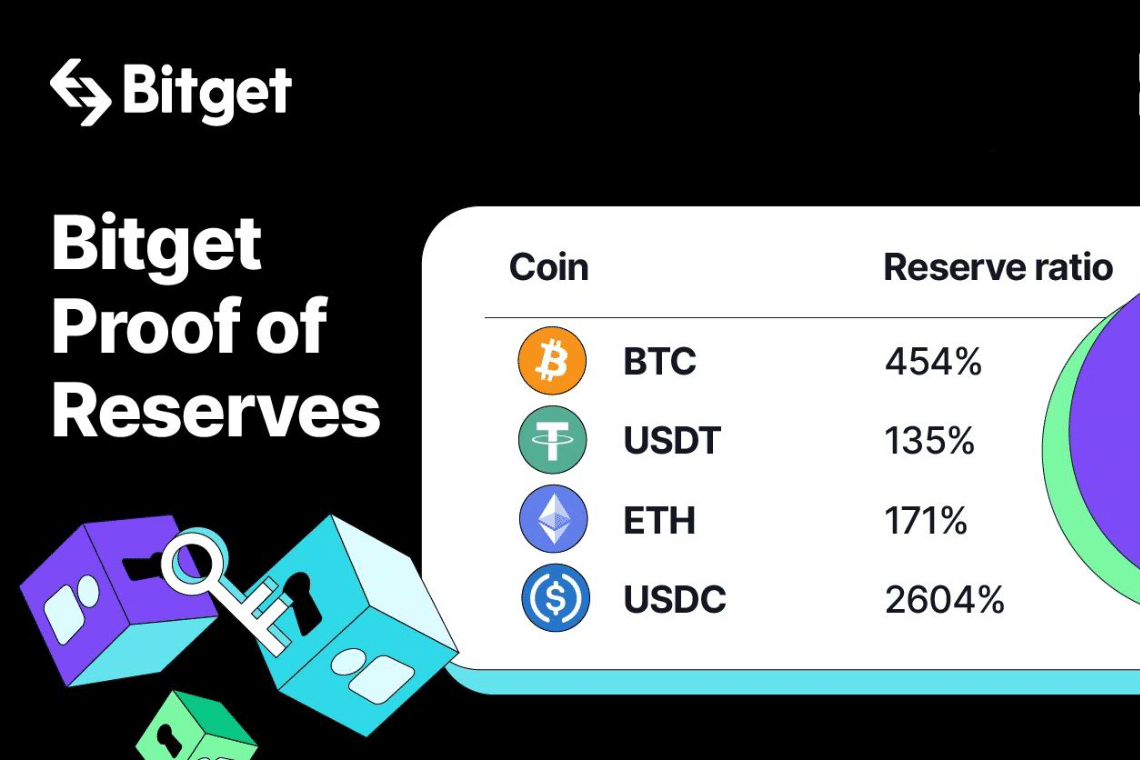

Bitget unveiled its monthly Proof of Reserves (PoR) showing that the crypto-exchange holds total reserves of 223%, well over twice the industry threshold of 100%.

Summary

Bitget shows that its total reserves are 223%

Bitget announced that its monthly Proof-of-Reserve (PoR) shows that the popular crypto-exchange, also famous for copy-trading, holds 223% total reserves.

This is more than twice the industry benchmark of 100%. This means that Bitget is working beyond the minimum necessary to build trust not only in its platform but also in the entire crypto industry.

Not only that, in Bitget’s latest reserve report on 11 July, the reserve balance was over $1.44 billion in 31 popular digital assets.

Bitget’s monthly Proof-of-Reserve is published every month along with the Merkle Tree proof, which ensures its transparency and maximum accuracy of information.

Bitget and the Merkle Validator tool: users can self-verify their accounts

The crypto-exchange also launched the new “Merkle Validator” feature, which allows users to self-verify their accounts.

Basically, through the new tool, users can verify the security of their funds in a few simple steps and by viewing the “Merkle leaf” status of their assets within Merkle’s tree data structure.

In this regard, Gracy Chen, Managing Director of Bitget commented as follows:

“In an ever-evolving global and market landscape, maintaining the stability of financial transactions is of paramount importance. At Bitget, we prioritize both financial and technical security to instill confidence in our users for the future

We will continue releasing consistent Proof of Reserves as a pillar of trust in our platform. Bitget also endeavors to set higher standards industry-wide — collaborating across exchanges to advocate for radical transparency through crypto’s evolution.”

The performance of the crypto-exchange after the collapse of FTX

For the first half of 2023, as well as for the period after the FTX collapse, Blockchain data provider Nansen published a report on the performance of centralized crypto-exchanges (CEXs), such as Bitget.

It appears that, generally speaking, there has been true resilience for these crypto companies.

In the specific case of Bitget, in the first half of 2023, there appears to have been a noticeable increase in derivatives volume, as well as a sharp rise in the price of its native BGB token.

At the time of writing, BGB is worth $0.47, more than twice as high as February 2023 and up +234% since July 2022.

In addition, Bitget also appeared on the list of top-performing platforms for copy-trading, along with ByBit, OKX, and Gate.io.