.

Be careful, as each liquidity pool has different rates of return, which can vary greatly depending on the liquidity available.

In general, the lower the liquidity, the higher the potential returns.

However, these are always short-lived when an ecosystem is expanding, as is the case with zkSync.

In addition, you need to be aware of the concept of “impermanent loss”, which occurs when assets deposited in liquidity pools are subject to large price fluctuations.

For a more detailed description of the concept of “impermanent loss”, you can read this article from the Binance Academy.

If you do not want to take this risk, you can choose a pool between two stablecoins.

Trading NFTs and other protocols on zkSync

Other on-chain actions you should take to increase your chances of receiving an airdrop from zkSync include trading NFTs and interacting with other smart contract protocols on the network.

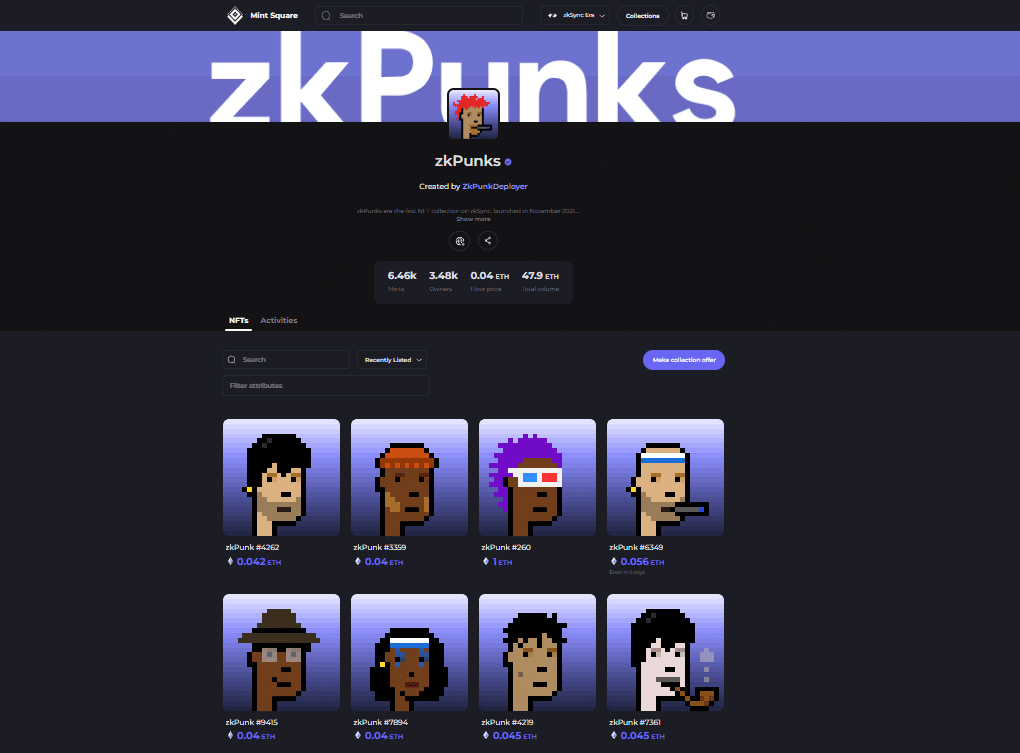

To trade NFTs, you can visit the Mintsquare marketplace and select one of the collections on zkSync. Buying, selling and holding some NFTs can earn you extra points if there is ever an airdrop.

Mintsquare works the same way as Opensea and Blur.

Don’t spend too much on Non-Fungible Token as it may be unnecessary and counterproductive.

It is wiser to keep money to trade on DEX or to act as a liquidity provider.

On the other hand, when it comes to interacting with smart contracts, you have to take into account that the choice of actions you can perform on the protocols present in the ecosystem is very high.

The discourse is that it is not worth interacting with unknown protocols without liquidity, as the risk of being trapped by them is high; it is much better to choose more “famous” platforms with a long history.

In the case of zkSync, there are many projects already live on zkSync ERA in addition to those already mentioned, such as Mute.io, Multichain, Orbiter Finance (only on zkSync lite) and Zig Zag exchange.

For the time being, it may be enough to do a total of 20 to 30 transactions on these protocols over the next 12 months to get an airdrop.

There are many platforms and projects that will soon be built on top of zkSync: to maximise your chances of receiving airdrop for a possible ecosystem governance token, you’ll need to keep up to date with future blockchain integrations and perform transactions on these new protocols.

The trick is to act like a true early adopter!