New Governance proposal for Aave, the DeFi industry’s main lending protocol, in which the community is called to a vote to decide how to manage treasury capital.

Specifically, the question is whether to convert 1,600 Ether into the wrapped versions WstETH and rETH belonging to the liquid staking protocols Lido and Rocket Pool.

Meanwhile, the Aave token performs very well in the 7-day chart/

See all the details below.

Summary

Aave and governance proposals in DeFi: treasury will acquire $3 million in WstETH and rETH

The community governance activities of Aave, one of the leading DeFi-themed projects providing contracts for decentralized loans, continue at full speed.

A few hours ago, a new proposal was posted within the community decisions section, where the major AAVE token holders are being asked if they should allocate a portion of the treasury to acquire the wstETH and rETH tokens.

This is not just a speculative buyout, but rather a more nuanced strategy to make the yield offered by the deposit platform more palatable.

Bgd Labs has proposed to convert the low-yielding balances of awETH and ETH assets, which yield 1.69% in the platform to earn higher interest, above 3%, by choosing to include the liquid versions WstETH and rETH,.

These tokens are part of the Lido and Rocket Pool liquid staking platforms and represent liquid assets to be used while staking on the Beacon Chain.

Those who want to do staking on the Ethereum proof-of-stake can either delegate 32 ETH themselves and join the family as a validator, or take advantage of these intermediary platforms and obtain liquid tokens in exchange, which are currently very much in vogue for their uses in the DeFi field.

Thus, even Aave has been drawn towards LS tokens, given the growth of liquidity in the decentralized pools in which they are present and the desirability of the expected yield.

In detail, the steps that will have to be taken to “transform” awETH into wstETH and rETH are the following:

- withdraw 1400 awETH from Aave V2 and convert all to ETH;

- withdraw the remaining ETH from treasury (104 units);

- withdraw 96 awETH margin from Aave V3 and convert all to ETH;

- deposit 800 ETH into the RocketPool pool, resulting in 800 rETH;

- deposit 800 ETH into Lido‘s pool, getting 800 stETH;

- wrap 800 stETH in 800 wstETH;

- transfer all wstETH and rETH (1600 units in total) into the Ethereum collector contract.

There are currently 252,000 votes cast in favor of the proposal, out of a total of 320,000 required to reach a quorum and go into operation.

No one voted against the proposal, which will end in two days if the minimum number of delegations is not reached.

Aave price analysis and future forecast

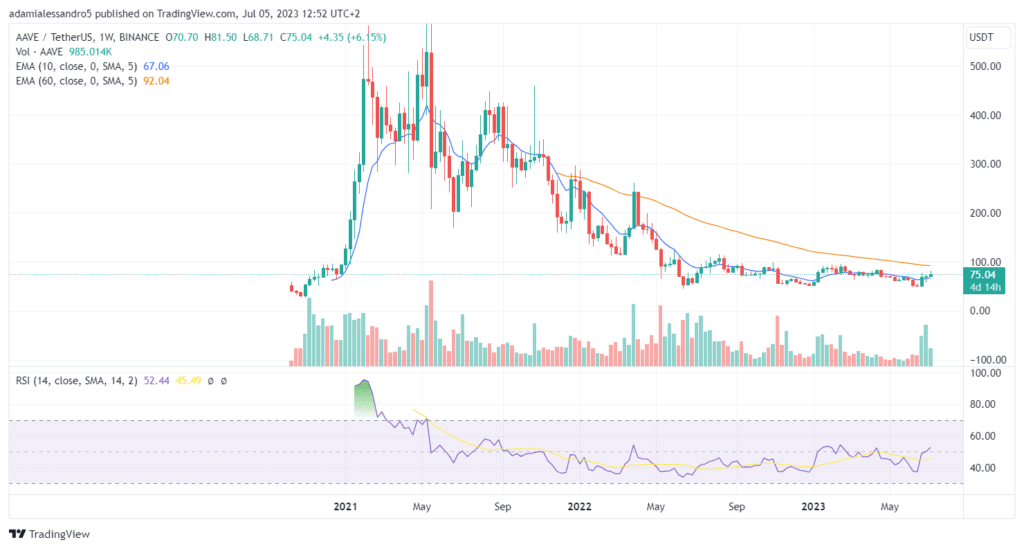

The Aave token, which is mainly used for the governance of the DeFi project, has been going through a very bullish phase over the past 7 days.

The price of the cryptocurrency has risen from around $60 on 28 June to the current $75.4.

At the time of writing, the price action on a 15-minute time frame is going through a downward phase, but without undermining the structure that has been created over the past few days.

Aave has a capitalization of $1 billion and volume of $231 million in the last 24 hours, up 50% from the transactions recorded yesterday.

Expanding the horizons of analysis and embracing a weekly time frame we can see how the recent rise is only a small recovery from the breakdown recorded since ATH.

Since the all-time high, the AAVE crypto has lost about 88% and is still far from recovering a strong structure.

Beyond that, we can see that prices have been in a consolidation phase for over 1 year, so we can expect a bullish return of the asset in the coming months.

In the last 3 weeks, volumes have increased quite a bit, accompanying the recent rally and giving more possibilities for a bullish continuation.

Before claiming victory though, we will have to wait for at least the break of $125 and then the break of $200.

Only at that point will it be possible to assess the actual feasibility of a return to new highs for the price of the cryptocurrency.

At the same time, it will be interesting to observe the trend of the decentralized protocol’s TVL, which is currently recovering slightly, but is still far from its peak performance.