On 12 April, the Shapella hard fork, which allowed ETH to be unstaked from the ETH 2.0 platform, went live, sparking several debates on the impact this event would have on the price of Ethereum.

Almost a month after the Ethereum blockchain update, let’s see how the situation has evolved and what the most likely scenarios are for the future price of ETH.

Summary

The price of Ethereum after the Shapella hard fork

The price of Ethereum did not experience any major complications after the Shapella hard fork, which once and for all sanctioned the switch from POW to POS and in parallel allowed users to unstake from the ETH 2.0 platform.

Many thought that the unstaking of the 18 million ETHs staked by the Ethereum community since November 2020 and never withdrawn for over two years would have a negative impact on the cryptocurrency’s price.

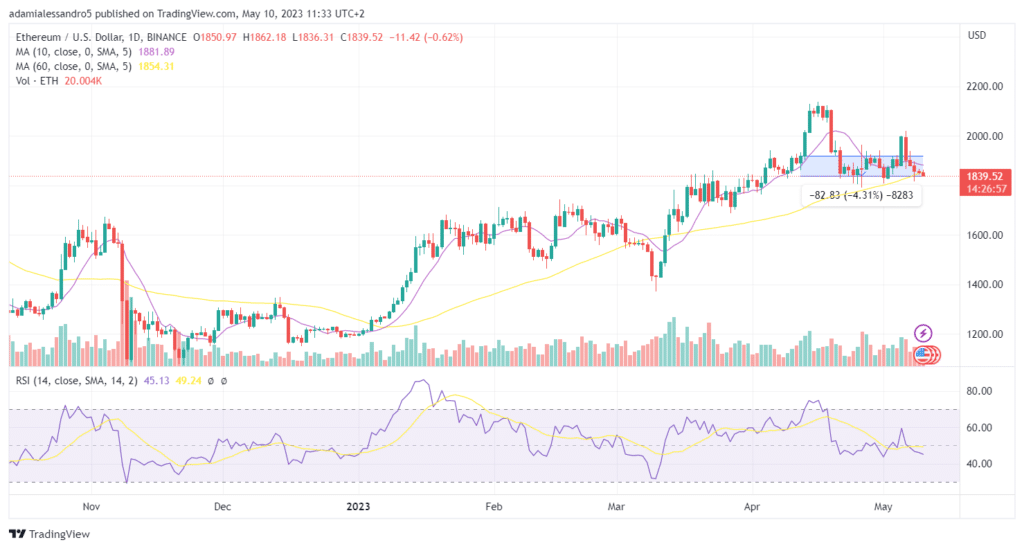

However, one month after the long-awaited Shanghai/Capella update, we can see that the price of ETH has only dropped by 4.3% while expectations of a drop exceeded double digits.

Ethereum has seen little change in price due to several factors.

Firstly, the fact that the data on ETH 2.0 withdrawals and alleged sales on the markets do not take into account the number of purchases made by traders on ETH, and as a result it is ineffective to observe only one side of the balance: let us remember once again that the price of an asset depends on the balance between supply and demand.

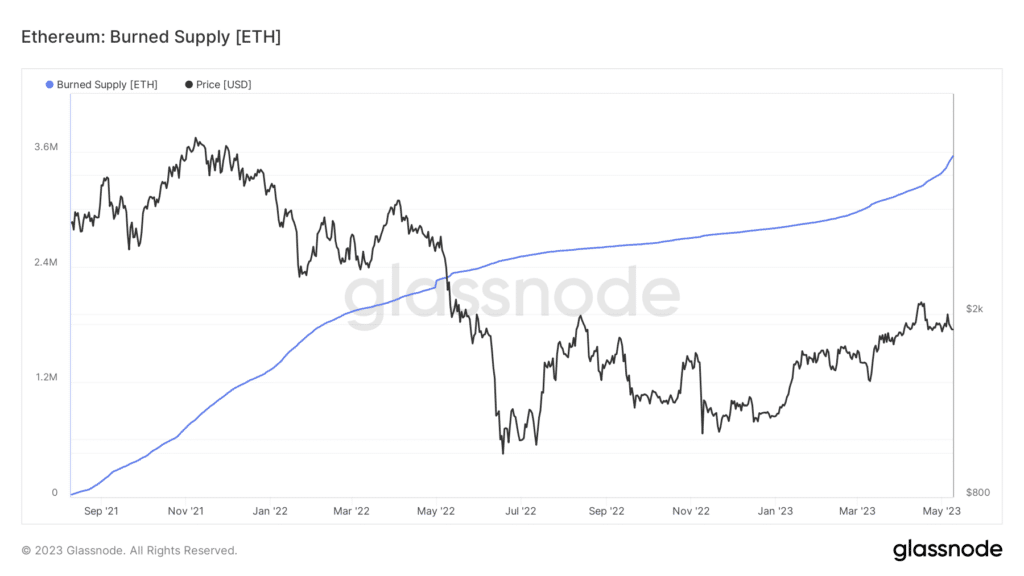

Secondly, after the implementation of the London hard fork, which introduced the EIP1559 mechanism, the Ethereum network began to burn part of the transaction fees spent by users, making the coin potentially deflationary.

In particular, considering that Ethereum’s average inflation is 1,700 ETH per day and that around 338,181 ETH have been burned since 12 April to date, we can calculate a supply deficit of around 290,581 ETH over this period.

This certainly helped to counteract the selling pressure of coins taken from users and liquid stakes providers.

Finally, it is important to understand that the 18 million ETHs unlocked after the Shapella hard fork were not all sold at the same time, given the technical limitations of network validators and the waiting times for withdrawals by some entities such as Binance, Coinbase, Kraken and Lido.

All of this serves to dilute the impact on the Ethereum price over time, while avoiding negative repercussions on the entire ecosystem.

Analysis of ETH 2.0 deposits and withdrawals

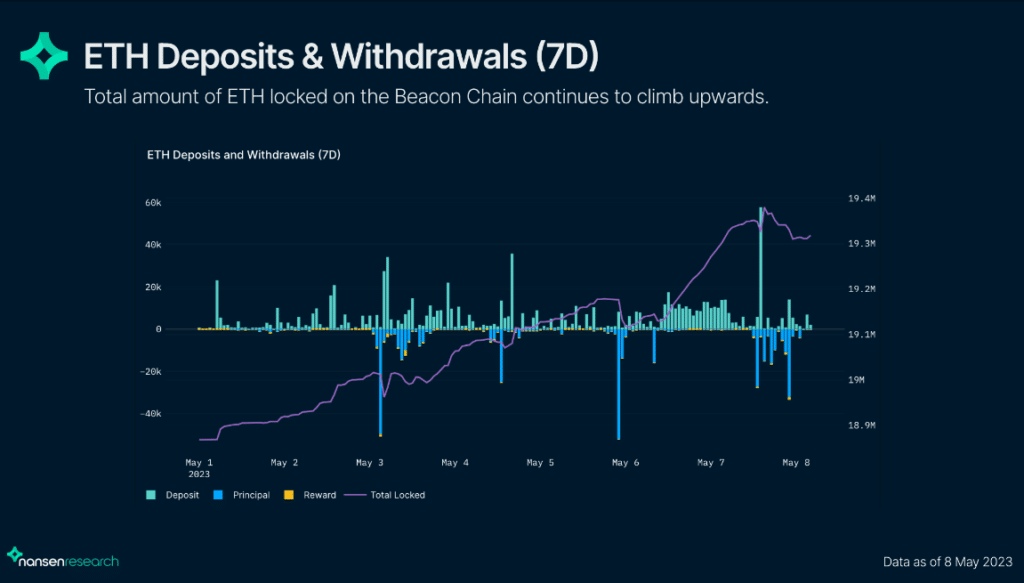

In order to fully understand how the protocol fork has affected the price of Ethereum, it is necessary to consider, in addition to the data we have discussed, the ratio of withdrawals to deposits on the ETH 2.0 platform since the unblocking date.

In fact, many entities have continued to deposit coins on the contract equal to the sum of coins withdrawn and sold on the market.

Specifically, considering that there were 19.3 million ETH on the Beacon Chain at the time of the update (about 19.1 percent of supply) and that withdrawals exceeded deposits by about 223,000 ETH in this first month, not counting the ETH burned by EIP-1559, the impact on the Ethereum price was almost zero.

Furthermore, the number of newly activated validators is similar to the number of validators waiting for full withdrawals.

This figure indicates a strong overall confidence in both ETH and the blockchain infrastructure, which is viewed positively by the community.

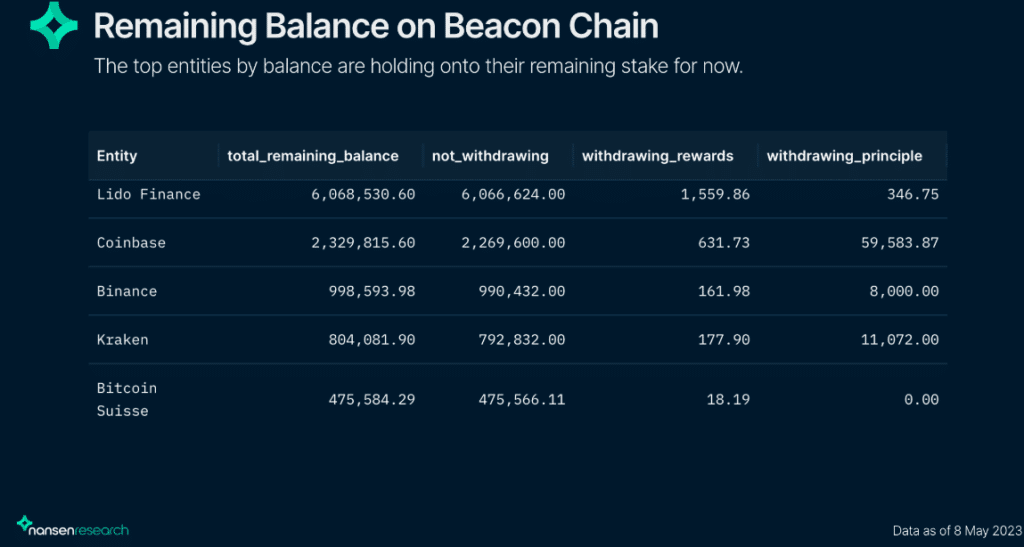

Among the entities that have withdrawn the most coins in this first period after the fork are names such as Kraken, Coinbase, Binance and Lido Finance.

Specifically, Kraken was responsible for the largest number of withdrawals, with over 646,000 ETH withdrawn, representing 26.3% of the total.

This was followed by Coinbase with 344,000 coins withdrawn, while Binance and Lido withdrew 288,000 and 272,000 ETH respectively.

In total, the top four companies in this picture made withdrawals of 1.55 million Ether.

It should be noted that Lido’s data is solely dependent on wagering rewards, which are automatically processed each time the validator is scanned, while V2 of the protocol, which will enter the mainnet in mid-May, will also allow withdrawals from wagering and configuring nodes without authorisation.

Ethereum price prediction after the hard fork: what will happen when all ETHs are unlocked?

Many are wondering what will happen to the Ethereum price after all ETHs are finally unlocked by the Shapella hard fork.

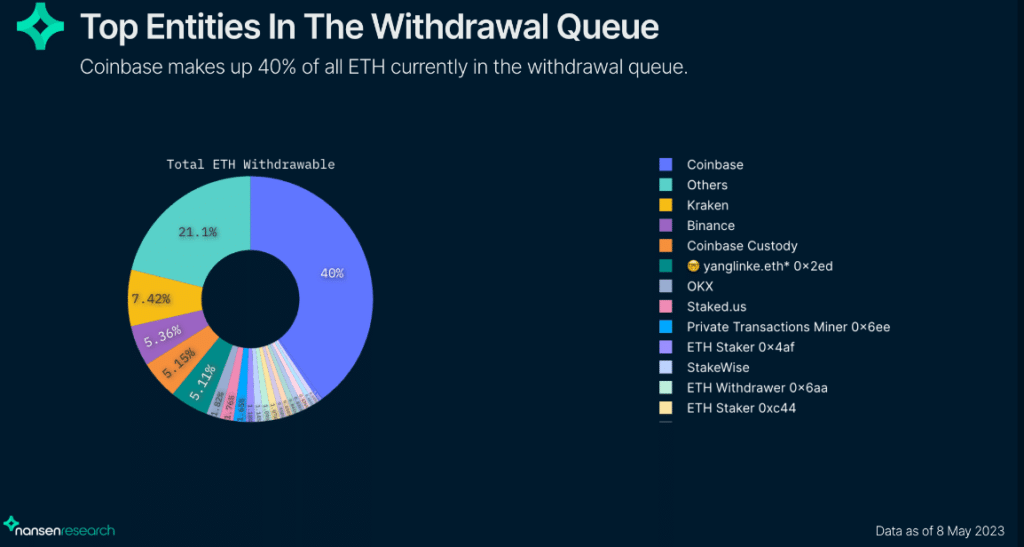

Although the update has indeed allowed all stakers to withdraw their ETH from the Beacon chain, there are still several withdrawals in the queue from 4500 validators waiting to be approved and confirmed.

Most of the ETHs in the withdrawal queue are from validators who are fully exiting their stake (Actively Exiting, Withdrawal Possible and Exited Unslashed), some of which could negatively affect the value of Ether.

On the other hand, many ETH withdrawn from exchanges such as Kraken may not be sold, but returned to the platform via alternative staking solutions.

Furthermore, the data is not at all worrying as 99.2 percent of ETH staked on the Beacon Chain are not scheduled for withdrawal, while only 150,000 ETH, or 0.78 percent, are in the withdrawal queue.

Of those who are withdrawing, we note that Coinbase is the largest entity, accounting for 40% of the total.

In this context, it is interesting to note that Brian Armstrong’s cryptocurrency exchange does not yet support ETH deposits from external validators, which currently show transactions stuck on the blockchain.

Coinbase’s technical support said:

“Funds may remain blocked until we are able to support these transactions”.

In conclusion, the price of Ethereum is not affected by the Shapella update and is unlikely to have a major negative impact in the coming days, especially if activity on the network remains high and we continue to burn through some of the supply as we have been doing since the 12th.

Outflows of around 30,000 ETH per 24-hour period are expected over the next few days, but this will have to be balanced against the deposits that will be made as ETH prices move in the market.

Rather than observing this data, which is ambiguous and insufficient to make predictions about the future price of Ethereum, it is more appropriate to monitor the amount of assets held on the Beacon Chain by the larger entities and observe whether there will be large withdrawals in the future.

In this sense, outflows in the order of several hundred thousand ETH could threaten the value of the second largest cryptocurrency by capitalisation in the short term.

For now, there is nothing to fear.