A few days ago, Binance published a study by its research team regarding the rising trend of BRC-20 tokens belonging to the Bitcoin ecosystem.

The standard, introduced by the Ordinals protocol, enables the creation of fungible tokens on the blockchain, raising the potential of the technology and making more money for miners.

Let’s try to summarize what Binance published.

Summary

Binance Research and the BRC-20 token study

Binance’s research team conducted a study on the emergence of BRC-20 tokens, highlighting the positive and negative factors of the new trend.

Although this new standard introduces the possibility of generating fungible tokens on Bitcoin’s blockchain for the first time in history, it also generates discordant opinions on the long-term sustainability and increasing chain fees.

First things first, let’s try to summarize in a few words what are BRC-20 tokens and how they have arrived in the Bitcoin ecosystem.

In early 2023, the rapid success of the Ordinals protocol, which introduced the possibility of generating NFT-like digital artifacts through the inscription of data on individual satoshi (minimal part of the BTC coin) inspired a Twitter user to propose a version of fungibility in the network.

Hence, BRC-20 is an experimental standard that allows users to generate fungible tokens within Bitcoin, somewhat like what happens in the Ethereum blockchain.

However, the latter was born precisely with the intention of providing an operational framework (ERC-20) for developers in the creation and management of cryptographic tokens backed by the network’s distributed digital ledger.

In the case of Bitcoin, BRC-20s do not enjoy all the features found in Ethereum, but they at least have the distinction of living on top of the world’s most decentralized and popular network.

The Bitcoin brand has influenced the success of the experiment, which currently enjoys a market capitalization of $475 million, although it had reached the $1 billion mark a few weeks ago.

It is worth pointing out that BRC-20 tokens are extremely risky and at a very early stage of development.

The creators themselves have been explicit about the risks of their experimental nature.

For now, beyond speculative interest in this type of market, there is no element of innovation that is not present in other compatible EVM networks or on Ethereum itself.

The three functions of the BRC-20 tokens

Let’s turn to an examination of the functions related to the creation of a BRC-20 token, made explicit by Binance’s research.

As mentioned, the creation of a fungible token within the Bitcoin blockchain is based on the process of inscription (hence the name “inscriptions”) of data on individual satoshis, or rather packets containing a certain amount of satoshis.

In fact, while the inscription of data on a SINGLE sat results in a non-fungible product similar to an NFT in view of the uniqueness of the essence of that unit of value, the transfer of data on packets of sats allows for the conceptual generation of a series of fungible tokens with the same characteristics in common.

These characteristics refer trivially to 3 factors, which are then those that each user must decide for himself or herself when creating a BRC-20 token:

- the name of the token;

- the supply of the token;

- rules on the minting limit.

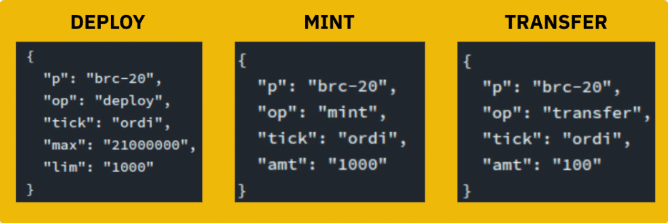

The 3 factors are made explicit on the Bitcoin blockchain through 3 different operations, namely deployment, minting and transfer, as shown in the following picture.

The example in the photo captures the first ever experiment of BRC-20 token called with the ticker “ordi“.

This token has a supply of 21 million and a minting limit of 1,000 units at a time.

This means that a user, while being able to then sell an arbitrary amount of ordi tokens in the market, can generate a maximum of 1000 ordi at a time, until the maximum threshold of 21 million is reached.

There are several platforms where a BRC-20 token can be generated and a supply and demand matching point created.

The main ones are ordinalswallet.com and unisat.io.

Both have incorporated a non-custodial wallet that allows performing the 3 functions just introduced, however Unisat is more professional and appropriate in this context.

In order to fund any of these two wallets and create one’s own BRC-20 token, it is necessary to make a BTC transfer from a wallet that supports the Taproot upgrade.

According to Binance, the advent of BRC-20 tokens benefits Bitcoin miners

Binance’s research team expressed an all-too-positive opinion about the advent of BRC-20 tokens although they highlighted concerns about long-term sustainability.

In particular, the trend has benefited Bitcoin miners who have received higher than usual fees from user TXs.

It is worth recalling that miners’ revenue is derived from two sources: block reward, currently at 6.25 Bitcoin per block, and user fees on every executed transaction.

Since the block reward is subject to halving every 4 years, according to the logic of the halving mechanism, rewarding miners with higher transaction fees than the norm supports and benefits their operations.

They represent the most important players in the Bitcoin ecosystem, being the ones who secure the network from cyber attacks through the computing power generated.

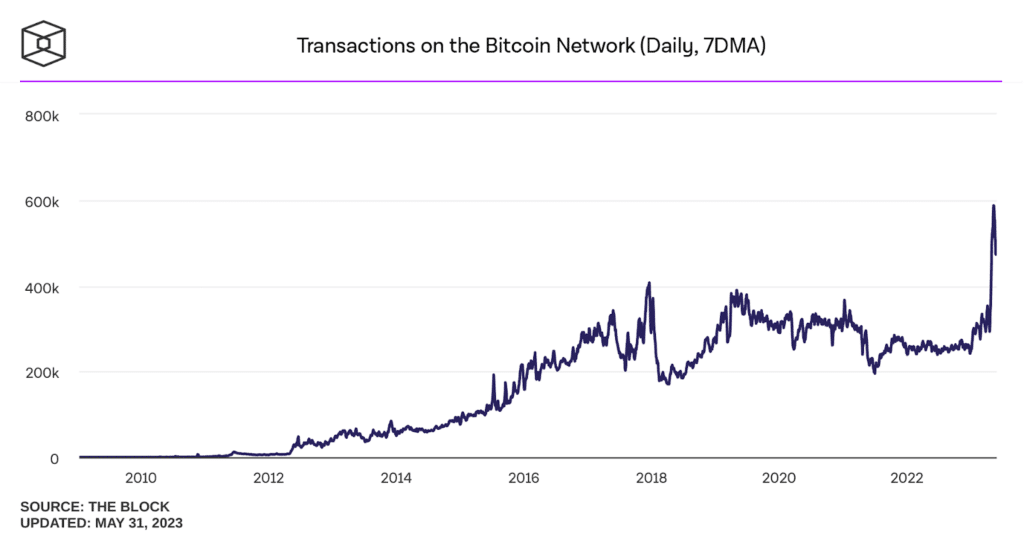

With the successful expansion of BRC-20 tokens, miners have been pleasantly surprised by the increase in the number of transactions on the network, which has boosted their earnings by about 10%.

However, although the issue of the BRC-20 experiment creates more viable conditions for miners, it at the same time generates discontent on the user experience side.

In fact, during the explosion of this trend, many individuals experienced higher than usual transaction execution fees and confirmation wait times.

A few days ago, there were more than 400,000 transactions in Bitcoin’s mempool waiting to be confirmed and added to a block

On-chain analytics firm Glassnode pointed to a spike for the demand of “blockspace” that is highly correlated to the use of the Ordinals protocol for the generation and exchange of fungible BRC-20 tokens.

We will see if a balance can be struck between these two opposing poles, or if developments in the Lightning Network will finally put a patch on these minor problems.