The macroeconomic scenario is getting more and more complicated: following the latest revelations about the US debt ceiling crisis and a possible default of the world’s first superpower, there are already those who are speculating about taking cover with safe haven assets such as Gold and Bitcoin.

The cryptocurrency is increasingly being associated with yellow gold, even though the data show a big difference between the two assets, especially the correlation with stock markets.

Let’s try to explore this in more detail in this article.

Summary

Bitcoin and gold as safe haven assets in case of a US debt ceiling crisis

In difficult times like these, investors set out in search of the best safe haven asset, and again eyes are on gold and Bitcoin.

Following the banking crisis in March that saw the failure of institutions such as Silicon Valley Bank, now it is the turn of the US debt ceiling crisis.

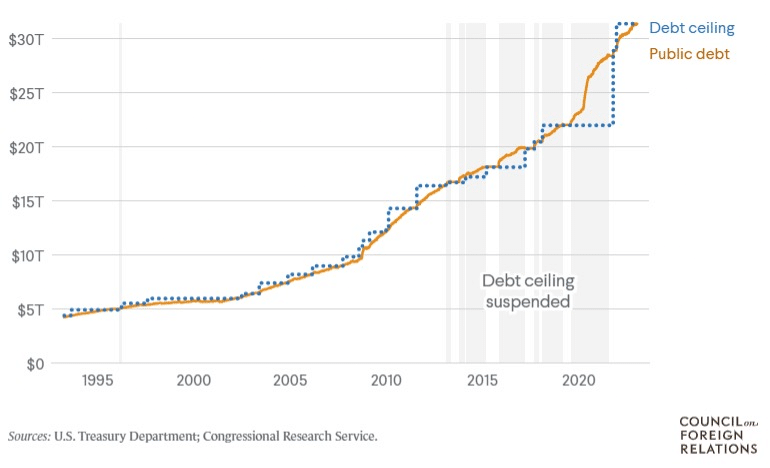

The United States has a federal debt ceiling of $31.4 trillion: the threshold is about to be crossed after the mountain of debt that government and households have taken on in recent years.

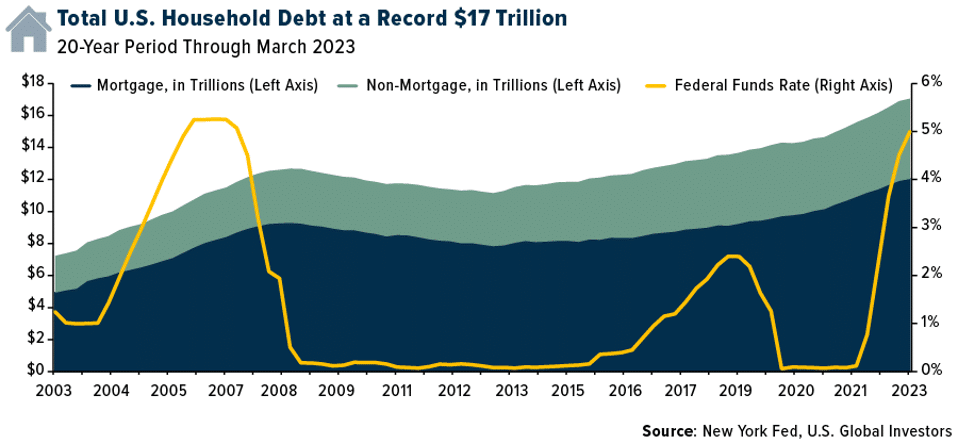

According to the Federal Reserve Bank of New York, the amount of US household debt exceeded $17 trillion for the first time in the first quarter.

The figure gives pause for thought when we consider that since March 2022, when the Fed began a restrictive policy by raising interest rates on government bonds, households have increased their debt even more, which highlights that the change in lending rates does not affect the habits of US citizens.

Specifically, since the Federal Reserve first tightened its monetary policies, consumers have added more than $860 billion to total mortgage balances, $145 billion in credit card debt, $93 billion in auto loans and $14 billion in student loans.

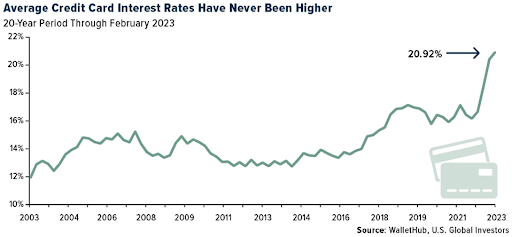

As of today, the federal funds rate is between 5% and 5.25%, but it does not seem to have slowed down the US debt frenzy, especially as it relates to credit cards.

To be fair, between the end of 2022 and the end of March 2023 there were no notable increases, however, the figure shows that at $1 trillion, the interest Americans owe on their credit cards reached its highest point ever.

Asking for a balance on one’s card now comes at a very high cost, with an average interest rate of 20.92%.

While it seems crazy for Europeans to ask for credit at these rates, it is common practice in the US to take on debt in this manner considering that many households have debt on more than one credit card.

All this only alarms investors: this mountain of debt connected with high interest rates could push the US into a debt crisis, provided the government does not raise the ceiling as it did in previous years.

What do investors prefer in times of crisis: gold or Bitcoin?

Let’s try to better understand investors’ attitudes in times of crisis.

At the Bitcoin Conference in Miami, which took place a few days ago, participants were asked to express their opinions about what they would buy if the US debt ceiling was reached, and they obviously chose gold and its virtual version.

However, these opinions are unreliable since everyone at the conference has a soft spot for Bitcoin and the crypto market in general.

Forbes, on the other hand, tried to take a more representative sample by asking 637 different investors which assets they would prefer in the event that the US defaulted on its obligations and did not pay its federal debts.

The result is very interesting: traditional gold comes in first place with an equal number of choices between retail and institutional investors, followed by US treasuries and Bitcoin taking the podium with 7.8% preferences from institutional and 11.3% from retail.

Traditional currencies such as the dollar, Japanese yen and Swiss franc lag behind highlighting a fallacy in being able to serve as safe haven assets, at least according to investors’ thinking.

Bitcoin and gold have always been praised for their decentralization and deflationary nature, although cryptocurrency, unlike the yellow metal, also enjoys the characteristic of being resistant to censorship.

With Bitcoin, it would not be possible to replicate what US President Franlink D. Roosevelt did when he issued Executive Order 6102 on 5 April 1933 with the aim of prohibiting the possession of any form of gold, depriving its citizens of it.

Satoshi Nakamoto designed his virtual cryptocurrency in such a way that it could withstand these attacks and serve as a true reserve, not controllable by anyone.

Beyond that, gold is certainly a more conservative and more reliable choice, given the presence of a broader history of price performance and given the low correlation with stock markets.

While over the past 5 years gold had a correlation index of 0.04 with the S$P500, Bitcoin records a very strong correlation of 0.88, meaning that it often moves in the same direction as stocks.

What would happen to the crypto market if the US goes into default?

The US is approaching the debt ceiling set during 2021, fueling fears of an inability of the government to repay bondholders consequently leading to a default of the nation.

However, it is often forgotten that the federal “debt ceiling” has been raised as many as 78 times since 1960 until the last time Congress decided that value to the current $31.4 trillion.

Until 2007, before the global financial crisis, the federal debt had been held below $10 trillion.

Within 15 years this has more than tripled resulting in a red-hot political climate between Democrats and Republicans.

The fact that the debt is approaching the maximum allowed ceiling does not necessarily mean a risk of default: first, because the debt ceiling can be raised even 1 day before the ceiling is exceeded.

Furthermore, in extreme cases, a “government shutdown” would take place, i.e., a cut in government costs starting with salaries of nonessential employees and moving on to payments of suppliers of goods and services, current expenditures, etc.

Markets would be immediately affected by this contingency plan, but it would still be possible to avoid default, which would lead to much more disastrous effects.

In the most pessimistic case, i.e., one in which the US proves unable to honor the federal debt in the coming months, markets, especially the more speculative ones such as cryptocurrency markets, would experience a colossal downturn.

While Bitcoin and Ethereum would probably be able to weather the storm, albeit with double-digit negative price changes, many tokens in the altcoin segment would perhaps not be able to survive.

All the more so if we are talking about cryptocurrencies with no fundamentals behind them or with derisory projects such as memecoins, a default could spell the end of these financial experiments, while in the long run assets with more intrinsic value would still manage to emerge.